Vietnamese Stock Market Surges: Overcoming Resistance Levels and Expert Insights

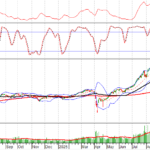

The Vietnamese stock market has been on a remarkable rally, with nine consecutive sessions of gains, breaking through multiple short-term resistance levels. A broad range of sectors, including securities, banking, insurance, and real estate, have witnessed substantial increases. Many stocks have surged by 50%-70%, and some have even doubled in value within a short period.

Some investors who prematurely sold their stocks, anticipating a market correction, are now buying back to avoid missing out on further gains. Meanwhile, prospective investors who are new to the stock market are hesitant to enter, fearing that the prices may have peaked.

Prospective investors are cautious about entering the stock market, fearing that the prices may have peaked.

Experts Believe There’s Still Room for Growth

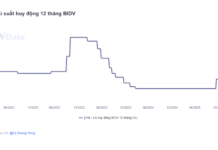

Mr. Tran Quoc Toan, Branch Director of Mirae Asset Securities Company (MAS), shared his insights with reporters, stating that determining the short-term peak of the market at this point is extremely challenging. He attributed this to the favorable macroeconomic backdrop, robust earnings growth of listed companies, and rising investor confidence.

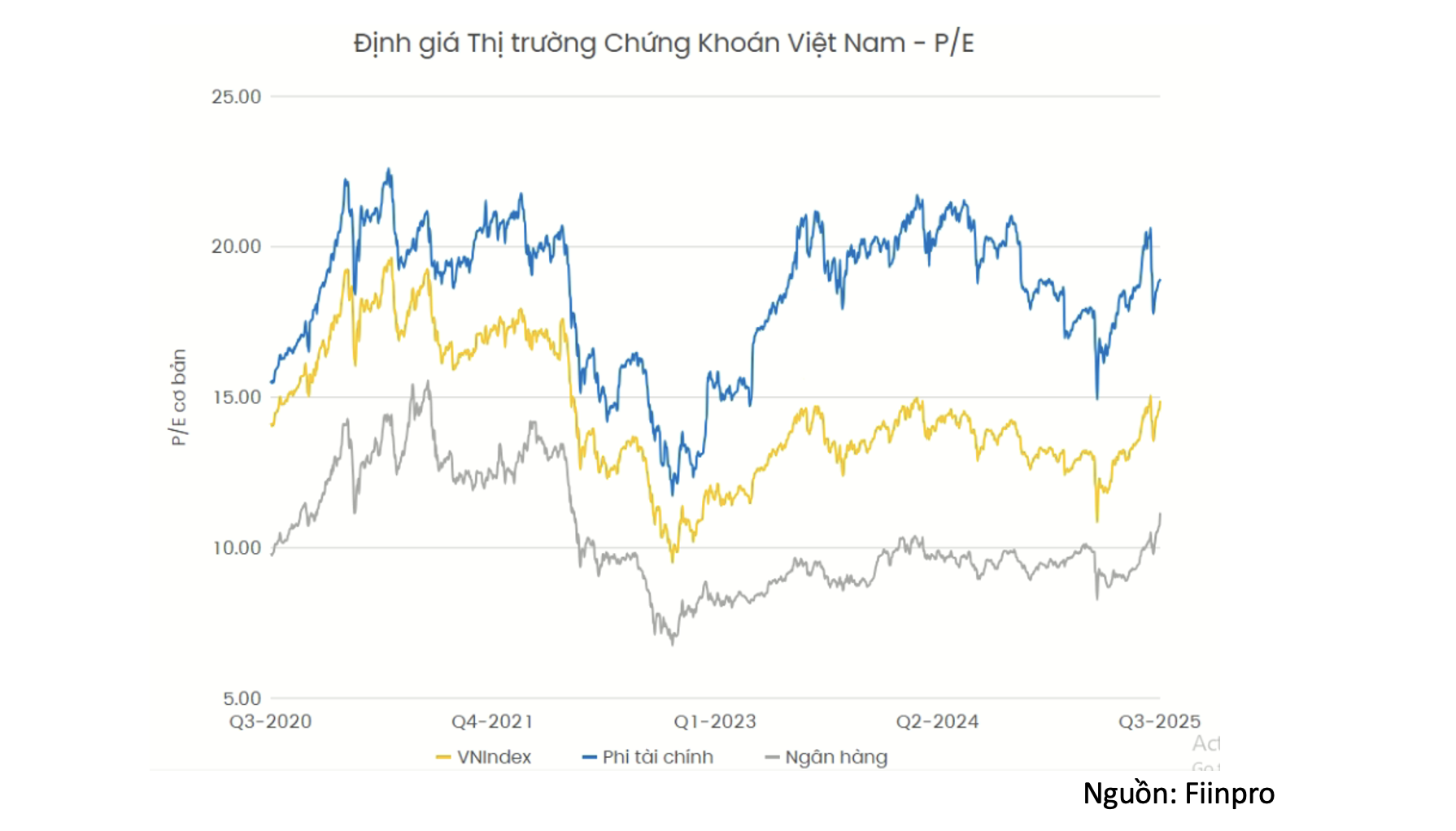

Despite VN-Index surpassing its previous all-time high from late 2021, the market’s current P/E ratio stands at 14.5, which is lower than the five-year average and below the 18 times level seen in 2021. “This indicates that there is still room for growth as earnings of listed companies, particularly in the banking and real estate sectors, improve, coupled with expectations of an expanding P/E multiple,” said Mr. Toan.

He acknowledged that the current pace of growth is “high and faster” than previous rallies, which could heighten concerns about a potential correction. Unexpected profit-taking could occur, similar to 2021 when the market experienced five corrections of more than 5%, including two corrections of over 10%. “Investors must always manage their risks,” he advised.

