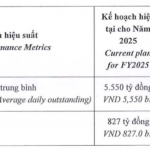

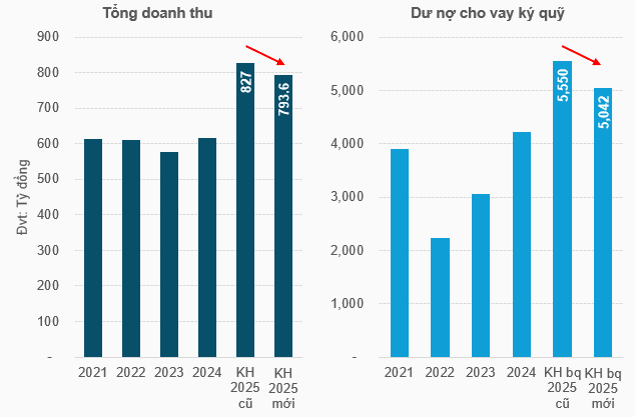

Regarding the 2025 business plan, the Yuanta Securities Board of Directors has approved adjustments to the figures presented at the previous meeting held on January 15. Specifically, the average margin lending target has been reduced from VND 5,550 billion to VND 5,042 billion, a 9% decrease, and total revenue has been adjusted from VND 827 billion to VND 793.6 billion, a 4% reduction.

Despite these downward revisions, the company is still on track to achieve historic business milestones if the new plan is realized.

