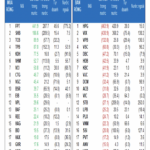

As the economy continues its recovery and banks extend more credit to support businesses and individuals, bad debt has become a top concern. Closely monitoring this metric helps assess the health of the banking system’s assets and the effectiveness of unlocking credit flows. Keeping bad debt ratios in check is crucial, as it instills confidence in banks to extend more loans, thereby fostering sustainable economic growth. Conversely, a surge in bad debt can disrupt capital flows, negatively impacting financial stability.

A detailed analysis of the banking sector’s bad debt situation in Q2 2025 reveals significant improvements compared to the previous quarter. This outcome reflects the positive impact of previous debt relief policies, which supported borrowers’ repayment capabilities and provided a crucial basis for assessing individual institutions’ debt management competencies. However, a closer look reveals that challenges persist, with a stark contrast in performances.

A notable bright spot this quarter was the marked improvement among smaller banks, which are typically considered higher-risk. Their restructuring efforts and proactive debt management strategies are beginning to yield positive results.

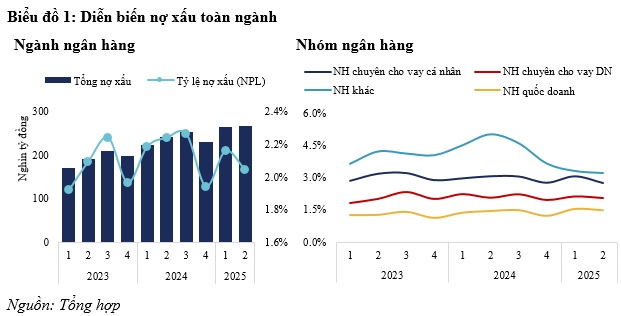

Industry-wide bad debt trends in the first half of 2025

Since 2023, the banking sector’s total bad debt has been volatile due to uncertainties in the real estate and bond markets. This upward trend continued into the first half of 2025, with total bad debt rising from VND 230,046 billion at the end of 2024 to VND 267,529 billion in Q2 2025. However, there is a silver lining—the growth rate has significantly slowed down. Specifically, bad debt increased by only 0.7% quarter-on-quarter and 10.2% year-on-year in Q2, the lowest in the last three years.

Regarding the non-performing loan (NPL) ratio, the end of 2024 was a positive period, with the ratio dropping to 1.94% due to successful debt resolution efforts.

The primary driver of the sharp increase in bad debt in the first half of 2025 was loans related to the real estate sector and consumer loans secured by real estate. Many individual borrowers who purchased properties in troubled real estate projects facing legal issues and delayed deliveries started defaulting on their loans, pushing these loans from Group 1–2 to bad debt status. Additionally, when Circular 06/2024 on debt restructuring expired, the NPL ratio surged to 2.16% in Q1 2025, reflecting a significant adjustment in the scale of bad debt as the relief policies ended. In Q2, with positive signs of economic recovery in production and consumption, along with proactive debt management by banks, the NPL ratio eased slightly to 2.04%. Nonetheless, the NPL ratio for the first half of 2025 remained significantly higher than in previous years, indicating that bad debt remains a significant challenge to be addressed.

Amidst the industry-wide developments, different groups of banks exhibited varying bad debt dynamics in the first half of 2025. The state-owned bank group, known for its strong asset quality, maintained the lowest bad debt ratio. However, their bad debt growth underwent a notable fluctuation, surging to 31.9% year-on-year in Q1 before dropping to below 20% in Q2. This volatility highlights the timing aspect of debt resolution, but overall, the state-owned group’s asset quality remains solid due to their robust risk management capabilities.

In contrast, the consumer lending bank group and the other small-scale bank group demonstrated commendable efforts in risk management. While their NPL ratios remain higher than those of state-owned banks, both the growth rate and NPL ratios have decreased. Specifically, the consumer lending bank group managed to lower their NPL ratio from 3.1% in the previous year to 2.7%. Similarly, the other small-scale bank group also witnessed a notable improvement, with their NPL ratio dropping from 3.7% at the end of 2024 to 3.2% at the end of Q2 2025.

On the other hand, the corporate lending bank group, which has been actively extending credit in the last two years, has not shown much improvement in their NPL ratio, which stood at approximately 2.05% in Q2 2025.

