HDB and VJC stocks soar, boosting shareholder wealth.

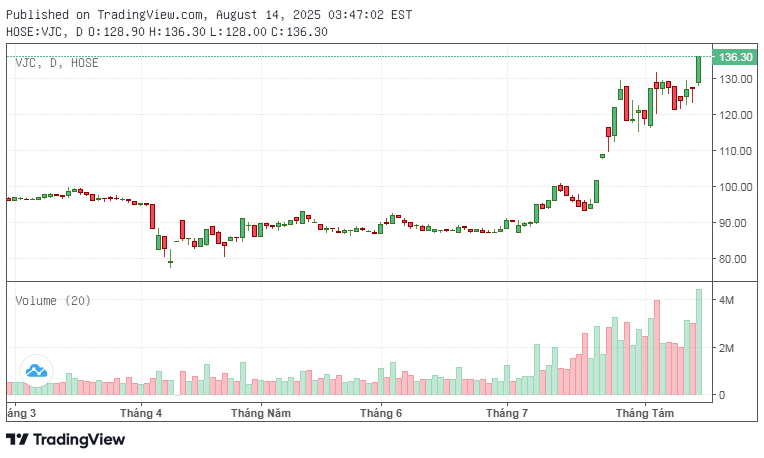

On August 14th, shares of HDB, Ho Chi Minh City Development Joint Stock Commercial Bank, and VJC, Vietjet Aviation Joint Stock Company, surged to the maximum allowed limit, reaching ceiling prices of 30,950 VND per share and 136,300 VND per share, respectively. This marked the third consecutive session of gains for HDB and the fourth straight session of increases for VJC.

HDB and VJC’s impressive stock performance.

The rising stocks have positively impacted the wealth of HDB and VJC shareholders.

As a result of the shares reaching their ceiling prices, the wealth of HDB and VJC shareholders, including billionaire Nguyen Thi Phuong Thao, has significantly increased. Forbes now estimates Ms. Thao’s wealth at $3.5 billion, a boost of $205 million, ranking her as the 1,111th richest person globally.

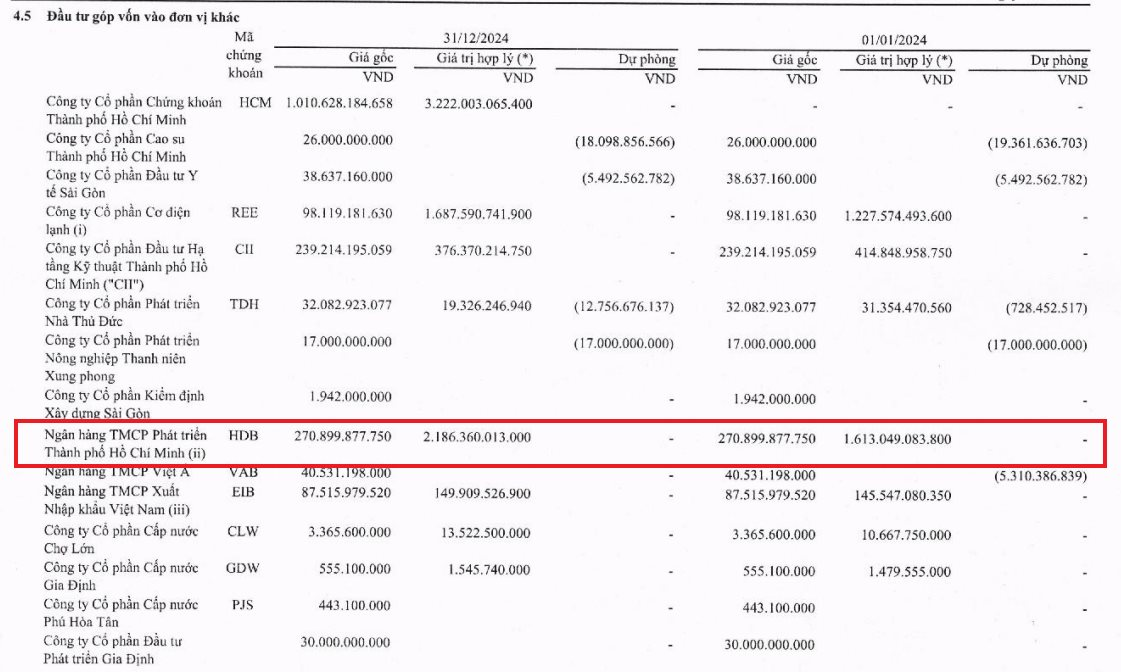

According to the audited consolidated financial statements for 2024 of Ho Chi Minh City Finance and Investment State-owned Company (HFIC), the company owns 93,591,512 HDB shares, originally purchased for nearly VND 270.9 billion. At the current market price of HDB, these shares are now worth nearly VND 2,897 billion, representing a 10.7 times return on their original investment. HFIC’s long-term investment in HDB has proven to be a wise decision.

HFIC’s substantial gains from their HDB investment.

In terms of business results, HFIC recorded consolidated net revenue of VND 12,708 billion in 2024, a 3% increase compared to the previous year. However, consolidated post-tax profit decreased by 23% to VND 1,634 billion.

Previously, at the Techcombank Investment Summit 2025 held on July 9th, Ms. Nguyen Thi Phuong Thao shared that Vietjet has become one of the most influential private listed companies in the market. She highlighted the significant growth in the value of Vietjet’s shares, with investors witnessing a fivefold increase since the company’s early days. For those who joined even earlier, approximately five years ago, the growth has been astonishing, reaching nearly a hundredfold.

“Top HSC Executive Looks to Offload 500,000 HCM Shares”

Mr. Lam Huu Ho, the CFO and Head of Accounting at HSC, has recently registered to sell 500,000 HCM shares with the intent of portfolio restructuring. This strategic move by Mr. Ho aims to diversify his investments and balance his financial portfolio.

Market Beat: VN-Index Hits New High, Financials and Industrials Soar.

The trading session concluded with significant gains, as the VN-Index climbed by 0.66% to reach 1,531.13, a gain of 10.11 points. Meanwhile, the HNX-Index also experienced a notable surge, increasing by 1.55% or 3.89 points, to finish at 254.56. The market breadth was overwhelmingly positive, with buyers dominating as 509 codes advanced while only 317 codes declined. However, the large-cap stocks in the VN30 basket painted a different picture, with 17 codes declining, 13 advancing, and 4 remaining unchanged, resulting in a slightly bearish sentiment.

Stock Market Week of July 21-25, 2025: Setting a New Historic High with a Six-Week Winning Streak

The VN-Index has been on a remarkable six-week streak of consecutive gains, accompanied by record-breaking liquidity. The persistent flow of funds and the unwavering confidence of investors have laid a solid foundation for the market’s upward trajectory. However, with the index reaching new historic highs, the recent selling spree by foreign investors and profit-taking at these elevated levels could trigger some technical fluctuations in the short term.