Export prices drop and profit margins eroded

The Vietnamese rice industry is facing significant challenges as the average export price for the first seven months of 2025 reached only $514 per ton, an 18.4% decrease compared to the same period last year, according to data from the Ministry of Agriculture and Rural Development. This has resulted in a 15.9% decrease in export turnover to $2.81 billion, despite a 3.1% increase in volume to 5.5 million tons.

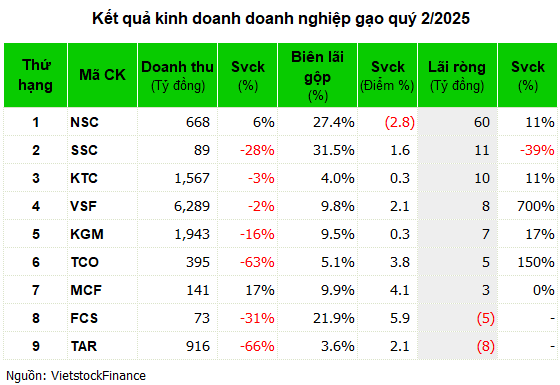

The decline in selling prices has eroded the profit margins of many businesses, while they continue to face working capital challenges with input costs remaining high. According to data from VietstockFinance, the combined revenue of nine listed rice companies in Q2 2025 was VND 12,100 billion, a 20% decrease year-on-year. While the industry’s net profit slightly increased by 1% to VND 91 billion, this growth fails to conceal the underlying struggles faced by the industry.

The gross profit margin improved to 9.6%, mainly due to some companies effectively controlling their costs. Compared to revenue, net profit remains very low, reflecting the thin profit margins and high risks inherent in the rice industry, especially when impacted by financial costs and raw material procurement pressures.

|

Which companies have the resilience to withstand the challenges?

The industry’s profit picture in Q2 2025 is not just about which companies are making profits or losses, but also about their ability to protect profit margins in a challenging market. Vinaseed (NSC) remains a bright spot, contributing 66% of the industry’s total profit with a net profit of VND 60 billion, an 11% increase year-on-year. However, even this leading company experienced a slight decrease in its gross profit margin to 27.4%. On the other hand, smaller-scale companies like Kigimex (KGM) and KTC achieved good profit growth, but their absolute values remain modest, ranging from VND 7-10 billion, which is just enough to sustain operations without creating a significant breakthrough.

In contrast, SSC, despite having the highest gross profit margin in the industry at 31.5%, saw a sharp decline in net profit of nearly 40% to VND 11 billion, indicating that cost control alone is insufficient without revenue growth.

Vinafood 2 (VSF) stands out with a remarkable 700% increase in profit, reaching nearly VND 8 billion, despite a slight 2% decrease in revenue to VND 6,289 billion. This growth is attributed to a significant reduction in cost of goods sold, resulting in a gross profit margin of 9.8%. However, VSF still carries a massive accumulated loss of VND 2,796 billion, a consequence of the difficulties faced after privatization in 2018 and a string of losses from 2013 to 2022.

Similarly, TCO Holdings, a newcomer to the industry transitioning from logistics to rice processing, reported a 150% increase in net profit to VND 5 billion, despite a decline in revenue due to machinery maintenance for the Summer-Autumn crop, and a 29% drop in gross profit for the rice segment to VND 10 billion.

Struggling companies sink deeper into crisis

Trung An (TAR) and Foodcosa (FCS) continue to be the industry’s “loss pits,” reporting losses for the fourth and fifth consecutive quarters, respectively, due to significant revenue declines that fail to cover management costs. TAR, in particular, faces auditing complications and prolonged financial crises, while FCS grapples with a severe working capital shortage, sinking deeper with accumulated losses of VND 201 billion, nearly four times its equity capital.