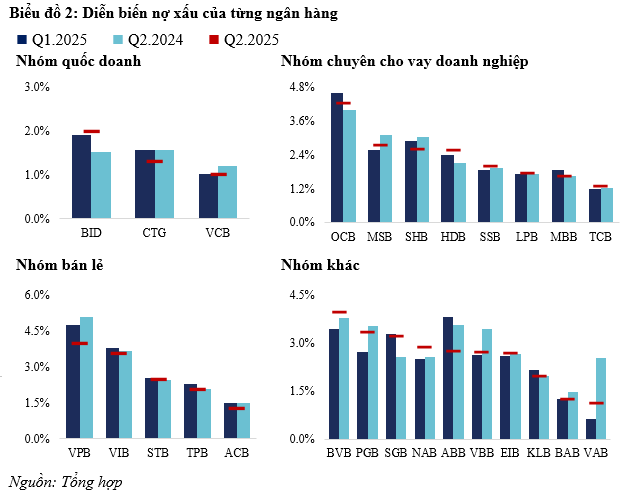

Bad debt dynamics within different bank groups

As the bad debt situation warrants continued observation, banks have demonstrated varying efforts as reflected in their Q2 2025 financial reports. The state-owned bank group remains the cornerstone of asset quality stability in the system. VCB stands out for its exceptional bad debt management, maintaining the lowest NPL ratio in the industry at just 1.0% as of Q2. This achievement is a result of VCB’s successful efforts to curb bad debt growth since the second half of 2024, which led to a rapid reduction in NPL ratio from 1.2% in the previous year.

Notably, CTG also showed significant improvement, with its NPL ratio dropping from 1.6% in the previous year to 1.3%. However, BID faced challenges, with a relatively high year-on-year bad debt growth rate of 50.4%, pushing its NPL ratio from 1.5% in the previous year to 2.0% in Q2 2025. CTG’s successful combination of strong credit growth and effective bad debt management has resulted in its stock outperforming the industry average and its state-owned peers.

The consumer lending bank group also reported positive signs in bad debt management. While there were variations among banks, the overall trend showed a decrease in NPL ratios and a slowdown in bad debt growth. VPB successfully lowered its NPL ratio significantly from 5.1% in the previous year and 4.7% in the previous quarter to 4.0%. Similarly, VIB improved its NPL ratio to 3.6%. The standout performer in this group was ACB, which achieved the lowest NPL ratio in the industry at just 1.3%. TPB and STB also demonstrated improvements in their NPL ratios, reflecting their determined efforts in debt resolution, especially in the consumer lending segment, which is gradually coming under control. This contributed to the consumer lending banks’ above-average profitability in the last six months.

The corporate lending bank group continues to face challenges in terms of bad debt. While their NPL ratios have remained relatively stable, some banks are under considerable pressure. On the positive side, MSB and SHB recorded lower bad debt compared to the previous year, reflecting their short-term debt management efforts. However, overall bad debt growth in this group remains high and warrants close monitoring, especially as they continue to expand their credit portfolios. Consequently, there has been a significant divergence in stock price performance within this group, with banks that effectively managed bad debt, such as TCB, MBB, and SHB, outperforming those that experienced a sharp rise in bad debt, like HDB.

Meanwhile, there have been positive signals regarding asset quality. The most notable improvement was observed in NVB, which witnessed a sharp decline in its NPL ratio from 35.3% in Q2 2024 to 11.4% in Q2 2025. This substantial reduction reflects their aggressive restructuring and bad debt resolution strategies. Similarly, VAB and VBB also achieved impressive bad debt reductions. However, some banks faced significant challenges, notably NAB, which experienced a staggering 36.3% year-on-year increase in bad debt.

This group has achieved remarkable credit growth in the past 12 months, resulting in record-high profit growth. However, this rapid expansion also raises concerns about potential bad debt issues in the future, as some of the new credit may be restructured debt transferred from other bank groups.

In summary, the banking sector’s bad debt situation in Q2 2025 presents a mixed picture, reflecting commendable efforts in maintaining asset quality. While industry-wide bad debt continues to rise, the growth rate has slowed significantly. As the economy gradually recovers, intensifying debt resolution measures, enhancing risk management practices, and leveraging supportive policies will be key to strengthening banks’ financial health and laying the foundation for the industry’s sustainable development.

Lê Hoài Ân, CFA

– 11:36 15/08/2025

The Social Media Sprint Among Vietnamese Banks in Q2 2025: Only One Big 4 Bank Makes the Top 5, Techcombank Takes Second, and a Surprising Winner Claims First.

The banking industry is currently buzzing with vibrant discussions and boasts an impressive volume of high-quality users.

Dr. Nguyen Tri Hieu: “Lowering Interest Rates to Support Growth is Logical, but it Also Harbors the Risk of Asset Bubbles”

The banking sector is the “backbone” of the economy, providing capital and making an ever-increasing contribution to the state budget. However, behind these impressive figures lies the pressure of a high credit-to-GDP ratio, maturity and interest rate risks, and the urgent need for digital transformation to stay in the global race.

“PV Power Plans First Capital Increase Since 2018, Shares Near 3-Year High”

For the first time since its privatization, PV Power is discussing a hike in its charter capital to fuel its capital-intensive key projects. This development comes amidst a strong H1 financial performance and a robust recovery in its stock price.