I. MARKET ANALYSIS OF SECURITIES ON AUGUST 14, 2025

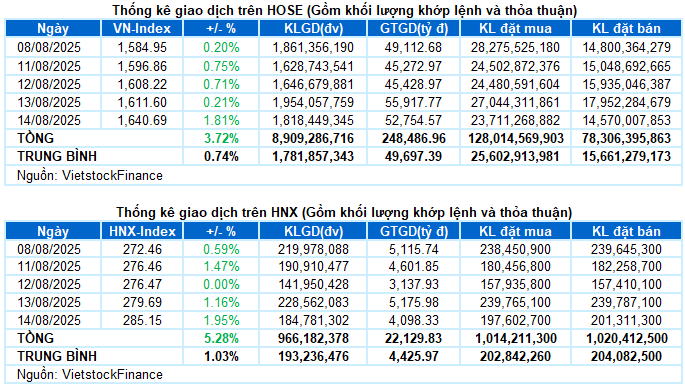

– The main indices simultaneously surged in the trading session on August 14. Specifically, the VN-Index increased by 1.81%, reaching 1,640.69 points. The HNX-Index also rose sharply by 1.95% to 285.15 points.

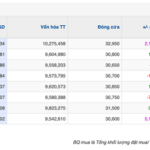

– The matching volume on the HOSE floor decreased by 5.9%, reaching more than 1.7 billion units. HNX recorded over 181 million units, a decrease of 19.8% compared to the previous session.

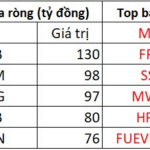

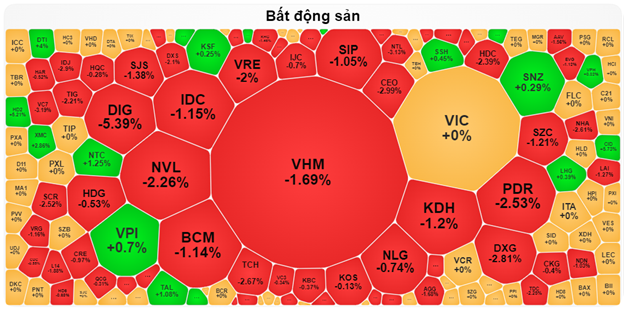

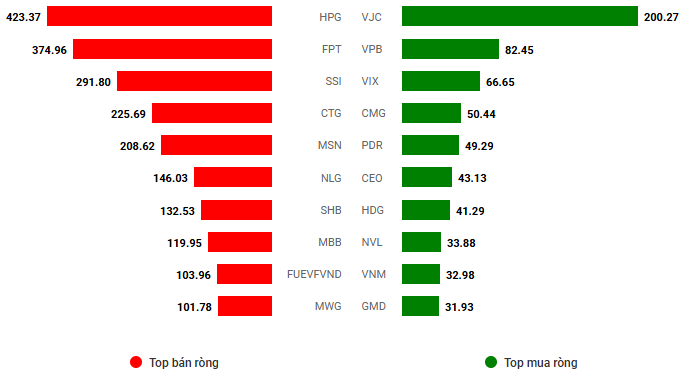

– Foreign investors continued to net sell with a value of 2.3 trillion VND on the HOSE and nearly 25 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: Billion VND

Net trading value by stock code. Unit: Billion VND

– The securities market continued to break strongly in the session on August 14, led by overwhelming demand in the financial group. With a large market capitalization, this group quickly pushed the VN-Index close to the 1,640-point threshold after just over an hour of trading. However, the momentum has not really spread as the market breadth was not positive. Apart from finance and real estate, the other sectors were quite divided, with red dominating. At the close, the VN-Index stood at 1,640.69 points, up a strong 1.81% from the previous session.

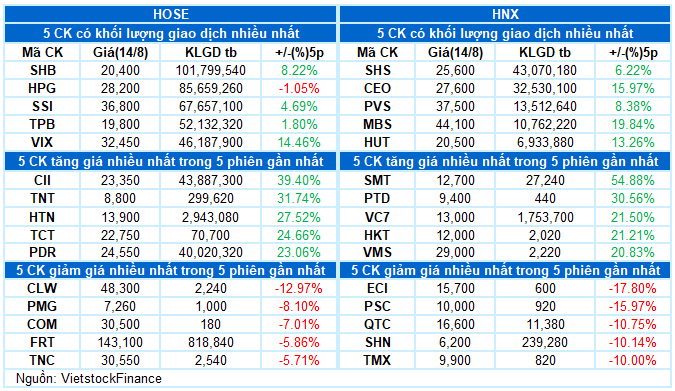

– In terms of impact, banks were the main drivers in today’s session, accounting for 8 out of 10 positions in the top contributing stocks, bringing a total of nearly 20 points to the VN-Index. The remaining two stocks were VIC and VJC, contributing an additional 2 points and 1.2 points, respectively. Meanwhile, the total impact of the 10 most negative stocks took away only 2.6 points from the overall index.

– The VN30-Index added more than 40 points, surging to 1,793.78 points. Buyers dominated with 22 gainers and 8 losers. Among them, MBB, VJC, ACB, HDB, and VPB attracted strong buying interest and rose to the maximum daily limit. In addition, SHB, SSB, VCB, and TPB also increased by more than 3%. On the downside, GVR fell the most by 1.7%, followed by MSN and FPT, which also lost more than 1%.

