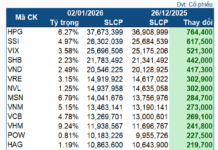

On August 12th, the VN-Index extended its winning streak to seven consecutive sessions, surging 11.36 points to a record high of 1,608.22 points. Market liquidity surpassed VND 50,000 billion, with over 1.9 billion shares changing hands, indicating strong inflows into the market.

Financial and banking stocks continued to lead the rally, attracting more than VND 18,000 billion. Real estate was the second hottest sector with transactions totaling over VND 8,100 billion. While some stocks showed signs of cooling off after their recent gains, KDH soared to the daily limit (+6.88%), followed by PDR (+5.29%) and NLG (+2.47%), all attracting strong buying interest.

|

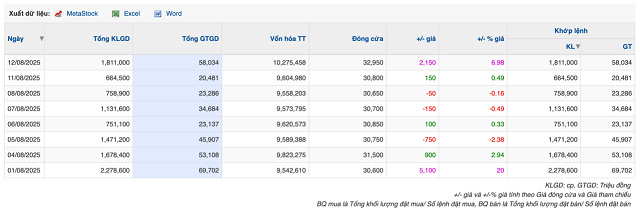

Since its listing on the Ho Chi Minh Stock Exchange (HOSE) on August 1st, transferring 311.85 million shares from UPCoM, TAL of Taseco Land has been on a remarkable upward trajectory. By the close of the August 12th session, TAL had reached VND 32,950 per share, with a market capitalization of VND 10,275 billion, firmly establishing itself among the “billion-dollar” enterprises.

During its first eight sessions on HOSE, TAL’s average daily matched volume was 1.3 million units, an eightfold increase compared to the previous year. Even on August 12th, despite hitting the ceiling price, there were still over 1 million shares on the buy side, with 961,600 units queued at the ceiling price.

Long Bien Central Project – launched right after the HOSE transfer event

|

Technically, TAL presented a bullish outlook across various indicators, including MACD, RSI, and MA. The RRG chart showed the stock exiting the “Weakening” quadrant and entering the “Rising” quadrant with a price strength of 94 points. Notably, Taseco Land recently launched the Long Bien Central project in Hanoi, witnessing full subscriptions for Phase 1 units during the debut event. The company is also poised to initiate several key projects, including the Thai Nguyen Walking Street, Trung Van Residential Area, Me Linh Hanoi Urban Area, and other strategic ventures.

Services

Kim Ngan

– 14:30 13/08/2025

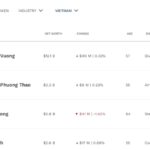

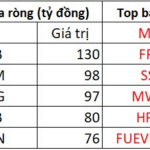

Foreign Sell-Off: 13th August Session Sees Massive Foreign Outflow of Over VND 1,500 Billion – Which Stocks Took the Biggest Hit?

“SHB stocks witnessed a significant boost in foreign investment today, as foreign investors net bought a substantial 130 billion VND worth of shares, making it the most actively traded stock in the market.”

Stock Market Update: Riding the Wave or Missing Out?

Today’s session (August 13th) saw the VN-Index fluctuate around the 1,600-point mark multiple times. The intense back-and-forth movement at this strong resistance level has put investors in a tricky situation: buying now risks buying at the peak, but selling early could mean missing out on potential gains. Experts suggest that if the market undergoes a technical correction until the end of August, it would present an opportunity to enter instead of rushing to buy at higher prices.

A Rogue Bank Code: The Sudden Surge of Prop Trading in Vietnam’s Stock Market

The HoSE witnessed a notable trading session on Thursday, with foreign investors and securities companies taking center stage. While foreign investors displayed confidence in the market by snapping up stocks, securities companies offloaded a substantial amount, amounting to a net sell value of VND 621 billion. This contrasting behavior between the two key market players has left market participants intrigued, with many wondering what the future holds for Vietnam’s stock market.