At this workshop, representatives from Digiworld’s board and HSC’s analyst provided investors with invaluable insights into the consumer retail industry, Digiworld’s unique business model and strategy.

Consumer spending expected to continue recovery in the second half

Kicking off the workshop, Ms. Tran Huong My, Director of Consumer Goods Research at HSC, provided updates on the economic context and prospects for the consumer goods industry. According to Ms. My, the government is demonstrating strong determination to boost economic growth with aggressive policies.

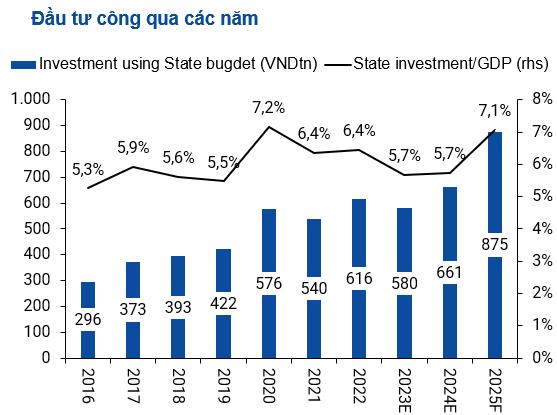

Firstly, there is a loose fiscal policy and FDI attraction policies. Specifically, the 2025 public investment plan is a record high of VND 875 thousand billion, focusing on promoting key infrastructure projects, especially in the Southern region. In the first seven months of 2025, it increased by 25.4% over the same period, equivalent to 40.7% of the government’s plan for the whole year.

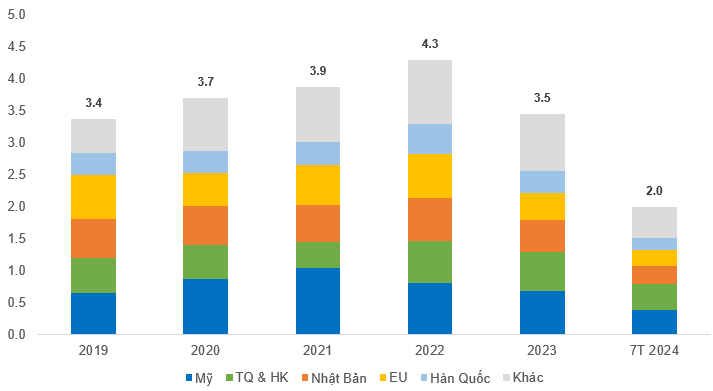

Meanwhile, FDI disbursement (USD 13.6 billion) and registered FDI (USD 24.1 billion) both recorded solid growth, increasing by 8.4% and 27.3% respectively compared to the same period, with FDI disbursement reaching the highest level for the seven-month period in the last ten years.

In addition, a loose monetary policy is also being applied, with credit growth for 2025 expected to reach a minimum of 18%, the highest in the last eight years. According to HSC experts, the low-interest rate environment is maintained thanks to SBV’s continuous support for liquidity through the OMO channel, mainly since June.

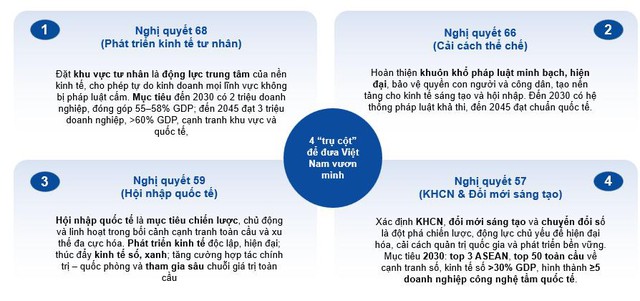

Ms. Tran Huong My also pointed out four important pillars to propel Vietnam forward in the new era, which are four resolutions: Resolution 68 (Private Economic Development), Resolution 66 (Renewal of law making and enforcement), Resolution 59 (International Integration) and Resolution 57 (Science, Technology and Innovation).

