This was shared by Dr. Ta Thanh Binh, General Director of Vietnam Securities Depository and Clearing Corporation (VSDC), Arbitrator at the Vietnam International Arbitration Center (VIAC) at the conference on “Legal Framework and Capital Mobilization Solutions for Enterprises”, organized by the Ho Chi Minh City Center for Investment Promotion and Trade (ITPC) and VIAC on the morning of August 14, 2025.

Dr. Ta Thanh Binh, General Director of VSDC and Arbitrator at VIAC, shared at the conference. Photo: Tu Kinh

|

Regarding investors’ inquiries about the implementation of intraday trading and selling securities “on the way home,” Dr. Ta Thanh Binh assured that the legal framework and systems are ready, pending the decision of the competent authority to commence.

Specifically, the KRX system interconnects the operations of the stock market for both cash and derivative markets, synchronizing with payment and clearing processes. This means there will be a unified technology platform, unlike the current separation of the Hanoi and Ho Chi Minh City exchanges, each with its system, and a separate system for payment and clearing.

The KRX system offers the most advanced trading methods globally. However, the immediate application of these methods depends on the perspective of the regulatory agency and the market’s development stage. For instance, while KRX permits trading without price bands, Vietnam will likely need more time to be ready for such implementation.

In the near future, several notable products will be introduced. According to Dr. Binh, the leadership of the State Securities Commission is directing the research on extending trading hours, possibly through intraday trading or lengthening the morning and afternoon sessions, thereby reducing the lunch break. They are also considering the implementation of T0 (day trading), allowing the buying and selling of the same volume of securities within the day, with only cash settlement at the end of the day, and enabling the sale of securities “on the way home,” correspondingly eliminating the need to wait for T+2.

Dr. Binh affirmed that the legal framework and systems are in place, awaiting the decision of the competent authority to commence.

Also, at the conference, regarding the question about the digital asset exchange, Dr. Binh shared that this exchange would not be established by the state. Instead, the state will officially recognize and license several private exchanges to operate digital asset trading platforms in Vietnam. Although the official number has not been announced, it is expected to be no more than five exchanges.

Caution in the Sensitive Margin Phase

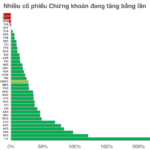

Commenting on the current stock market from a securities company perspective, Mr. Hoang Anh Tuan, Director of Customer Relations at MBS Securities Joint Stock Company (MBS), stated that there is a substantial amount of cheap money in the market. Typically, when there is cheap money, the market tends to experience a surge of about 2-2.5 times, equivalent to 100-150%. Therefore, starting from the low of 1,100 points in 2025, the market is expected to reach 2,000-2,200 points.

Although this increase is rapid and substantial, with Vietnam in the “leap forward” phase and aiming for a minimum double-digit GDP growth in the next five years, the 2,000-2,200-point range is merely a stepping stone for the subsequent growth cycle.

Mr. Hoang Anh Tuan, Director of Customer Relations at MBS (sitting on the right) shared at the conference. Photo: Tu Kinh

|

Dr. Binh advised investors to exercise caution, especially when using financial leverage. Currently, the total margin debt in the market has reached a record high of VND 330,000 billion, making it very sensitive at this point.

In reality, during the dispute resolution process at VIAC, there have been cases related to margin trading where poor risk management led to account liquidation, causing losses for both investors and securities companies due to unrecoverable debts. Therefore, investors must diligently manage their risks.

– 16:40 14/08/2025

The Stock Market is No Longer Cheap: Capital Raising is the Lifeline.

The stock market wave is riding high with the Vietnamese stock market’s record-breaking strides. While the valuation of stock sector stocks is no longer a bargain, capital hikes remain pivotal for enterprises to vie for market upgrade waves and deploy digital assets.

Port of Nghe Tinh: Profit Surge Post-Audit, Thanks to Land Lease Privileges, Shares Dive Post-Peak Sessions

After a recent review, the Hai Phong Port Joint Stock Company (HNX: NAP) has reported a 5% increase in profits due to a reduction in land lease costs. This adjustment pushes the company’s first-half 2025 earnings to a record high of over VND 15 billion. NAP’s stock price has undergone a significant correction after reaching a peak of VND 16,000 per share.

Unleashing Digital Assets: MB and Korean Partners Gear Up for Vietnam’s First-Ever Platform

“As per the agreement, Dunamu steps in as a pivotal strategic partner for MB. This partnership entails sharing cutting-edge technology and robust infrastructure, along with expert consultation on legal compliance, investor protection, and talent development. With Dunamu’s expertise, MB is poised to elevate its operations and fortify its position in the market.”

The Rise of the First Domestic Digital Asset Exchange in Vietnam: Enter the ‘Big Boss’ – A South Korean Powerhouse Managing $80 Billion, Backed by the Company Behind the Sensational BTS

Dunamu, the powerhouse behind South Korea’s leading cryptocurrency exchange, Upbit, is a force to be reckoned with in the world of digital assets. As the operator of the country’s largest centralized crypto exchange, which ranks third globally, Dunamu boasts an impressive 80% market share in South Korea.