Source: Yuanta Securities, compiled by the author

|

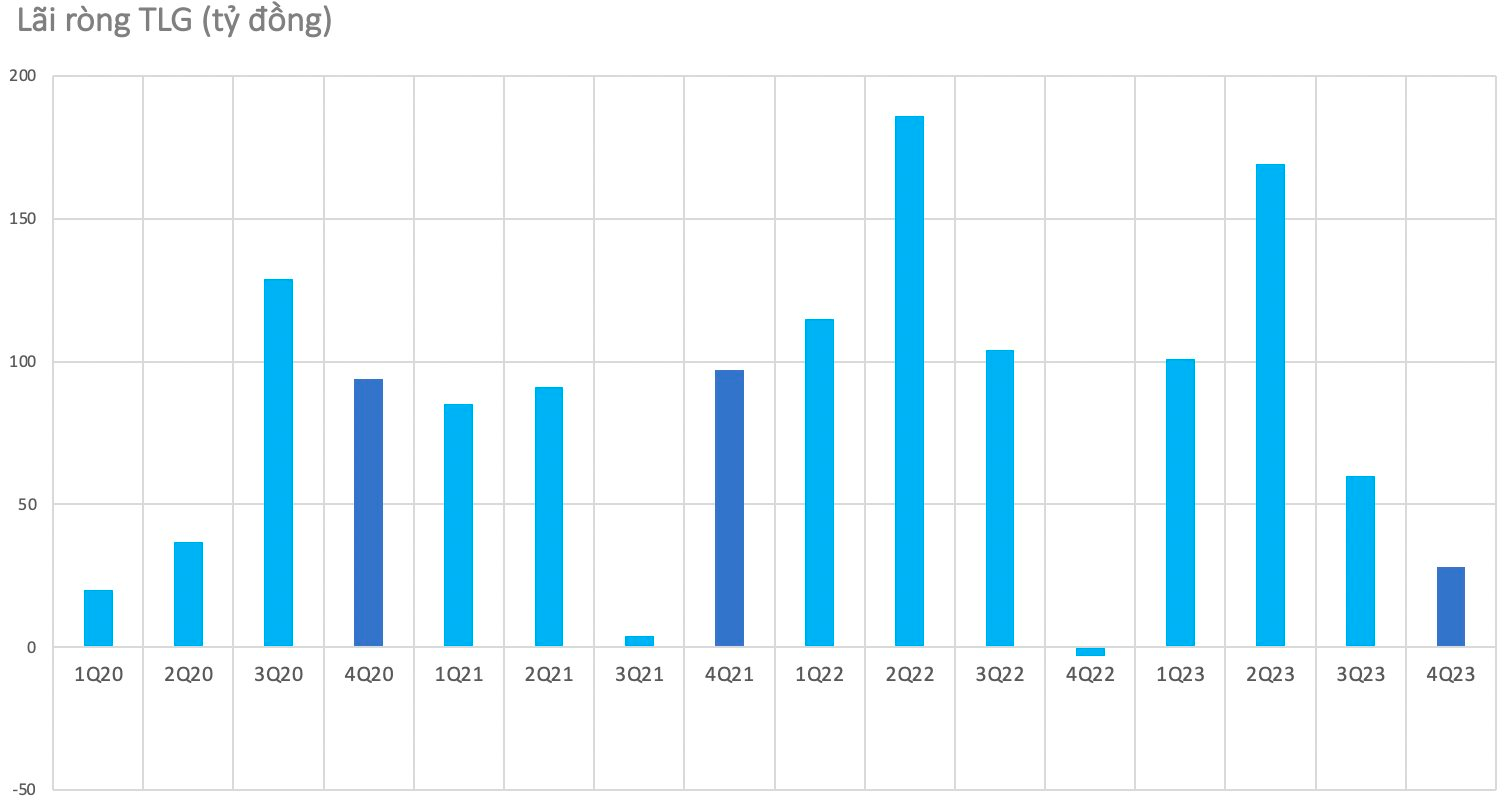

For the first half of 2025, Yuanta Securities reported total revenue of nearly VND 305.4 billion, a 6% decrease compared to the same period last year. With these results, the company has achieved close to 37% of its initial plan and over 38% of the new plan.

After deducting all expenses, the company’s net profit stood at over VND 51 billion, a 28% decline.

As of the end of Q2 2025, the company’s asset size reached over VND 5,571 billion, a 3% increase from the beginning of the year. Margin lending accounted for the largest proportion, with nearly VND 4,432 billion, a 5% rise.

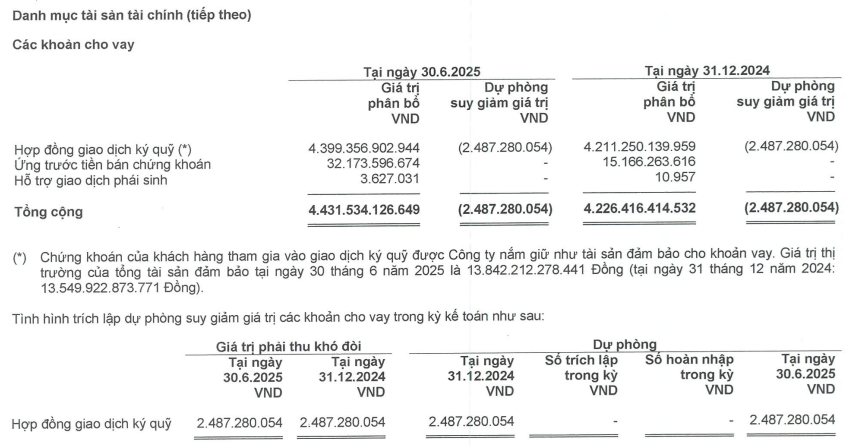

According to the explanatory notes to Yuanta Securities’ reviewed semi-annual financial statements for 2025, the scale of margin trading contracts stood at over VND 4,399 billion, a 4% increase, and provisions for impairment were nearly VND 2.5 billion. The remaining loan balance came from advance payments for securities sales, totaling VND 32 billion.

The company stated that the securities of customers participating in margin trading are held by the company as collateral for the loan. The market value of total collateral at the end of Q2 2025 was over VND 13,842 billion, a 2% increase compared to the beginning of the year.

Source: Reviewed Semi-annual Financial Statements for 2025 of Yuanta Securities

|

At the meeting, the Yuanta Securities Board of Directors also approved amendments to the terms of the CP/HCM/006-23 credit contract dated June 9, 2023, valued at VND 120 billion, from Bangkok Bank Public Company Limited – Hochiminh City Branch (Bangkok Bank – Hochiminh) and a Letter of Support for this loan from Yuanta Securities Company Limited (a company within the same group).

Additionally, the Board approved the cancellation of a guarantee letter from Yuanta Securities Asia Financial Services Private Limited (the parent company holding 94.1% of Yuanta Securities’ capital) on the existing loan at Bangkok Bank – Hochiminh under the aforementioned credit contract.

– 6:11 PM, August 13, 2025

“ND2 Approves Cash Dividend of VND 2,500 per Share”

Northern Power Investment and Development JSC 2 (UPCoM: ND2) will finalize the list of shareholders for a 2024 cash dividend payout with a ratio of 25% (VND 2,500 per share). The ex-dividend date is September 15th, and the payment is expected to be made on October 16th.

What’s Going On: A Surprising Move by a Securities Company to Trim Margin Debt and Annual Revenue Plans Amid VN-Index Peak

“The decision was made in the wake of less-than-favorable financial results for the first half of the year.”

The Attention-Grabbing Move of the Company Associated with Duc Hoang Anh

“The thriving Hung Thinh Loi Gia Lai Company, with a majority stake held by Hoang Anh Gia Lai Joint Stock Company, has just launched an enticing investment opportunity. The company has issued 10,000 bonds, coded HTL12501, offering a fixed interest rate of 10.5% per annum. These bonds have a maturity date of August 8, 2028, presenting a stable and attractive investment prospect for discerning investors.”