Specifically, FPTS registered to sell nearly 1.2 million cp MSH during the period from 08/18 to 09/16, via matching or floor trading, thereby reducing ownership from 11.7% to 10.7%. FPTS stated that this transaction relates to proprietary business operations.

This is not the first time FPTS has divested from May Song Hong this year. After the US announced a shocking countervailing duty policy in April 2025, the business prospects of exporters became uncertain in the eyes of investors, despite short-term business results remaining positive.

US President Donald Trump announced countervailing duties on a range of trading partners on 04/02/2025 (US time). Trade negotiations took place immediately after. To date, countervailing duties on imports into the US have been adjusted to be lower than the initial announcement.

|

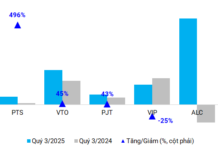

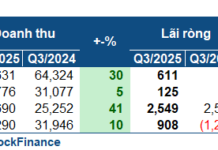

In Q2 of 2025, May Song Hong reported a 10% increase in consolidated net revenue and a surge of over 96% in net profit year-on-year. The company shared that they had secured numerous orders but did not elaborate on whether this positive trend was related to rushed shipments to beat the US countervailing duty deadline.

Amidst these circumstances, investors have clearly expressed their perspective. From April until now, the MSH code has dropped by nearly 5% while the VN-Index surged by 25%. This is also the situation faced by a series of export enterprise stocks, including those in the textile, seafood, and wooden furniture industries.

– 10:32 14/08/2025

The Price of a Daily Bubble Tea Habit: Missing Out on Swimming with Vietnam’s Billionaires

For the savvy investors out there, the top-performing stocks with high liquidity could have doubled, tripled, or even quadrupled your boba tea money in the past 7.5 months.

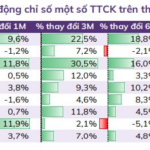

Stock Market Update: Riding the Wave or Missing Out?

Today’s session (August 13th) saw the VN-Index fluctuate around the 1,600-point mark multiple times. The intense back-and-forth movement at this strong resistance level has put investors in a tricky situation: buying now risks buying at the peak, but selling early could mean missing out on potential gains. Experts suggest that if the market undergoes a technical correction until the end of August, it would present an opportunity to enter instead of rushing to buy at higher prices.

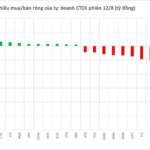

A Rogue Bank Code: The Sudden Surge of Prop Trading in Vietnam’s Stock Market

The HoSE witnessed a notable trading session on Thursday, with foreign investors and securities companies taking center stage. While foreign investors displayed confidence in the market by snapping up stocks, securities companies offloaded a substantial amount, amounting to a net sell value of VND 621 billion. This contrasting behavior between the two key market players has left market participants intrigued, with many wondering what the future holds for Vietnam’s stock market.