“More Banks Improve Non-Performing Loans: A Comprehensive Analysis of Vietnam’s Banking Sector”

Data from VietstockFinance reveals that as of June 30, 2025, the total outstanding loans of 29 banks that have published their financial statements exceeded 14.9 quadrillion dong, marking a 10% increase since the beginning of the year.

Saigonbank (SGB) was the only bank to experience a 7% decline in credit extension, while the remaining banks demonstrated positive growth. Notably, NCB (NVB) led the pack with a remarkable 22% increase, followed by VPBank (VPB) at 19.7%, HDBank (HDB) at 17.8%, ABBank (ABB) at 16%, and Nam A Bank (NAB) with a 14.7% surge.

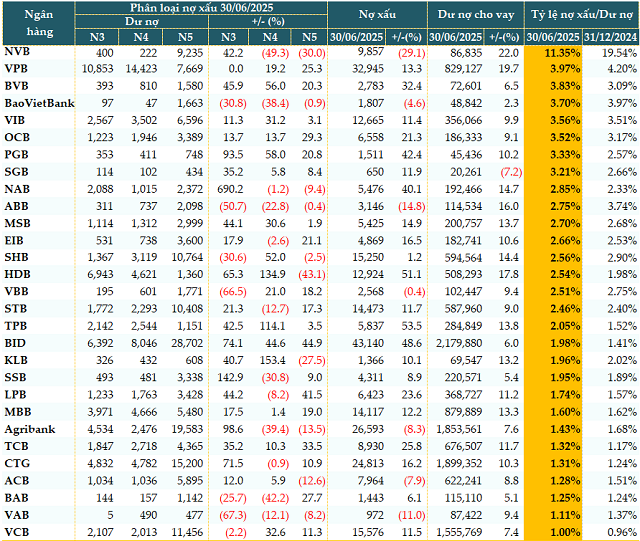

As of the second quarter of 2025, the total non-performing loans of these 29 banks amounted to 294,393 billion dong, reflecting a rise of over 13% compared to the start of the year.

However, it is encouraging to note that 7 banks witnessed a decrease in non-performing loans by the end of the second quarter (compared to just 4 banks at the end of the first quarter), with an average reduction of 11%. The financial institutions that demonstrated improved loan quality include NVB (-29%), ABB (-14.8%), VietABank (VAB, -11%), Agribank (-8.3%), ACB (-8%), BaoVietBank (-4.6%), and Vietbank (VBB, -0.4%).

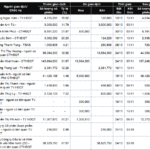

A breakdown of the non-performing loan structure reveals an increase across all loan categories since the beginning of the year. Substandard loans (group 3) rose by nearly 32%, doubtful loans (group 4) increased by over 17%, and loss loans (group 5) climbed by almost 7%. However, when compared to the end of the first quarter, there is a noticeable improvement in the loan structure.

Several banks have made significant strides in enhancing their loan quality, with ABB, VAB, and BaoVietBank successfully reducing all categories of non-performing loans. Meanwhile, NVB, Agribank, and Bac A Bank (BAB) have shown improvements in most loan groups.

|

Loan Quality of Banks as of June 30, 2025 (in trillion VND)