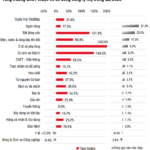

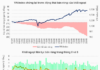

In terms of sectors, finance was the brightest spot today, recording an outstanding increase of 3.68%. Banking, insurance, and securities all agreed on a strong upward momentum. A series of stocks hit impressive ceiling prices, such as MBB, HDB, VPB, ACB, VIX, MBS, and BIC, along with many other codes that rose more than 2%, including VCB, TCB, STB, LPB, SHB, TPB, SSB, MSB, BVH, and VIB…

The real estate group also traded positively, increasing by more than 1%, mainly contributed by VIC (+1.9%), VRE (+2.38%), NVL (+2.44%), DXG (+1.39%), CEO (+6.15%), PDR (+1.45%), SCR (+5.05%), and SSH (+4.74%).

On the contrary, the information technology group decreased by nearly 1%, influenced by stocks such as FPT (-1.24%), ELC (-0.63%), DLG (-1.43%), ITD (-1.08%), and HPT (-2.22%). The media services, healthcare, materials, and non-essential consumer goods sectors also remained subdued with a divided trend.

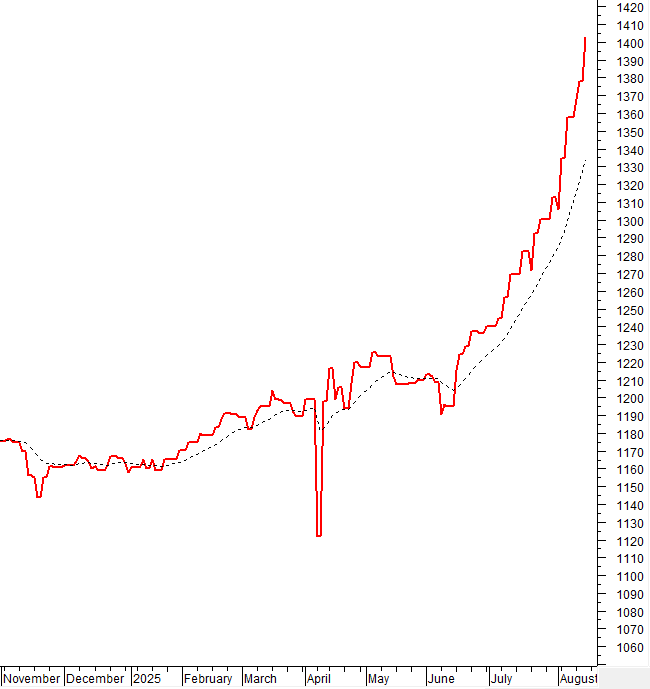

The VN-Index rose sharply and continued to set a new peak with the 9th consecutive gaining session. The upward trend of the index is supported as the MACD indicator continues to widen the gap with the Signal line after a buy signal. However, the risk of intraday fluctuations should be noted as the Stochastic Oscillator indicator is deep into the overbought zone.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Increasing for the 9th consecutive session

The VN-Index rose sharply and continued to set a new peak with the 9th consecutive gaining session. The upward trend of the index is supported as the MACD indicator continues to widen the gap with the Signal line after a buy signal. However, the risk of intraday fluctuations should be noted as the Stochastic Oscillator indicator is deep into the overbought zone.

HNX-Index – Closely following the Upper Band of Bollinger Bands

The HNX-Index continued to surge with a Big White Candle pattern while closely following the Upper Band of the Bollinger Bands.

The Stochastic Oscillator and MACD indicators are still heading up after giving buy signals, reinforcing the positive outlook for the index. If these signals are maintained, the index may target the old peak of August 2022 (equivalent to the 295-305-point region) in the coming period.

Analysis of Money Flow

Fluctuation of smart money flow: The Negative Volume Index indicator of the VN-Index is currently above the 20-day EMA. If this status continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Fluctuation of foreign capital flow: Foreign investors continued to net sell in the trading session on August 14, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS ON AUGUST 14, 2025

Economics & Market Strategy Division, Vietstock Consulting Department

– 17:00 14/08/2025

“Maybank Ups Year-End VN-Index Target to 1,800 Points”

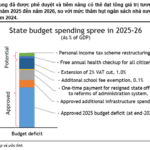

As of the August 13 strategy report, Maybank Investment Bank maintains a positive outlook for the second half of 2025, raising its year-end VN-Index target by 20% to 1,800 points. This upgrade is underpinned by a target P/E of 14.5x, in line with the five-year average, and an expected earnings growth of 18.5% year-over-year for 2025.

The Sky’s the Limit: TAL Soars on HOSE Debut, Surpassing VND 10,000 Billion Market Cap

“Since its uplisting on August 1, Taseco Land’s stock, trading as TAL, has surged nearly 30% in just under 10 sessions on the Ho Chi Minh Stock Exchange (HOSE). This impressive performance witnessed an eightfold increase in trading volume compared to its yearly average, catapulting the company’s market capitalization to over VND 10,000 billion.”

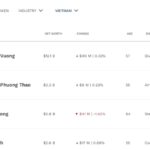

The Stock Market Soars to New Heights: A Peek Into the Portfolios of Vietnam’s Billionaires.

Recently, the stock market has been on a record-breaking streak, causing a significant shift in the fortunes of Vietnam’s billionaires on the Forbes rich list.