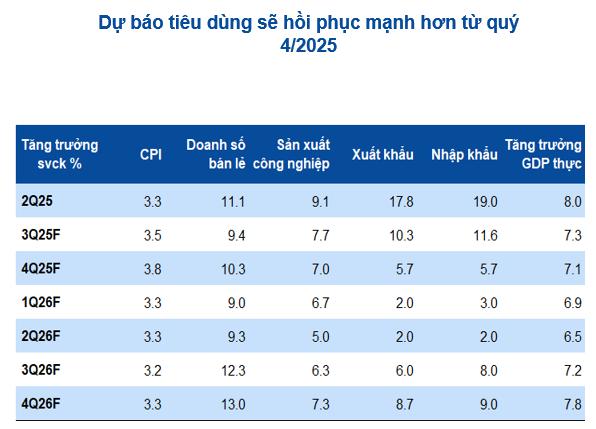

Regarding the consumer goods industry, HSC experts believe that consumer demand is still on the recovery path, although the pace is not as expected. Cumulative for the first seven months, retail sales of goods and services increased by 9.3%, partly due to the strong growth of international arrivals to Vietnam by 22% over the same period. Meanwhile, inflation remained relatively stable at 3.3% compared to the same period. However, it is undeniable that consumer confidence remains low. Citing a report from Kantar World Panel, Ms. My said that consumer confidence had hit bottom in the second quarter of this year, even lower than the Covid period in 2021.

HSC raised its GDP forecast for 2025 and 2026 to 7.3% and 7.1%, respectively. HSC experts expect the government’s aggressive measures to have a positive impact on income and, subsequently, on consumer spending. It is predicted that by the fourth quarter, retail sales could reach an 11% growth rate, with non-essential items expected to have more room for growth than essential items. It is forecasted that spending on non-essential items will increase by double digits in 2026 compared to the single-digit growth of essential consumer goods.

Vision to become a billion-dollar enterprise: It can be one billion dollars or more

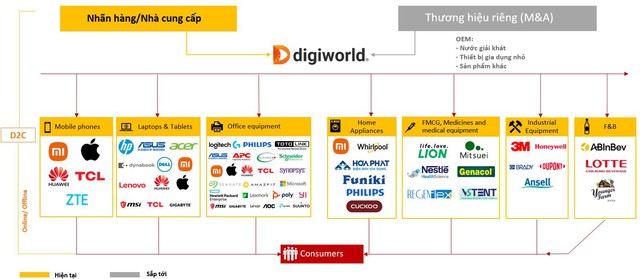

From a business perspective, Mr. Doan Hong Viet, Chairman of Digiworld’s Board of Directors, expressed his excitement about the potential growth of the economy. According to Mr. Viet, Digiworld has long followed the 3C strategy: People – Physical Infrastructure – Opportunities. With the current economic context, there are many opportunities, and the company is confident in seizing them to continue its growth trajectory.

Sharing about the journey of market creation, the Chairman of Digiworld said that the successes came from the vision, mission, and core values that the company has built for its members. Specifically, Digiworld defines its vision as becoming a billion-dollar company – not only in terms of capitalization but also in terms of revenue and profit scale. During its operation, Digiworld will be recognized by society for its contribution to elevating Vietnam’s position. Digiworld’s people are also rewarded commensurately, fulfilling their life purposes, and always aiming to create new markets.

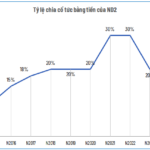

According to the Chairman of Digiworld, in the ten years since its listing, the company has increased shareholder value by eight times, with revenue growing by six times, profit by five times, and capitalization by seven times. DGW has never had a loss-making quarter, and its average ROE has reached an impressive 21% despite going through many ups and downs – a figure that is impressive for any listed company. Notably, DGW is proud to be a business that has not needed to raise additional capital since its listing, but has consistently paid cash dividends – totaling nearly VND 700 billion to shareholders.