Additionally, two notable cases are Angimex (AGM) and Loc Troi (LTG), which have not yet published their Q2 financial statements, creating a significant transparency gap. As of March 2025, Angimex was carrying accumulated losses of VND 482 billion and negative equity capital of VND 300 billion, while Loc Troi has repeatedly postponed the publication of its financial statements since Q4 2024 due to “force majeure,” and has yet to hold its 2025 Annual General Meeting despite multiple schedule changes.

The controversies surrounding governance, especially post-Louis Holdings at Angimex and allegations of asset misappropriation at Loc Troi, serve as stark reminders of the importance of governance and restructuring in the industry.

Is the inventory strategy a risky move?

The rice industry’s inventory at the end of June 2025 increased by 20% compared to the beginning of the year, totaling more than VND 4,700 billion, with Vinaseed and Vinafood 2 accounting for the majority of this increase. Vinaseed’s inventory primarily consisted of finished goods (93%), while Vinafood 2 experienced significant increases in both raw materials and finished goods. In contrast, companies like Kigimex and KTC reduced their inventory by 13% and 6%, respectively, while also achieving profit growth, demonstrating their effective management of working capital.

While the strategy of holding inventory may reflect expectations of price recovery, it also poses significant cash flow challenges, especially for small and medium-sized enterprises, given the implementation of the 5% VAT policy effective July 1, 2025. Some companies, like TAR, have improved their operating cash flow, turning it around from negative VND 249 billion to positive VND 153 billion by recovering receivables and reducing inventory, but such cases remain in the minority and do not represent an industry-wide trend.

Competitive pressures and quality demands

Q2 2025 wasn’t a significant downfall, but it served as a clear reminder of the Vietnamese rice market’s self-regulation, as noted by Mr. Bui Le Quoc Bao, CEO of TCO Holdings: “Those who cannot adapt will be eliminated. Those who have survived until now possess resilience.”

The gap between companies capable of managing profit margins and cash flows effectively and those struggling has become more pronounced. However, positive policy signals, such as the reduced US tax (effective August 2025) and the EU’s demand for low-carbon rice, present opportunities for companies to upgrade their supply chains and traceability. At the same time, competition from India, Pakistan, and the US, coupled with declining rice prices and increasing quality demands, compel businesses to focus on value addition rather than solely relying on volume.

Ultimately, profit is not the only indicator of success; it also reflects a company’s governance capabilities, adaptability, and transparency within an industry already burdened by market and policy pressures.

The Manh

What’s Happening with FPT: Foreigners Sell for 12 Straight Sessions, Record High Room of 140 Million Shares Despite High Profit Growth

Despite the stock market’s relentless surge to new highs, FPT stock has lagged, falling 20% from its mid-January peak.

The Ultimate Recession-Proof Industry: A $70 Billion Behemoth, with Retail Giants Scrambling to Open Stores in Rural and Urban Areas Alike

The pharmaceutical retail market is often deemed “recession-proof”, owing to the consistent demand for pharmaceuticals, which remains imperative despite macroeconomic fluctuations. In the context of Vietnam, with its aging population and growing middle class, the demand for healthcare, and by extension, the pharmaceutical industry, is experiencing unwavering growth, as highlighted by Vietdata, a prominent provider of reports on the Vietnamese economy.

Unlocking the Export Potential of Vietnam’s Tropical Fruits: BIG Ventures into Agricultural Business with a Focus on Dollar-Valued Produce

To seize the ever-growing opportunities in the agricultural export market, especially for the “king of fruits” – durian, Big Invest Group JSC (UPCoM: BIG) has swiftly expanded its business into the agricultural produce sector. Along with the establishment of two specialized agricultural produce companies, BIG also forged a strong partnership with a leading durian exporter to China in the Southern region.

The $3 Billion Project: Revolutionizing 1 Million Hectares of Rice Cultivation for High-Quality, Low-Carbon Yield

If the initiative to cultivate 1 million hectares of high-quality, low-emission, specialized rice fields aligned with green growth principles is successfully implemented, it could boost the entire rice industry’s value by an estimated VND 21 trillion per year. However, the biggest challenge lies in securing the required investment of approximately USD 3 billion to turn this vision into a reality.