Becamex TDC and Global Corp signed a Term Sheet on July 21, 2025, marking a significant step forward.

|

Lot E15 is strategically located in the heart of the Hoa Loi residential area, with convenient access to major transportation arteries such as National Highway 13 and Binh Duong Boulevard. It is also adjacent to several key industrial parks, including VSIP II, My Phuoc Industrial Park, Mapple Tree, and Dong An 2, offering a vibrant and well-connected environment.

Location of Lot E15

|

The sale of Lot E15 is expected to generate an estimated revenue of VND 726.9 billion, encompassing both construction and infrastructure development. As per the consolidated financial statements for the second quarter of 2025, TDC reported long-term production, business, and unfinished development costs for Lots E15 and E19 in the Hoa Loi TDC residential area at just VND 354 billion by the end of June 2025.

Addressing the significant difference between the revenue and cost of goods sold for Lot E15, TDC representatives attributed nearly VND 320 billion of the VND 726.9 billion revenue from the transfer activity to the construction of housing and infrastructure.

The proceeds from the sale of Lot E15 will be strategically allocated by TDC towards three primary objectives. Firstly, expanding the land fund for residential and commercial purposes in areas surrounding Ho Chi Minh City. Secondly, accelerating the implementation of subsequent subdivisions within the Hoa Loi project, capitalizing on the investment appeal of Lot E15. And thirdly, investing in synchronous technical infrastructure, legal framework, and internal utilities to elevate the value proposition, attracting both residents and investors.

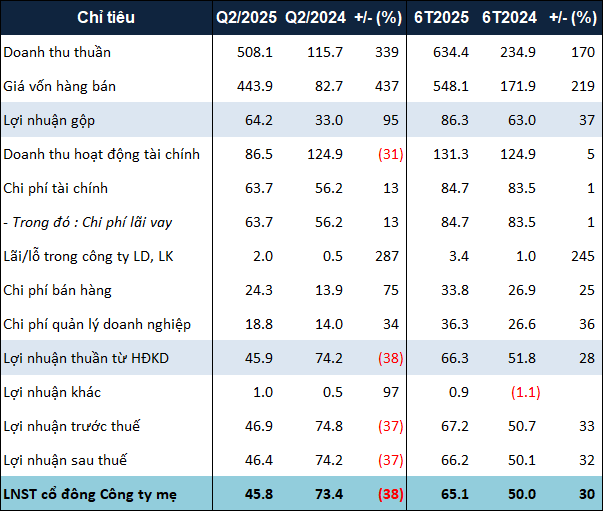

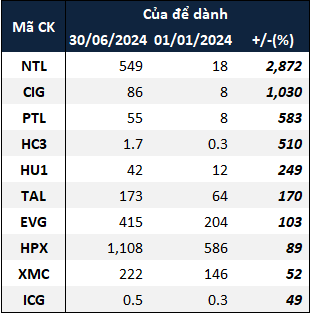

In terms of financial performance, TDC recorded gross revenue of over VND 634 billion in the first half of 2025, a remarkable 2.7 times higher than the same period last year. Real estate contributed the most to this growth, with revenue exceeding VND 206 billion, a 3.8 times increase, accounting for nearly 32% of total revenue.

Due to the incurrence of brokerage and other expenses, TDC‘s selling and management expenses increased by 25% and 36%, respectively. Consequently, the company’s net profit increased by 30%, amounting to over VND 65 billion.

|

Financial performance for the second quarter and the first six months of 2025 for TDC. Unit: Billion VND

Source: VietstockFinance

|

As of June 30, 2025, TDC‘s total assets remained stable at over VND 4,400 billion, unchanged from the beginning of the year. Total receivables and inventory increased by 3% and 9%, respectively, reaching over VND 1,800 billion and VND 434 billion.

Meanwhile, payables decreased by 11% to over VND 2,900 billion, mainly due to a significant 82% reduction in deposits and reservations for projects, totaling just over VND 58 billion. Borrowings also witnessed a modest 2% increase, amounting to over VND 1,600 billion.

– 6:11 PM, August 15, 2025

“Two Companies Chaired by Nguyen Duy Hung to Receive Billions in Dividends from PAN Group”

PAN Group has announced a dividend payout of VND 104.4 billion for the fiscal year 2024. As major shareholders, two companies chaired by Mr. Nguyen Duy Hung are set to receive a substantial windfall, totaling tens of billions of dong in dividends for this payout period.

The Million-Dollar Stock: Unveiling the High-Value Opportunity

The last time Vietnam’s stock market witnessed a share price surpassing the one-million-dong mark was in early 2023.

“IDP Appoints New CEO Amidst Record Losses and Plummeting Stock Prices”

In a bid to turn around its fortunes, International Dairy Products Joint-Stock Company (IDP) has appointed Doan Huu Nguyen as its new CEO and legal representative. This move comes after the company reported a net loss of over VND 36 billion in Q2 2025, marking the first time it has fallen into the red in its history. Nguyen replaces Bui Hoang Sang, who took on the role just over a year ago.