Source: VietstockFinance

|

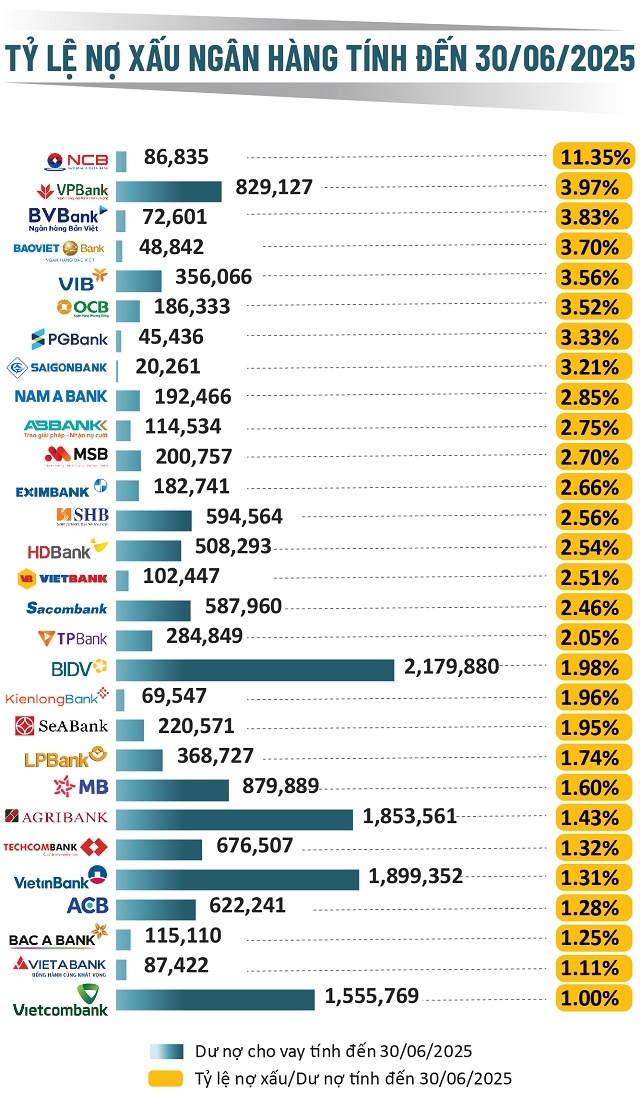

Non-performing loan ratios stabilize

As of June 30, 2025, 11 out of 29 banks exhibited a decrease in their non-performing loan ratios compared to the beginning of the year, while only 7 banks showed similar improvements at the end of the first quarter. Notably, the number of banks with non-performing loan ratios exceeding 3% remained unchanged at 8 from the previous quarter.

Source: VietstockFinance

|

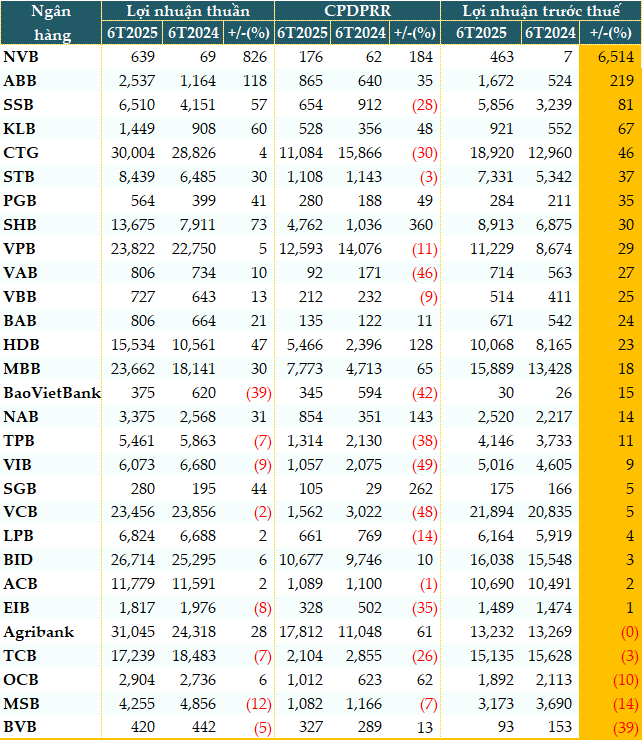

During the first half of the year, banks also bolstered their credit risk provisions while maintaining profit growth.

According to VietstockFinance data, the total credit risk provisions of the 29 banks during the first six months reached 86,057 billion dong, reflecting a 10% increase compared to the same period last year. Out of these banks, 14 increased their provisions, but only 5 experienced a decline in pre-tax profits during the first half of the year.

|

Pre-tax Profits of Banks in the First Half of 2025 (in trillion VND)

Source: VietstockFinance

|

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, offered his assessment, stating that positive signals are emerging, albeit unevenly, indicating that non-performing loans are entering a phase of “stabilization under pressure” and gradually shifting from a defensive to a proactive control approach.

The economy is being supported by a stable monetary policy, with interest rates maintained at low levels, significantly easing financial pressure on both businesses and individuals. In parallel, the restructuring of repayment periods and the retention of debt groups according to Circular No. 02 are still being implemented selectively, providing a necessary “buffer” for customers facing temporary difficulties.

