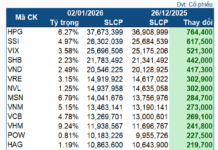

M&A deals in Vietnam for July 2025. (Source: Grant Thornton)

According to data from Grant Thornton, the real estate sector witnessed a robust recovery in M&A activities during the first half of 2025, especially in July. This rebound was primarily driven by positive signals from the macroeconomic environment, which bolstered the market’s absorption capacity for real estate products. Additionally, the Land Law that came into effect in August 2024 contributed to enhanced transparency and accelerated growth.

A notable deal in the real estate sector involved Vinaconex Group’s completion of the sale of 70% of its shares in Vinaconex ITC (VCR), the investor of the Cat Ba Amatina tourism and urban project (172 ha, Hai Phong), to three domestic investors: Ha Noi An Pha (23.06%), Imperia An Phu (24.1%), and Silver Field International Business JSC (22.5%).

A glimpse of the Cat Ba Amatina project. Source: Vinaconex

The transaction was conducted through a private placement, and the value was not disclosed. However, based on the VCR stock price at the time of valuation, the estimated value for 70% of the shares ranges from $250 to $300 million. Post-transaction, Vinaconex still holds 24.5% of the shares but is expected to divest entirely in the future.

In another significant deal, UOA Vietnam Pte. Ltd., a subsidiary of United Overseas Australia Ltd (UOA Group), acquired 100% of VIAS Hong Ngoc Bao JSC for $68 million. The target company owns the development rights to a prime 2,000 sq. m plot in District 1, Ho Chi Minh City, where they plan to construct a commercial office building spanning approximately 20,000 sq. m. This acquisition gives UOA Vietnam full control over this asset and strategically expands their real estate portfolio in Vietnam.

A New Look at Tra Khuc Bridge: A 60-Year-Old Icon

After six decades of service, the Tra Khuc 1 Bridge in Quang Ngai Province has fallen into a state of disrepair, with concrete pillars crumbling to expose rusted steel. A new bridge will be constructed, with a total investment of nearly VND 2,200 billion, ensuring a safer and more reliable crossing for generations to come.

The Legend Danang: A Legend Unfurls by the Dragon Bridge

The Legend Danang emerges as a rare “iconic landmark” project, situated right next to the Dragon Bridge symbol. It embodies a unique dual value proposition: a cultural and tourism landmark that also offers robust potential for value appreciation, with Danang poised to become the financial and economic hub of the region in the future.