At the event “Legal Framework and Capital Mobilization Solutions for Enterprises” on August 14, securities analyst Hoang Anh Tuan shared that Techcom Securities (TCBS) is piloting a separate IPO platform. Enterprises only need to submit their documents for assessment by the securities company instead of waiting for approval from the Securities Commission.

“Going forward, a company does not necessarily have to IPO on HOSE, HNX, or UPCoM. They can list on a separate exchange operated by a securities company. Once they meet the evaluation standards, they can immediately IPO, and investors within the system can purchase their stocks even if the enterprise is not listed on any traditional exchange,” said Mr. Tuan. “This is a much more open and positive direction than the traditional market.”

In parallel, TCBS is also experimenting with crowdfunding for individual projects. This form is popular in many countries but is still quite new in Vietnam. “This is a suitable choice for small businesses, allowing them to raise capital at a lower scale without the burden of cumbersome procedures,” added Mr. Tuan.

Mr. Hoang Anh Tuan – Photo: Tu Kinh

|

Depositary Receipts – Opening Doors for Vietnamese Enterprises to the International Market

Among the new capital mobilization channels, depositary receipts are considered a breakthrough solution for Vietnamese enterprises to access international capital without having to establish a subsidiary abroad, as was previously the case.

According to lawyer Nguyen Van Hai of Allen & Overy Shearman Sterling Vietnam, enterprises listed in Vietnam can transfer a portion of their shares to a reputable depositary bank such as Deutsche Bank or Bank of New York Mellon. The bank will hold these shares and issue depositary receipts at a conversion rate, for example, one share can generate 10 receipts.

These depositary receipts are then offered and listed on exchanges in the US, London, or other major financial centers. As a result, foreign investors, especially funds or individuals who are only allowed to invest in their domestic market, can access Vietnamese company stocks without direct investment.

“The benefits are clear,” said Mr. Hai. “Enterprises can raise more capital than domestically, enhance their brand reputation, and improve liquidity by attracting international capital. The State Securities Commission strongly supports this, and some Vietnamese enterprises have started exploring and may implement it soon.” However, there are still some legal uncertainties that need to be gradually addressed during the implementation process.

Will the International Financial Center Open Doors for Enterprises?

In reality, there are still many barriers for Vietnamese enterprises to access the international market. A typical case is VinFast, which established its parent company in Singapore to be listed on Nasdaq instead of directly listing from Vietnam.

“In essence, VinFast’s shares in the US are owned by the Singapore-based company that holds VinFast Vietnam,” Mr. Hai analyzed. “They had to choose this approach because domestic laws do not yet allow direct listing in foreign markets.”

To address this, Resolution 222 on the International Financial Center has provided a basis for enterprises to establish a capital mobilization company in Vietnam to conduct international transactions, including listing on foreign exchanges. According to the lawyer, instead of having to go to Singapore like VinFast, enterprises in the future can establish their legal entity at the international financial center in Vietnam to more conveniently mobilize capital.”

While awaiting further guiding decrees, the initial legal framework has already brought great confidence to the business community. Depositary receipts are expected to become a “bridge” for Vietnamese enterprises to tap into global capital while maintaining their domestic legal identity.

From left to right: Ms. Ta Thanh Binh, Mr. Nguyen Van Hai, and Mr. Hoang Anh Tuan at the event on August 14 – Photo: Tu Kinh

|

Securities Remain the Most Effective Capital Raising Channel

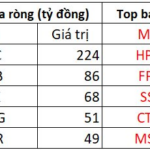

Despite the emergence of new capital channels, the speakers agreed that securities remain the most effective fundraising tool. Mr. Hoang Anh Tuan cited the period from 2020 to 2022 when interest rates were low; numerous enterprises successfully raised capital: VND increased its capital from VND 2.2 thousand billion to over VND 12 thousand billion, with its stock price surging 14 times; SSI raised its charter capital from VND 6 thousand billion to VND 15 thousand billion; BCG increased its capital from VND 1.3 thousand billion to VND 5.3 thousand billion, with its stock price increasing 11-fold.

“Once listed, the likelihood of a successful issuance is as high as 99%,” he emphasized. “In my over ten years of experience, I rarely witness issuance failures. Most deals meet or exceed expectations.”

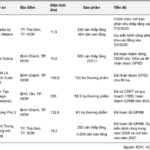

In fact, Vietnam’s market has recorded significant transactions in recent years. In 2023, VinFast was listed on Nasdaq with a valuation of $23 billion, and its market capitalization once reached $85 billion. In the same year, VPBank sold $1.5 billion worth of shares to SMBC, the largest deal in the banking industry at the time. Moving into 2025, VIC shares tripled just three months after Vinpearl (VPL) went public, Vinhomes (VHM) increased by 1.5 times, and TCBS’s upcoming IPO contributed to Techcombank’s doubled market capitalization.

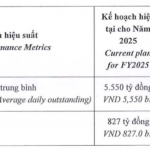

According to Mr. Tuan, the prospects are even more positive with the Fed’s rate cut since late 2024, bringing back cheap capital. Domestically, deposit interest rates remain at 5-6% per year, along with a GDP growth target of 8% in 2025 and a minimum of 10% annually from 2026-2030.

Additionally, private capital from investment funds, family offices, or wealthy investors is flowing towards small and medium-sized enterprises, which typically have difficulty accessing bank credit. Notably, ESG capital is becoming increasingly popular, with low costs and interest rates of just under 2% plus capital costs, focusing on enterprises led by women or those adhering to sustainable development standards.

With the diversification of capital mobilization channels, including separate IPOs, crowdfunding, international depositary receipts, and ESG capital, along with a favorable macroeconomic environment, Vietnamese enterprises now have more options than ever before. Experts believe that 2026-2030 will be a booming period for capital mobilization, especially through the securities channel.

“Currently, cheap capital is abundant in the market. Whenever such a phase occurs, the market tends to rise by 2-2.5 times, or about 100-150%. If we take the low of around 1,000 points at the beginning of 2025 as a reference, VN-Index could certainly reach 2,000-2,200 points,” said Mr. Tuan optimistically.

“This figure may come as a surprise, but with the market’s dynamics and Vietnam’s entry into an era of high growth, it is just a springboard for the next five-year cycle. With a minimum double-digit GDP, there will be further room for the market to ascend.”

Tu Kinh

– 11:35 16/08/2025

Breaking News: ‘Super Sandboxes’ in Ho Chi Minh City and Da Nang to Pilot Cutting-Edge Innovations: Digital Currency, Fintech, Blockchain, and Quantum Tech.

The latest in tech and finance innovations will be piloted in a controlled test environment across two international financial hubs: Ho Chi Minh City and Danang.