Against this backdrop, banks have proactively redirected credit capital towards safer areas. Priority has been given to sectors that drive economic growth, including production and export, renewable energy, high technology, and clean agriculture. Conversely, credit to high-risk sectors such as real estate, construction, and households with unstable cash flows has been tightly controlled.

These efforts have yielded initial results. There are signs of recovery in the cash flow of businesses in the tourism, services, logistics, and consumer goods export sectors during the second quarter. Consequently, a portion of customers has exited the non-performing loan category, contributing to an improved overall non-performing loan ratio for the entire system.

Notably, banks have also taken a more proactive approach to debt handling and risk management. The sale of non-performing loans to VAMC and asset management companies (AMC), disposal of secured assets, and increased credit risk provisions have been accelerated to clean up balance sheets. Simultaneously, banks have also restructured loans for customers showing early signs of difficulty, preventing the formation of new non-performing loans.

The solution to the credit risk challenge lies in digital transformation. This is no longer just a technological trend but has become a core tool for addressing non-performing loans at their root.

Banks are accelerating the comprehensive digitization of their customer portfolios, building multidimensional data profiles (cash flow, repayment history, supply chain linkages) by connecting various systems, including core banking, CRM, and eKYC.

Leveraging the power of Big Data and Artificial Intelligence (AI), banks can: identify abnormal financial behaviors and potential non-performing loan formations before they occur; develop flexible credit scoring models that automatically adjust to market fluctuations and customer behavior; and based on system alerts, proactively propose loan restructuring options to support customers’ liquidity and prevent the occurrence of non-performing loans.

Expectations for stable non-performing loan ratios until the end of the year

Based on current factors, Mr. Huy presented scenarios for non-performing loans from now until the end of the year. In the base case scenario, which is the most likely, the non-performing loan ratio is expected to fluctuate between 3.2% and 3.5%. This range remains within a manageable level, assuming a slight improvement in business cash flow and the effectiveness of risk management solutions.

In an optimistic scenario, if the economy recovers more robustly than expected, with a significant surge in consumption and exports, the non-performing loan ratio could be pushed below 3%.

Conversely, in a risk-averse scenario, should external shocks occur or the real estate market continue its deep slump, the non-performing loan ratio may surpass the 3.8% to 4% threshold.

While there have been positive developments in the non-performing loan landscape, challenges remain on the horizon. The true driver for long-term risk control lies not only in macroeconomic policies but also in the digital transformation capabilities of individual banks. Institutions that invest strategically in digital infrastructure and intelligent data strategies will hold the advantage in both risk management and sustainable profit growth.

– Cat Lam

– 10:51, August 14, 2025

“G-Group and MBV Collaboration: Unlocking the Power of Tech and Finance for Digital Transformation”

On August 6, G-Group Technology Corporation and the Vietnam Modern Commercial Joint Stock Bank (MBV) signed a comprehensive strategic cooperation agreement, forging a long-term partnership between two leading enterprises in the fields of technology and finance. This collaboration aims to empower and accelerate comprehensive digital transformation.

“Unlock the Power of Digital Authentication: VNeID on OCB OMNI”

“In a significant step towards enhancing customer experience and supporting the successful implementation of Scheme 06, Orient Commercial Joint Stock Bank (OCB) and the Research and Application Center for Population Database and Civil Status (RAR) under the Ministry of Public Security have joined forces. The two entities have officially signed a contract to integrate electronic authentication services via VNeID into the OCB OMNI application, marking a pivotal move towards optimizing customer journeys and solidarily collaborating with relevant authorities.”

A Model to Help Ho Chi Minh City Businesses Save Billions

With the successful implementation of smart manufacturing, a factory has achieved significant cost savings, amounting to millions of dollars. This remarkable feat has caught the attention of Ho Chi Minh City authorities, who are now planning to replicate this success across various economic sectors.

![[Infographic] Comprehensive Annual Bank Performance in 2023](https://xe.today/wp-content/uploads/2024/03/info-kqkd-ngan-hang-2023-100x70.jpg)