Xiaomi, the Chinese tech giant, has ventured into the electric vehicle (EV) space with the launch of the Xiaomi YU7. This mid-to-large-sized SUV has created a buzz by attracting 200,000 orders within just 3 minutes of its launch on June 26. However, this stands in stark contrast to the mere 6,024 units delivered in the first month following its release.

This disparity has raised questions about Xiaomi Auto’s production and supply capabilities, especially considering that their Phase 1 factory, with an annual capacity of 150,000 units, has been operational for a year now, and the recently completed Phase 2 factory, expected to have a similar capacity, began operations in mid-June 2025.

In the highly competitive Chinese EV market, Xiaomi faces not only delivery pressures but also the challenge of retaining customers. The fact that only around 10% of those who pre-ordered the SU7 switched to the YU7 upon its launch indicates that the YU7 has not alleviated the delivery pressure for the SU7. Moreover, the waiting time for the YU7 has now exceeded 10 months, which is unreasonably long.

As a result, Xiaomi has started requesting full payment from some customers to prioritize deliveries for those with stronger purchasing intentions. However, this is only a temporary solution, and it remains uncertain if it will resolve the significant backlog, especially considering that the Xiaomi YU7 received 315,900 orders within 72 hours of its launch.

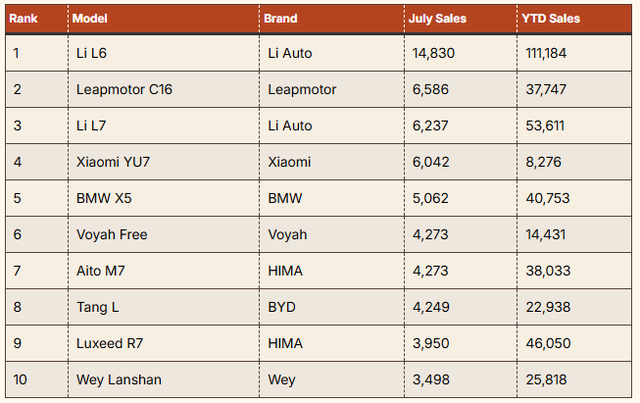

The sales statistics for mid-to-large-sized SUVs in July 2025 highlight the intense competition in the industry. The Xiaomi YU7 remained in fourth place in the rankings until the end of the month.

Source: Car News China

Xiaomi Auto’s delivery target for this year is 350,000 units, and after delivering 150,000 vehicles in the first half, they need to deliver an additional 200,000 in the second half. This means Xiaomi needs to deliver an average of 33,000 vehicles per month. With 30,452 units delivered in July, including both the SU7 and YU7, Xiaomi faces significant pressure to achieve its production goals.

To address these challenges, Xiaomi could consider launching new models to encourage customers to switch their current orders. However, this strategy may not be effective, as evidenced by the YU7’s inability to reduce the delivery pressure for the SU7. Meanwhile, the production and supply of vehicles is a race against time, not just for Xiaomi but for the entire electric vehicle industry.

Given the current challenges, Xiaomi Auto must find quick solutions to improve its delivery capabilities and meet customer expectations to maintain its edge in the highly promising EV market.

The Fourth Lamborghini Almost Was… A Sedan

Lamborghini once considered introducing the Estoque sedan concept in 2008 as its fourth model, but ultimately abandoned the idea in favor of its first electric vehicle, the Lanzador.