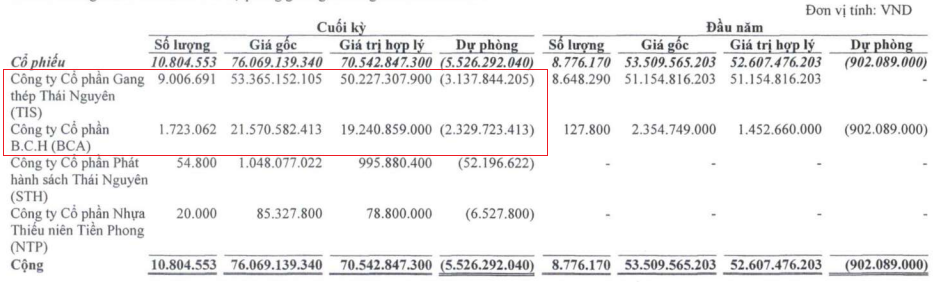

In its explanation, the audit adjustment increased financial expenses by over VND 5 billion due to the re-evaluation of provisions for trading securities and borrowing costs, resulting in a negative post-tax profit. As of June 30, 2025, DHM has set aside over VND 5.5 billion in provisions for its trading securities portfolio worth more than VND 76 billion (original value), compared to less than VND 1 billion in the same period last year.

Which stocks is DHM holding?

In its investment portfolio, TIS stock accounts for 70% of the original value (VND 53.4 billion) and is currently trading at a loss of nearly 6%. The company has also increased its purchase of BCA stock by nine times since the beginning of the year, totaling VND 21.6 billion, but is currently trading at an 11% loss. The company also invested in STH and NTP stocks on a smaller scale, but these are also temporarily loss-making. On the other hand, bank deposits of over VND 131 billion brought in interest income of over VND 4 billion, an increase of 89% compared to the previous year.

The two stock investments with the highest provisions for reduced securities value by DHM – Source: DHM

|

Revenue for the first half of 2025 decreased sharply by 52% year-on-year to VND 987 billion, losing the thousand-billion-dong biannual milestone maintained for the previous two consecutive years. Although the gross profit margin increased to 1.4% from 0.8% in the same period last year, it was still very low and unable to offset expenses. Cumulatively, for the first six months, the company has only achieved 28% of its annual revenue plan and is yet to make a profit, while the full-year target is set at nearly VND 10 billion.

DHM stated that the steel industry is currently affected by tariffs imposed by major economies such as the US, causing price fluctuations, reduced consumption, and a 52% plunge in sales. Combined with high operating costs, the company incurred losses in the first half of the year.

| DHM’s business results for the first half of the year in previous years |

In terms of capital sources, total liabilities decreased by 14% to VND 537 billion, mainly consisting of short-term bank loans (VND 449 billion) with the two largest lenders being BIDV – Nam Thai Nguyen Branch (VND 239 billion) and MB (VND 138 billion).

On the stock exchange, DHM stock recorded four consecutive declining sessions, closing the session on August 15 at VND 6,550 per share, down 16% in three months and nearly 20% in one year, with an average liquidity of about 26,000 shares per day.

| Price movement of DHM shares since the beginning of 2025 |

– 15:58 15/08/2025