“Stock Stocks Surge, Valuations No Longer Cheap”

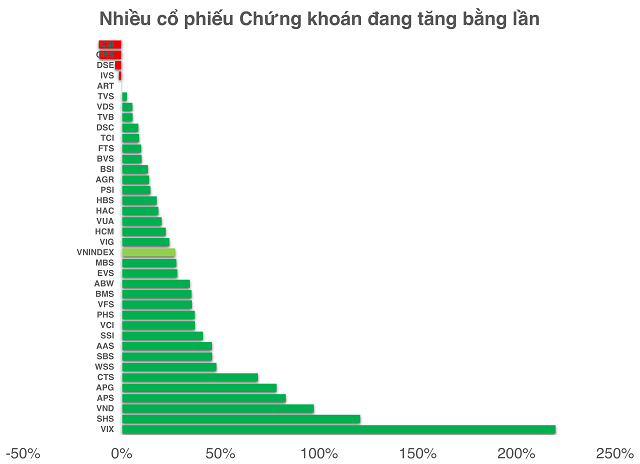

The stock market has seen impressive gains recently, with the securities sector leading the charge as numerous stocks have recorded significant price increases.

The most notable performers include VIX, which has tripled in value, SHS with a 122% increase, VND doubling in price, and APS surging by 84.6%. This momentum reflects the strong enthusiasm of investors and their high expectations for market upgrades and the deployment of digital assets.

Stocks such as VIX and SHS have tripled in value, while VND has surged by 97.3% as of the trading session on August 12th.

|

However, according to experts, the current valuations are approaching a zone that is no longer considered cheap. Mr. Bui Van Huy, Director of FIDT Research, stated: “Compared to the historical average P/B (Price to Book) ratio, the securities sector has been valued by the market at a much higher level. While the valuation is no longer cheap, the key highlight of this sector remains the high expectations associated with market upgrades and the pilot program for the digital asset exchange.”

Sharing a similar view, Mr. Nguyen Anh Khoa, Head of Analysis and Investment Consulting at Agribank Securities Joint Stock Company (Agriseco), noted that the P/B ratio for this industry is currently over 2 times, higher than the average of 1.5 times in the last 5 years. In addition to the drivers of market upgrades and digital assets, securities companies are maintaining margin lending at a safe level amid booming market liquidity. “This lays the foundation for strengthening other pillars such as IPO (Initial Public Offering) and M&A (Mergers and Acquisitions) activities, creating incentives to attract foreign capital,” emphasized Mr. Khoa.

Similarly, Mr. Nguyen The Minh, Director of Research and Development for Individual Customers at Yuanta Vietnam Securities, also suggested that after the positive results from proprietary trading and margin lending in the previous quarters, investors should pay attention to the revenue from IB (Investment Banking) activities of securities companies, especially the larger ones.

Capital Increase Remains Crucial for Survival

The story of capital increases is not new for securities companies over the past few years. However, even with already high valuations, the market continues to witness unabated efforts in this regard.

After conducting a private placement at the beginning of 2025, Techcom Securities Joint Stock Company (TCBS) is now implementing a new IPO with the aim of increasing its charter capital to over VND 23,000 billion, and owner’s equity may exceed VND 40,000 billion, affirming its determination to maintain its top position in the industry in terms of scale. The gap between TCBS and the rest has made the competition even more intense.

Ho Chi Minh City Securities Corporation (HSC) is also rushing to complete a capital increase to over VND 10,000 billion to expand its lending capacity. HSC is expected to finalize this process by September 2025.

Meanwhile, SSI Securities Corporation, with its ambitions in the field of digital assets, may also join the race for scale in 2025. Recently, SSI announced plans to hold an extraordinary general meeting of shareholders on September 25, 2025. Although the agenda has not been disclosed, analysts believe that a capital increase is likely to be the main focus, especially as its competitors are accelerating their growth.

It’s not just the large players; numerous smaller securities companies such as Rong Viet Securities Joint Stock Company (VDS), Military Bank Securities Joint Stock Company (MBS), and KAFI Securities Joint Stock Company (KAFI) have already initiated or are preparing to implement capital increase plans to enhance their competitiveness.

Overall, in a market where scale is the key to maintaining strength, the wave of capital increases is unlikely to subside in the short term. As the “big boys” continue to aggressively expand their financial capabilities, the rest must follow suit or risk losing market share. Mr. Bui Van Huy cautioned that investors need to carefully assess the fundamentals, especially the risk of ROE (Return on Equity) dilution if the capital increase is not accompanied by an effective utilization strategy.

Quan Mai

– 07:30 14/08/2025

The Unloved Export Stock: FPTS Divests from May Song Hong

FPT Securities (FPTS, HOSE: FTS) seeks to further divest its stake in May Song Hong (HOSE: MSH) amidst a cautious market sentiment towards stocks of exporting businesses.

Stock Market Update: Riding the Wave or Missing Out?

Today’s session (August 13th) saw the VN-Index fluctuate around the 1,600-point mark multiple times. The intense back-and-forth movement at this strong resistance level has put investors in a tricky situation: buying now risks buying at the peak, but selling early could mean missing out on potential gains. Experts suggest that if the market undergoes a technical correction until the end of August, it would present an opportunity to enter instead of rushing to buy at higher prices.