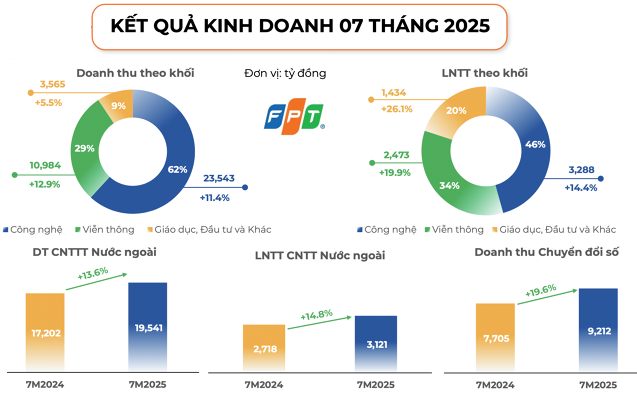

Joint Stock Company FPT (HOSE: FPT) has just announced its revenue for the first seven months of 2025, amounting to VND 38,091 billion, an 11% increase compared to the same period last year. Its pre-tax profit reached VND 7,196 billion, up by 18%, while net profit stood at VND 5,147 billion (a 20% increase). The basic earnings per share (EPS) was VND 3,033, reflecting a rise of over 19%.

The preliminary results were announced immediately after an investor meeting, according to a report by Vietcap Securities. During this meeting, FPT’s leadership presented a revised target scenario for 2025, aiming for a 15% growth in revenue and an 18-20% increase in profit. These targets are slightly lower than the ones set at the Annual General Meeting of Shareholders (a 20% revenue increase and a 21% profit rise).

The Technology and Telecommunications blocks remain the main drivers of the company’s performance.

In the seven-month period, the technology sector continued to make the most significant contributions, with VND 23,543 billion in revenue, accounting for 62% of the total revenue, and VND 3,288 billion in pre-tax profit (46% of the total), marking an 11% and 14% increase, respectively, compared to the previous year.

Within the technology sector, the foreign information technology (IT) block achieved VND 19,541 billion, a 14% increase. The Japanese market witnessed a significant boost, rising by nearly 28% to VND 8,590 billion. New contract value in the foreign IT sector reached VND 23,730 billion, an almost 8% increase year-on-year, with a 27% surge in July alone.

|

The telecommunications sector recorded VND 10,984 billion in revenue (29% of the total) and VND 2,473 billion in pre-tax profit (34%), reflecting a nearly 13% and 20% increase, respectively. These positive results are attributed to subscriber market share gains and cost optimization strategies.

The education sector and other investment areas contributed VND 3,565 billion in revenue and VND 1,434 billion in pre-tax profit, representing increases of over 5% and 26%, respectively. While these sectors account for 9% of the total revenue, they contributed a significant 20% to the pre-tax profit.

On the stock exchange, FPT shares traded around VND 102,000 per share in the afternoon session of August 15, 2025, marking a 7% decrease over the last month. However, liquidity remained high, with over 9.5 million shares traded per session. Selling pressure from foreign investors has led to an unusually high foreign room of 153 million shares as of the morning of August 15, the largest on the market.

Concurrently, MSCI announced the inclusion of FPT and HCM in the MSCI Frontier Market Index during the quarterly portfolio restructuring in Quarter 2.

| FPT Share Price Movement since the Beginning of 2025 |

– 13:41, August 15, 2025

How Much Has the CEO Invested in the Sonasea Van Don Harbour City Project?

With a significant boost in gross margins, CTCP Group C.E.O Joint Stock Company (HNX: CEO) witnessed a remarkable surge in its Q2 and H1 2025 net profits, rising by 37% and 24% year-over-year, respectively.

The Oil Baron’s Company: Uncovering the Secrets of Ninh Binh’s Energy Empire

According to Tien Phong Newspaper’s sources, Trung Linh Phat Limited Company, a key petroleum trader in Ninh Binh province, tops the list of local tax debtors with an outstanding tax liability of over VND 195.8 billion. Notably, this company has just had its business license revoked by the Ministry of Industry and Trade.