Mr. Dang Thanh Duy

|

Mr. Duy’s transaction took place on August 12th, with the session’s liquidity falling short of his purchase volume. Following this deal, Mr. Duy’s total ownership in VNS reached 42.56%, equivalent to nearly 28.9 million shares.

| VNS Share Price Movement since the beginning of 2025 |

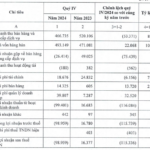

Mr. Duy’s move comes shortly after VNS announced its Q2/2025 consolidated financial statements, revealing a decline in business performance for both the quarter and the first half of 2025.

Revenue for the first six months decreased by 15% to over VND 451 billion. Other income also fell by 44% to VND 14.1 billion due to a shortfall in gains from fixed asset disposals and taxi advertising. With borrowing costs rising by nearly 47%, VNS‘s net profit eroded to nearly VND 24.1 billion, a 38% drop compared to the same period last year.

Compared to the 2025 target of nearly VND 54 billion in after-tax profit, VNS‘s first-half profit achievement stands at 45%.

– 10:13 15/08/2025

The Power of Words: Crafting Captivating Headlines

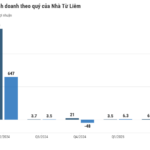

“Second Quarter Revenue Down 99.6% Year-over-Year, Nhã Từ Liêm Remains Resilient with Modest Profit through Strategic Cost-Cutting and Investment Diversification”

The company’s Q2/2025 revenue plummeted due to a near standstill in business operations. However, NTL managed to record a slight profit of VND 2 billion, attributed to financial gains from interest income, investment in securities, and operational cost-cutting measures.

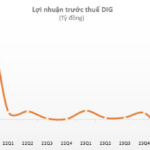

“DIC Corp Plunges into Pre-Tax Loss in Q3, with Negative Cash Flow from Operations of nearly VND 1,200 Billion”

The real estate company witnessed a staggering decline in its operating cash flow, plunging to a negative figure of nearly VND 1,200 billion in the third quarter. This represents a dramatic shift from the negative flow of VND 125 billion experienced in the same period last year.