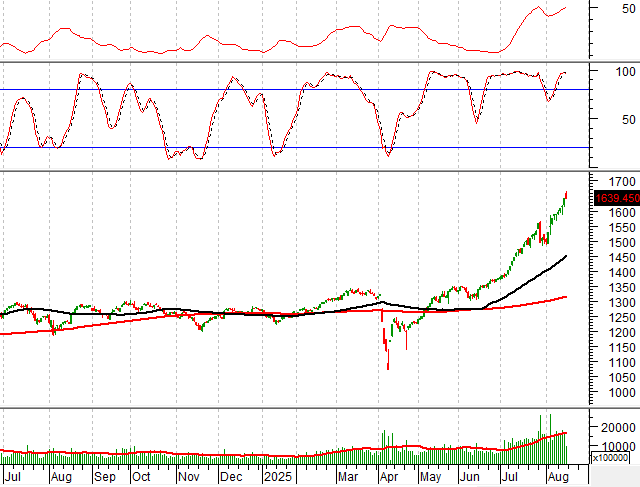

Technical Signals for the VN-Index

During the trading session on the morning of August 15, 2025, the VN-Index witnessed a decline and formed a Big Black Candle pattern, while trading volume slightly decreased, indicating investors’ cautious sentiment.

Additionally, the Stochastic Oscillator has given a sell signal within the overbought region. If the indicator falls out of this zone in the upcoming sessions, the short-term outlook may turn bearish.

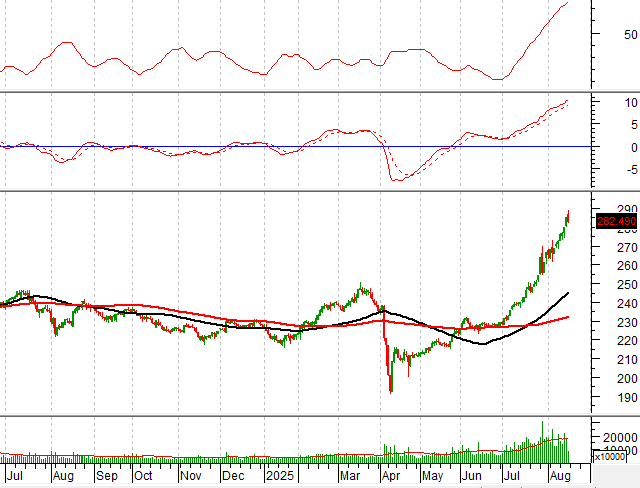

Technical Signals for the HNX-Index

In the trading session on the morning of August 15, 2025, the HNX-Index experienced a slight decrease in conjunction with a drop in trading volume, reflecting investors’ indecision.

However, MACD continued its upward trajectory after providing a buy signal, while the ADX line remained in the strong trend region (ADX > 25). This suggests that the uptrend is still in play.

BSR – Binh Son Refinery Joint Stock Company

On the morning of August 15, 2025, BSR’s stock price opened with a significant increase and formed a Big White Candle pattern, accompanied by trading volume surpassing the 20-session average, indicating active participation from traders.

Moreover, the MACD indicator maintained its upward trajectory after generating a buy signal, while the gap between the 50-day SMA and the 200-day SMA narrowed.

Should a Golden Cross occur in the near future, it would further reinforce the upward momentum.

PLX – Vietnam Petroleum Group

During the trading session on the morning of August 15, 2025, PLX’s stock price opened higher, coupled with trading volume exceeding the 20-session average, reflecting investors’ optimism.

Currently, a Golden Cross between the 50-day SMA and the 200-day SMA has emerged. If this signal persists, the long-term uptrend will become more robust.

(*) Note: The analysis in this article is based on real-time data up until the end of the morning session. Therefore, the signals and conclusions are for reference only and may change when the afternoon session concludes.

Technical Analysis Team, Vietstock Consulting

– 12:08 15/08/2025

Market Beat: Foreigners Maintain Heavy Sell-off, VN-Index Retreats to 1,630 Points

The trading session concluded with the VN-Index dipping 10.69 points (-0.65%), settling at 1,630 points. Likewise, the HNX-Index witnessed a decline of 2.81 points (-0.99%), closing at 282.34 points. The market breadth tilted towards decliners, as 609 stocks closed in the red, while 242 stocks ended in the green. The VN30 basket mirrored this trend, with 19 stocks losing ground against 9 gainers and 2 stocks remaining unchanged.

Stock Market Review: Foreign Investors Ramp Up Pressure

The VN-Index’s upward trajectory stalled as it dipped in the week’s final session. This pause is a necessary adjustment, allowing the market to consolidate gains and build a stronger foundation for future growth. However, the mounting selling pressure from foreign investors is a notable concern. If this trend persists, the index may face heightened challenges in the coming periods.

The Stock Market Soars to New Heights

“An array of stocks with impressive returns, often exceeding multiples of the initial investment, has captivated the attention of many individuals, enticing them to channel their funds into this lucrative avenue.”