Stock shares soar, valuations are no longer cheap

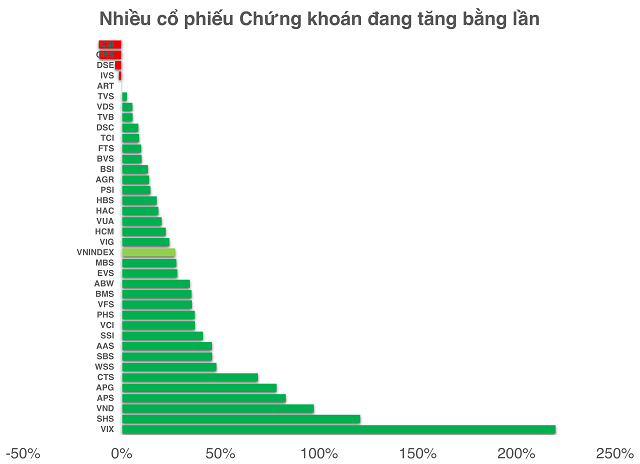

With the impressive strides made by the stock market recently, securities firms have been at the forefront of this wave, with numerous tickers witnessing remarkable price hikes.

Most notably, VIX JSC Securities Company (VIX) has tripled in value, Saigon-Hanoi Securities JSC (SHS) has surged by 122%, VNDirect Securities Corporation (VND) has doubled, and APS Securities JSC (APS) has climbed by 84.6%. This dynamic reflects the robust enthusiasm of capital flows and the high expectations surrounding market upgrade narratives and the deployment of digital assets.

Stocks VIX and SHS have tripled, while VND has surged by 97.3% as of the trading session on 12/8.

|

However, according to experts, the current valuations are approaching a zone that is no longer considered inexpensive. Mr. Bui Van Huy, Director of FIDT Research, asserted: “Compared to the historical average P/B (Price to Book) ratio, the securities group has been valued by the market at a significantly higher level. While the valuation is no longer cheap, the narratives of expectations are the most prominent aspect of the securities sector, such as market upgrades and the pilot program for digital asset exchanges.”

Concurring with this perspective, Mr. Nguyen Anh Khoa, Head of Analysis and Investment Consulting at Agribank Securities Joint Stock Company (Agriseco), revealed that the P/B ratio for this industry is currently over two times, surpassing the five-year average of 1.5 times. In addition to the drivers of market upgrades and digital assets, securities firms are maintaining margin lending at a safe level amid booming market liquidity. “This lays the groundwork for bolstering other pillars, such as IPO (Initial Public Offering) and M&A (Mergers and Acquisitions) activities, thereby attracting foreign capital,” emphasized Mr. Khoa.

Similarly, Mr. Nguyen The Minh, Director of Research and Retail Client Development at Yuanta Vietnam Securities, suggested that, along with the positive outcomes derived from proprietary trading and margin lending in the previous quarters, investors should also pay attention to the revenue stream from IB (Investment Banking) activities of securities companies, particularly those of larger entities.

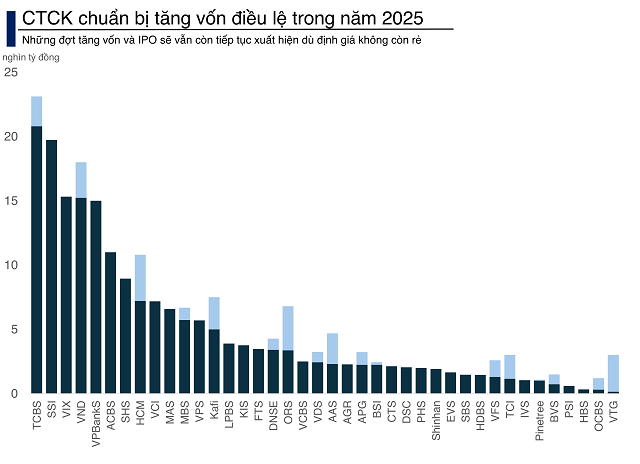

Capital hikes remain a matter of survival

The narrative of capital hikes is not novel for securities firms over the last few years. However, even at these elevated valuation levels, there are no indications of this trend abating.

Following a private placement at the beginning of 2025, Techcom Securities Joint Stock Company (TCBS) is currently undertaking a new IPO to elevate its charter capital beyond 23 trillion VND and potentially propel its owner’s equity above 40 trillion VND, underscoring its determination to retain its top-tier industry position. The gap between TCBS and the rest is accentuating the intensifying competitive pressures.

Ho Chi Minh City Securities Corporation (HSC) is also expediting efforts to finalize a capital hike, aiming to surpass 10 trillion VND in charter capital to expand its lending capacity. HSC is projected to accomplish this goal by September 2025.

Meanwhile, SSI Securities Corporation, harboring aspirations to venture into the realm of digital assets, is likely to remain in the capital race in 2025. Recently, SSI announced plans to convene an Extraordinary General Meeting of Shareholders on September 25, 2025. While the agenda has not been disclosed, analysts speculate that capital augmentation will likely be the focal point, especially given the accelerated momentum of its rivals.

It’s not just the industry giants; numerous smaller securities firms, such as Rong Viet Securities JSC (VDS), MB Securities JSC (MBS), and KAFI Securities JSC (KAFI), have already initiated or are preparing to implement capital enhancement strategies to bolster their competitive stance.

Overall, in a market where scale is pivotal to sustaining strength, this wave of capital hikes is unlikely to subside in the near term. As the “heavyweights” vigorously expand their financial capabilities, the remaining players must join the fray to avoid a diminution of their market share. Mr. Bui Van Huy cautioned that investors should meticulously assess fundamental factors, particularly the risk of ROE (Return on Equity) dilution if capital hikes are not strategically employed.

– 07:30 14/08/2025

Port of Nghe Tinh: Profit Surge Post-Audit, Thanks to Land Lease Privileges, Shares Dive Post-Peak Sessions

After a recent review, the Hai Phong Port Joint Stock Company (HNX: NAP) has reported a 5% increase in profits due to a reduction in land lease costs. This adjustment pushes the company’s first-half 2025 earnings to a record high of over VND 15 billion. NAP’s stock price has undergone a significant correction after reaching a peak of VND 16,000 per share.

What Stock Symbol Was the Focus of Proprietary Trading Firms’ Accumulation on August 14th?

The HoSE-listed securities investment firms witnessed a net buy value of VND1.89 trillion by proprietary traders.

The Vietnam Stock Market: Legally Prepared for Seamless Afternoon Trading, T+0

In the coming months, the Vietnamese stock market is set to introduce several notable products and initiatives. Among these are extended trading hours, potentially including a lunch break; the implementation of T+0 trading; and allowing the sale of securities “on the way home.” The legal framework and systems are in place, and the market eagerly anticipates the rollout of these initiatives by the relevant authorities.