Vietnam’s stock market has been on a roll, with a nine-day winning streak fueled primarily by banking stocks. The VN-Index surged 29 points (+1.81%) to cross the 1,640-point mark, setting a new record. This performance made Vietnam the best-performing stock market in Asia on August 14.

Since the confirmed tariff bottom on April 9, the VN-Index has gained nearly 550 points. During this period, Vietnam’s stock market has witnessed numerous spectacular rallies, ranking among the top performers in the region and the world. In fact, over the last three months, no stock market index globally has outperformed the VN-Index.

Low-interest rates have been a key driver, boosting credit, infrastructure investment, and public investment, all of which benefit businesses and domestic cash flow. This is evident from the numerous high-liquidity sessions with matching orders exceeding $2 billion, and even reaching $3 billion on some days. Additionally, the increasingly clear prospect of an upgrade has bolstered investor confidence.

An upgrade to emerging market status is one of the most important goals for Vietnam’s stock market at present. The Prime Minister has recently instructed the Ministry of Finance to urgently implement necessary measures to upgrade the stock market from a frontier to an emerging market, promptly addressing challenges and creating favorable conditions for capital mobilization to drive economic development.

In reality, after much effort to improve regulations and technical infrastructure, Vietnam’s stock market is highly likely to be upgraded by FTSE this year, according to both domestic and foreign organizations. The State Securities Commission also expressed confidence in Vietnam’s prospects for an upgrade to emerging market status by FTSE in October.

Following the strong upward momentum over the past period, short-term profit-taking pressure is inevitable. However, given the clear growth drivers, several securities companies have raised their VN-Index forecasts significantly. In an optimistic scenario, Maybank Securities (MSVN) even expects the VN-Index to reach the 1,800-point threshold.

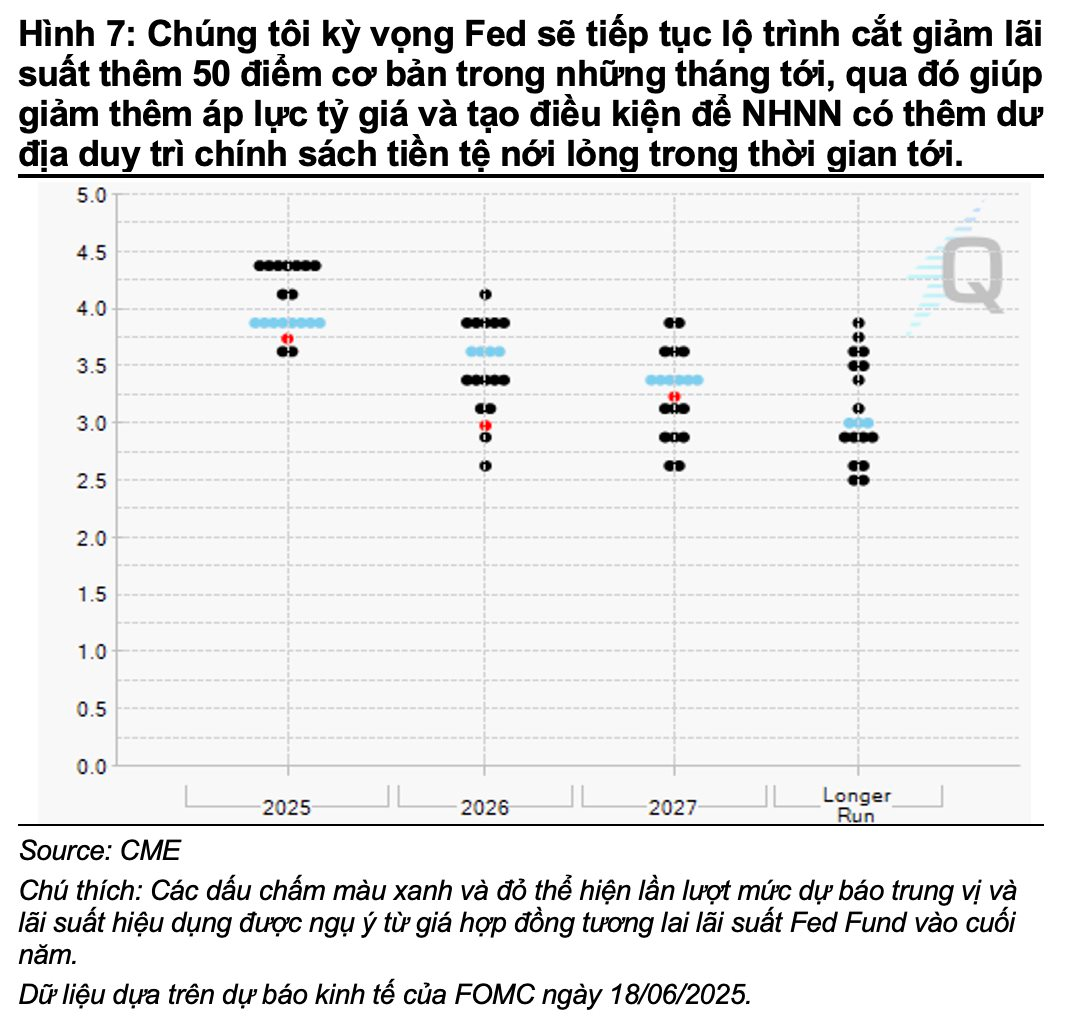

Analysts anticipate slower but higher-quality profit growth in the second half of 2025. The government is aggressively pursuing an 8% GDP growth target through proactive fiscal measures. Maybank Investment Bank forecasts domestic deposit rates could rise by 0–50 basis points due to increased capital mobilization needs, but the State Bank will likely maintain its accommodative policy if the Fed continues to cut rates.

Sharing this view, Dragon Capital’s recent report states that the overall outlook remains positive. Despite external challenges such as tariffs from the US, Vietnam’s economy remains resilient due to stable credit growth, controlled inflation, robust public investment, and positive FDI inflows.

“Investor sentiment is likely to remain optimistic if macro conditions and corporate earnings continue their current trajectory,” Dragon Capital emphasized. “However, given the market has recorded one of the strongest rallies in the past three years, sensitivity to negative global factors related to the trade war and economic prospects could increase.”

Market Beat: Profit-Taking Pressure Mounts, VN-Index Retreats

The selling pressure intensified, causing key indices to plunge into the red at the end of the morning session. By the mid-session break, the VN-Index hovered near the reference level, settling at 1,639.45 points; while the HNX-Index posted a 0.93% loss, landing at 282.49 points. The decline intensified, with 540 declining stocks outweighing 207 advancing ones.

“SCR Surges Past 10,000 VND per Share”

The trading session on August 14, 2025, witnessed a remarkable surge in the share price of SCR, breaching the 10,000 VND mark and culminating at 10,400 VND at the closing bell. This pinnacle represents a significant milestone, as it surpasses the highest level attained since September 2022, heralding a new era of potential growth and investor confidence.