Vietnam’s stock market continues to conquer new highs. In the context of enthusiastic cash flow, many stocks have recorded strong gains. One of these is CII – Ho Chi Minh City Infrastructure Investment Joint Stock Company.

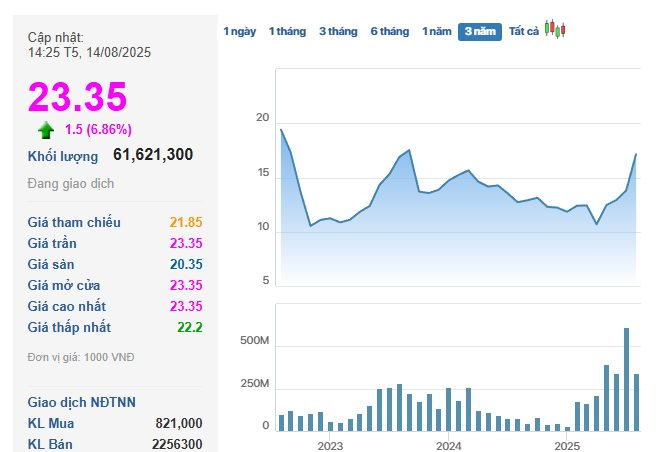

On August 14, CII witnessed a 6.9% surge to VND 23,350 per share right from the opening bell, marking the sixth consecutive session of reaching the maximum daily limit and closing at the purple-chip price. Since the beginning of April 2025, CII stock has soared over 153%, climbing to its highest level in more than three years.

Following the consecutive ceiling-hitting sessions, CII issued an explanation letter. According to the company, the stock price surge during this period was an objective development driven by the supply and demand dynamics in the stock market. The company’s production and business activities remain normal, adhering to the planned course, without any abnormal changes or significant impacts on its financial situation and business operations.

CII also committed to fulfilling its information disclosure obligations as stipulated by the law and the Ho Chi Minh City Stock Exchange.

CII is renowned for its vast land bank of over 96,000 square meters, assigned by the Ho Chi Minh City People’s Committee for the development of a new urban area. Of this, 90,078 square meters in the Thu Thiem New Urban Area are for stable long-term use, intended for CII to construct residential projects, while the remaining 6,053 square meters are for 50-year leasehold, designated for building offices for rent.

Presently, the Land Development Center is in the process of selecting a consulting unit to establish a certificate of appraisal for the initial price. Regarding the seven land plots outside of Thu Thiem, the commune-level authorities are working on the 1/500 planning for housing projects and making investment decisions.

According to the Department of Agriculture and Environment, two projects with expected revenues of VND 4,168 billion have been submitted to the Land Price Appraisal Council. These include the Thu Thiem Observation Tower Complex project in functional area No.2b of the Thu Thiem New Urban Area, with estimated revenue of VND 4,000 billion, and the Song Viet Complex project in functional area No.1, expected to generate VND 168 billion.

Additionally, there are 23 projects planned to be submitted to the Land Price Appraisal Council in 2025. Among these, 18 projects are anticipated to bring in VND 7,956 billion, while the remaining five projects are undergoing price determination in accordance with Conclusion No.77 of the Politburo.

In terms of business performance, for the first six months of 2025, CII recorded a slight decline with consolidated revenue reaching nearly VND 1,447 billion, an 8% decrease compared to the same period in 2024. After-tax profit also witnessed a decrease of nearly 54%, amounting to over VND 206 billion.

Recently, CII concluded the issuance of nearly 77 million bonus shares to shareholders, resulting in an increase in charter capital from nearly VND 5,481 billion to over VND 6,249 billion.

A Private Equity Firm Wants to Divest its Stake in Seaprodex

Red Capital is set to offload its entire stake in SEA, amounting to 18 million shares, which represents 14.4% of the charter capital of Seaprodex. The transaction is expected to take place between August 14 and September 5, 2025.

CII Completes Distribution of Nearly 77 Million Bonus Shares to Shareholders

On August 6, 2025, CII concluded its issuance of over 76.7 million bonus shares to 42,311 shareholders, successfully raising its charter capital from nearly VND 5,482 billion to over VND 6,249 billion.