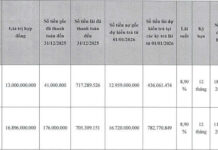

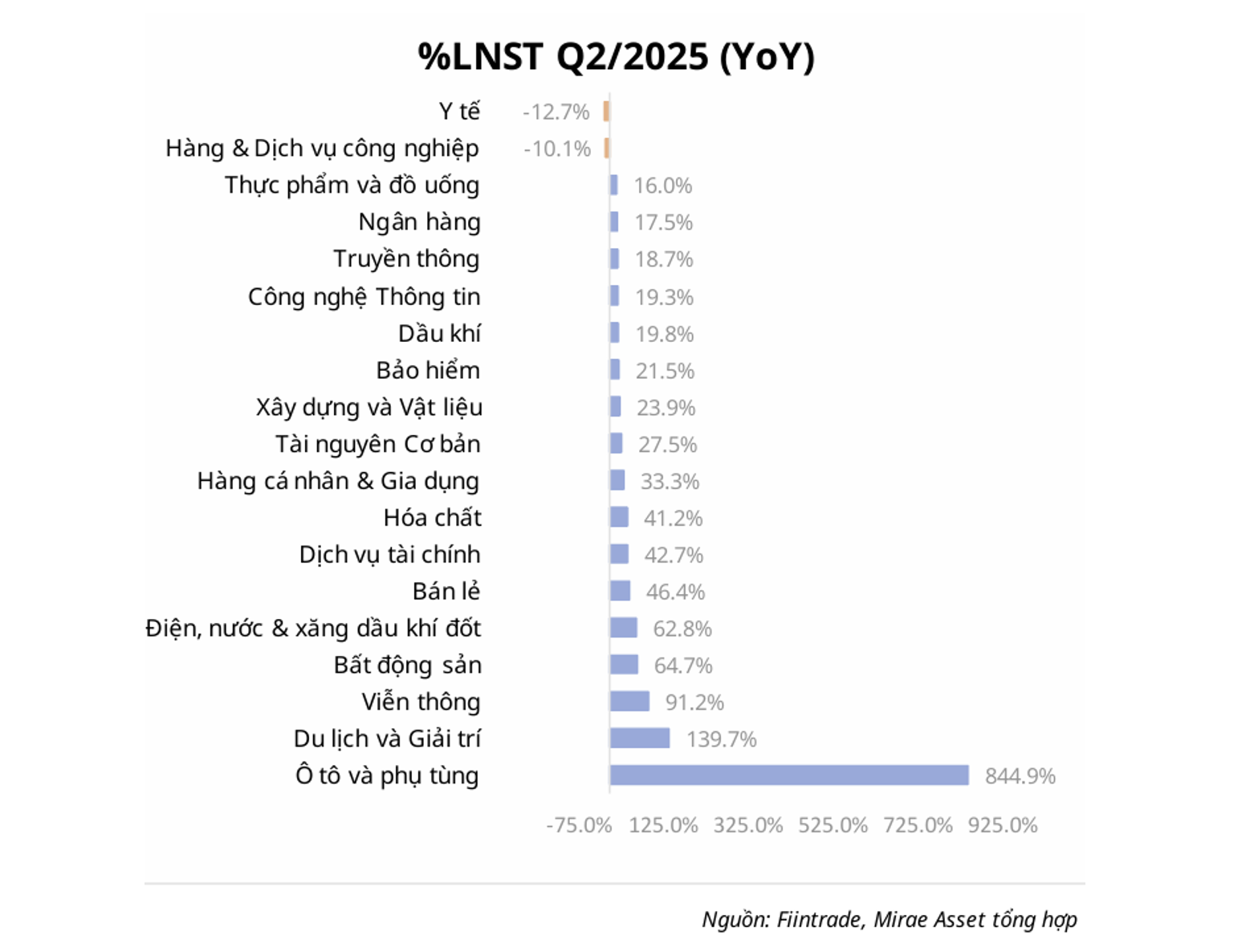

Listed companies’ earnings in Q2 2025 showed significant growth.

Sharing Mr. Toan’s optimistic outlook, Mr. Phan Dung Khanh, Investment Advisory Director at Maybank Securities Company, believes that the VN-Index could reach new peaks in the coming period. He observed that many investors who missed out on the rally are waiting for a correction to buy back in.

To avoid “peak-chasing” and minimize risks, Mr. Khanh suggested that investors using high margin or holding large positions should reduce their stock holdings. Those with smaller portfolios can wait for a correction or buy in small quantities. “However, it’s important to distinguish between short-term and long-term peaks. If it’s a short-term peak, reduce your holdings and lower your margin; for medium and long-term peaks, you can accumulate stocks during corrections. If you’re holding cash, it’s advisable to stay invested in stocks,” he advised.

Mr. Toan emphasized that to overcome the “invisible fear,” investors should focus on the attractive valuations, Vietnam’s potential market upgrade, and strong earnings growth. He added that short-term corrections are an inevitable part of a rising market, serving to transfer expectations between investor groups.

Seizing Opportunities in Correction Phases

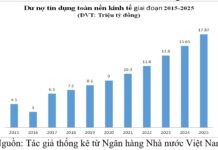

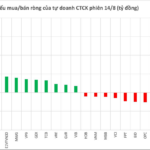

However, risks remain, and some experts caution that margin debt has reached a record high of approximately VND 330 trillion. “If investors do not manage their positions well, the risk of account liquidation is real,” warned a financial expert.

