Entertainment Services JSC Hung Thinh Quy Nhon (Hung Thinh Quy Nhon) has recently sent a document to the Hanoi Stock Exchange (HNX) and bondholders, announcing the results of its early bond repurchase.

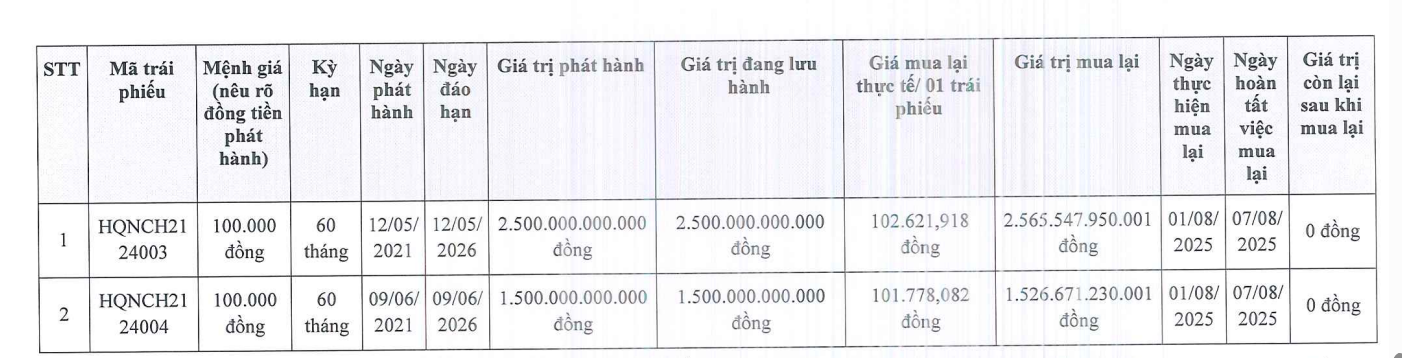

During the period from August 1 to 7, 2025, Hung Thinh Quy Nhon repurchased 25 million bonds with the code HQNCH2124003 at an actual repurchase price of nearly VND 102,622 per bond, equivalent to a repurchase value of nearly VND 2,566 billion, thus fully settling this bond lot.

Also during this period, the enterprise proceeded to settle the HQNCH2124004 bond lot at an actual repurchase price of more than VND 101,778 per bond, corresponding to a total repurchase value of nearly VND 1,527 billion.

Source: HNX

Both bond lots are non-convertible, non-attached warrant bonds, guaranteed for payment, and secured by assets, with a combined fixed and floating interest rate…

All proceeds from the bond issuance were used by the Issuer to supplement operating capital, carry out mergers and acquisitions of companies or real estate projects, and/or collaborate with partners to develop potential real estate projects.

The collateral includes movable property, property rights, revenues arising from or related to certain component projects of the Project in Nhon Hai Commune, Quy Nhon City (formerly known as Quy Nhon City), Nhon Hoi Economic Zone, Binh Dinh Province (now Gia Lai Province); Land use rights and assets attached to the land that have been formed or will be formed in the future of some or all of the land plots belonging to the Project in Nhon Hai Commune; Other assets and security measures legally owned or used by the Issuer and/or third parties as agreed upon by the relevant parties, which can be supplemented or replaced at any time to secure the bond obligations.

Some of the collateral may be shared with the HTQNB2124001 and HTQNB2124002 bond obligations.

It is known that both HTQNB2124001 and HTQNB2124002 bond lots were issued in 2021. In July 2024, the company settled these two lots ahead of schedule with a total repurchase value of VND 1,000 billion.

Regarding Hung Thinh Quy Nhon’s bond repurchase situation, on April 3, 2025, the company repurchased VND 600 billion of HQNCH2124007 bonds, bringing the outstanding value of this lot to VND 300 billion.

The HQNCH2124007 lot was issued to increase the scale of operating capital and/or implement investment programs and projects of the Issuer, specifically to compensate/pay for costs incurred/yet to be incurred in the Projects invested by the Issuer.

The Bonds were privately placed through the issuing agent, VPS Securities Joint Stock Company.

Grand Center Quy Nhon Project Overall Perspective. Image: Hung Thinh

The collateral includes: Land use rights and all assets attached to the land (including both existing and future assets) related to a 2,916.2 sq. m land plot in Ly Thuong Kiet Ward, Quy Nhon City, Binh Dinh Province (now Gia Lai Province) owned by the Issuer, which is used for the implementation of the high-rise apartment and commercial services project (Block A) belonging to the Office, Hotel and Apartment Complex Project (Grand Center Quy Nhon), with the Issuer as the investor; Property rights currently existing and arising in the future from and/or related to the Project (including the Pledged Account) and any other assets used for the purpose of securing the Bonds (if any).

In addition, the HQNCH2124007 lot is also personally guaranteed by Mr. Nguyen Dinh Trung and organizationally guaranteed by Hung Thinh Land JSC.

The bondholder is a domestic credit institution; the arranger for this issuance is VPS Securities Joint Stock Company; and the asset management agent is Vietnam Prosperity Joint Stock Commercial Bank (VPBank).

Also in 2021, Hung Thinh Quy Nhon issued two other bond lots: HQNCH2124005 and HQNCH2124006.

Entertainment Services JSC Hung Thinh Quy Nhon was established in 2018 and is a member of Hung Thinh Group. Its headquarters are located at Lot K20, Hung Thinh Residential Area, Che Lan Vien Street, Area 3, Ghenh Rang Ward, Quy Nhon City. The legal representative is Mr. Nguyen Van Cuong.

It is known that the company is in charge of developing projects in Binh Dinh Province, such as the Mui Tan Quy Nhon sea reclamation urban area, the Grand Center Quy Nhon apartment and office complex, and the most famous one is the Merryland Quy Nhon tourist area.

The Stealthy Conglomerate’s Latest Acquisition: Vinhomes Ocean Park 2, Fueled by a 7,000 Billion VND Bond Issue at a Mere 3% Interest Annually

Prior to the issuance of the 1,000 billion VND bond, this company had mortgaged its contractual rights as collateral at a bank.

Unlocking Credit Opportunities for the Underserved

With total deposits of around 15 quadrillion VND as of now, the interest rates are quite low, yet banks are “desperately seeking borrowers”. Experts suggest that banks need to open up more to Fintech in the approval process and move away from the traditional “collateral requirement” mindset if they want to avoid capital stagnation. However, how much banks are willing to embrace Fintech is a challenging question due to the prevalent “all-or-nothing” mentality.