“With our market understanding, we are confident that in the future, we can create new market segments. In the near future, Digiworld plans to introduce products related to AI servers running data solutions for enterprises. I believe that if hardware prices are reasonable and software support technology is good, it will create a new market in the future,” said Mr. Viet.

Digiworld confident in maintaining a double-digit growth rate of 15%-25%/year with 3 main product categories

Regarding financial performance, in the first six months of 2025, Digiworld recorded net revenue of nearly VND 11,251 billion, up 13%. Net profit reached VND 222 billion, up 22% over the same period last year, completing 42% of the full-year profit target. Although not yet halfway through the third quarter, the company has estimated its business results with expected revenue growth of 12% over the same period to VND 7,000 billion and net profit increase of 23% to VND 150 billion.

For the full year 2025, Digiworld expects revenue and net profit to reach VND 25,450 billion and VND 523 billion, respectively, growing by 15%-18% compared to the previous year. Mr. Viet said that the company is confident in this business plan and strives to achieve higher results, especially net profit, as products with thicker profit margins are increasingly contributing a higher proportion.

At the workshop, Mr. Doan Hong Viet also shared the strategic orientation for development until 2030. Digiworld will maintain 45+ existing brands, adding over 3 global brands annually, and enhancing production capacity. The company will also actively diversify horizontally by expanding its portfolio and entering at least 2 new industries, aiming for a minimum of 1-2 M&A deals per year, as well as optimizing its organizational structure, operating processes, and applying platforms such as S/4HANA and reliable data systems. Digiworld will allocate capital reasonably, with cash dividends of approximately 40% of profit and the remaining 60% for development.

The company is determined to maintain a double-digit compound growth rate of at least 15%/year, constantly adding new products to old product categories, improving average selling prices for old product categories, and developing new ones. Digiworld’s short-term momentum for the next 1-3 years will come from office equipment (based on the demand for digital transformation); household appliances (based on urbanization and brand expansion); and a new product category related to ‘automotive’ – not only electric vehicles and automobiles but also spare parts and related products. Mr. Viet emphasized that the scale of this new industry is vast, and the level of fragmentation among distributors is high, presenting a significant opportunity for Digiworld.

According to Mr. Viet, Digiworld will not spend money to capture market share aggressively and then seek profits. Instead, the company aims for sustainable development, increasing revenue and market share while also improving profitability. A growth rate of 25%/year is a desirable figure for the company’s expectations.

Regarding the home appliance industry, the Chairman of Digiworld said that Xiaomi’s TV products are currently the largest contributor to revenue, followed by small household appliances such as Philips, Cuckoo, Sunhouse, and Hoa Phat. Mr. Viet added that in the latter part of the third quarter to the beginning of the fourth quarter, the company will expand Xiaomi’s electronics and refrigeration products and expects this to be one of the growth drivers for home appliances.

Wealthy Province: Post-Merger, Phu Tho Ranks Among Vietnam’s Top 10

In the first half of this year and July, the province of Phu Tho witnessed remarkable socioeconomic progress, with an average economic growth rate of 10.09%, ranking among the top 10 fastest-growing localities nationwide. This impressive growth has attracted over USD 469 million in foreign direct investment (FDI).

“TDC Aims to Garner $30 Million from the Transfer of Lot E15 in the Hoa Loi Residential Area”

On July 21, 2025, Becamex TDC, a leading real estate company listed on the Ho Chi Minh Stock Exchange (HOSE: TDC), and Global Corp proudly announced the signing of a term sheet for the transfer of residential properties in Lot E15, located within the TDC Hoa Loi residential project in Binh Duong Ward, Ho Chi Minh City.

“Two Companies Chaired by Nguyen Duy Hung to Receive Billions in Dividends from PAN Group”

PAN Group has announced a dividend payout of VND 104.4 billion for the fiscal year 2024. As major shareholders, two companies chaired by Mr. Nguyen Duy Hung are set to receive a substantial windfall, totaling tens of billions of dong in dividends for this payout period.