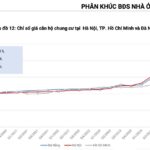

Mr. Toan suggested that investors should view corrections as opportunities to increase their holdings and provide a chance for those who missed out to re-enter the market. He recommended focusing on high-quality stocks and strict risk management, with particular attention to the banking, securities, and construction materials sectors.

Taking a more optimistic stance, Mr. Hoang Anh Tuan, Customer Relations Director at MBS Securities Company, forecasted that the VN-Index could reach 2,000-2,150 points by the end of this year or early 2026. He explained that during a strong uptrend, the index could double or even triple from its bottom. “If we consider the low of around 1,100 points this year, reaching the 2,000 mark is feasible. While it may sound ambitious, with Vietnam’s GDP expected to grow in double digits over the next five years, such a scenario is not far-fetched,” Mr. Tuan stated.

VN-Index has reached a historical peak, but the market’s P/E ratio remains lower than in 2021.

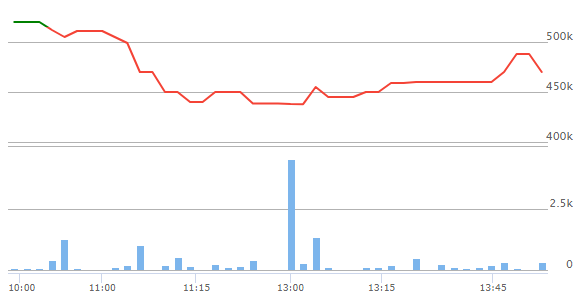

Market Beat: Profit-Taking Pressure Mounts, VN-Index Retreats

The selling pressure intensified, causing key indices to plunge into the red at the end of the morning session. By the mid-session break, the VN-Index hovered near the reference level, settling at 1,639.45 points; while the HNX-Index posted a 0.93% loss, landing at 282.49 points. The decline intensified, with 540 declining stocks outweighing 207 advancing ones.