According to YouNet Media statistics, the banking sector attracted 699,018 users in Q2 2025 alone, generating over 1.9 million discussions related to brands.

However, only 37.3% of the discussions came from qualified users (those without abnormal patterns in frequency, quantity, or content repetition). While this figure falls short of industry expectations, it is significantly higher than other sectors.

The data indicates that the banking industry is witnessing vibrant discussions alongside a superior quality of users, demonstrating a strong appeal to potential customers who understand the true value proposition.

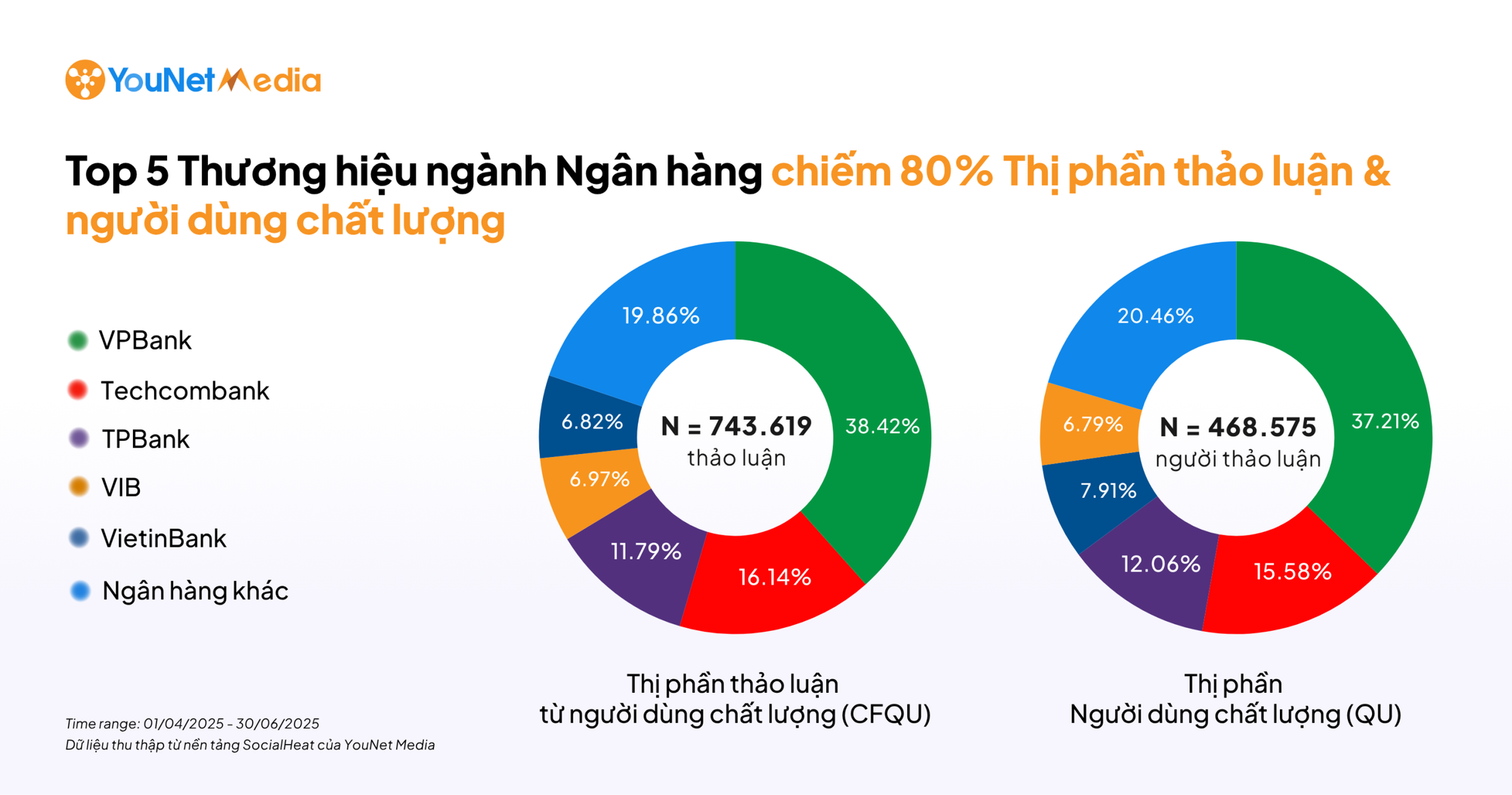

The top 5 brands in the banking industry accounted for 80% of the discussion market share (CFQU) and quality users (QU), and they are prominent names, including: VPBank, Techcombank, TPBank, VIB, and VietinBank. These banks are also associated with sponsorships of popular game shows and music and entertainment events, such as “Anh Trai Vượt Ngàn Chông Gai,” “Em Xinh Say Hi,” and the VPBank K-Star Spark 2025 music festival.

VPBank maintained its leading position with 285,680 discussions, accounting for a 38.42% market share from qualified users, and also boasted the highest number of Qualified Users (174,363 discussants – 37.21%).

Techcombank ranked second with 120,034 discussions (16.14%) from 72,992 Qualified Users (15.58%).

TPBank came in third with 87,677 discussions (11.79%), followed by VIB with 51,803 discussions (6.97%) and VietinBank with 50,751 discussions (6.82%).

The remaining banks accounted for the other 20% in terms of discussion volume and quality users.

YouNet Media attributes the success of VPBank, Techcombank, and TPBank to their effective utilization of three core elements: large-scale events and activities, engaging entertainment content, and practical benefits for customers.

Specifically, VPBank (VPBank K-Star Spark In Vietnam) leveraged the appeal of international artists and exclusive benefits, creating a discussion “fever” that far surpassed its competitors during the event.

Meanwhile, Techcombank, through its involvement in concerts like “Anh Trai Vượt Ngàn Chông Gai” and the “Tân Binh Toàn Năng” program, maintained stable discussion volumes throughout the quarter by employing a multi-channel strategy, including livestreams on their Facebook and YouTube fan pages.

TPBank, with its “Em Xinh Say Hi” show, consistently generated high levels of discussion by turning each episode into a social media sensation, amplified by content shared by its own employees.

The common denominator among these three banking brands is their ability to leverage events as catalysts for extended media exposure, combining them with practical benefits and interactions to not only increase their market share of quality users but also solidify their brand presence in the minds of their customers.

Market Beat: VN-Index Hits New High of 1,640

The VN-Index closed the August 14th session with a significant gain of nearly 30 points, despite some late-afternoon volatility. It soared to a new record high of 1,640.69 points. The HNX-Index also witnessed a robust surge of almost 5.5 points, climbing to 285.15.

“VPBank at 32: Shaping the Modern Financial Lifestyle”

“VPBank, at 32, exudes a confident maturity and a pinnacle of creativity. With a rich history of innovation, the bank is poised for groundbreaking progress, ready to soar with the nation into a new era. Marking its 32nd anniversary, VPBank expresses its gratitude to its valued customers by launching a plethora of enticing promotional programs.”

Dr. Nguyen Tri Hieu: “Lowering Interest Rates to Support Growth is Logical, but it Also Harbors the Risk of Asset Bubbles”

The banking sector is the “backbone” of the economy, providing capital and making an ever-increasing contribution to the state budget. However, behind these impressive figures lies the pressure of a high credit-to-GDP ratio, maturity and interest rate risks, and the urgent need for digital transformation to stay in the global race.