Investment Joint-Stock Company Năm Bảy Bảy (coded NBB on the HoSE) on August 13 announced that it has completed the procedure for transferring capital contribution at NBB Quang Ngai One Member Co., Ltd. to Investment Joint-Stock Company SDP.

As of June 30, 2025, Năm Bảy Bảy had invested 85 billion VND in NBB Quang Ngai (with a provision of 23.14 billion VND), corresponding to 100% ownership.

Prior to the transfer, on July 16, Năm Bảy Bảy issued Resolution No. 63/NQ-HĐQT on signing a contract for capital support with NBB Quang Ngai with a maximum debt limit of 50 billion VND.

A project perspective of NBB.

NBB Quang Ngai is an enterprise that manages and exploits Tho Bac and Nui Mang stone mines in Quang Ngai province, and performs construction and installation work by contracting construction projects and schemes in the province and other localities.

Tho Bac stone mine has an area of 21.8 hectares, with an exploitation capacity of 180,000 cubic meters per year. It is expected to be exploited from September 22, 2008, to September 22, 2024. Meanwhile, Nui Mang stone mine has an area of 4.4 hectares, with a capacity of 5,300 cubic meters per year. It is expected to be exploited from December 2015 to December 2023, and the mine is currently in the process of closing procedures.

Regarding the transferee, Investment Joint-Stock Company SDP was established in February 2024, with a registered business line of consulting, brokering, and auctioning real estate.

The enterprise has a charter capital of 20 billion VND, of which Mr. Nguyen Tan Thang contributes 50%, Mr. Tran Duc Dung contributes 20% and holds the position of Director and legal representative, and the remaining 10% is held by Mr. Luu Hai Duong.

In another development, Năm Bảy Bảy has been approved by shareholders through a written opinion on entrusting the Board of Directors to decide on legal work related to the NBB II high-rise apartment project.

Previously, Năm Bảy Bảy was approved by the People’s Committee of Ho Chi Minh City for its investment policy and investor for the NBB II high-rise residential area project under Decision No. 3108/QD-UBND dated June 21, 2025.

The NBB II high-rise residential area project has a scale of about 7.9 hectares, expected to build 5 18-storey apartment towers, with an investment capital of VND 4,136 billion. The Company has completed compensation work and is expected to complete the next investment procedures in the period of 2025 – 2026.

“The Quarry Conundrum: Unveiling the Intriguing Story of a Stone Mining Company’s Journey in Quang Ngai”

“Year Seven Seven has finalized the transfer of its capital contribution in NBB Quang Ngai One Member Co., Ltd. to SDP Investment Joint Stock Company. This strategic move underscores Year Seven Seven’s commitment to streamlining its investments and focusing on core business areas. The transfer ensures a more efficient allocation of resources and paves the way for future growth initiatives.”

The Final Plot: Unveiling Lideco’s Long-Awaited Project in Dich Vong Urban Area

The Dich Vong New Urban Area project, a prestigious development in the heart of Hanoi, was entrusted to Lideco by the People’s Committee of Hanoi back in 1997, with an initial completion date set for 2007. Nearly two decades later, this long-awaited project on prime real estate is finally being untangled, with construction expected to commence in the near future.

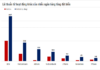

The Billion-Dollar Boom: Unlocking the Potential of Vietnam’s Real Estate Market

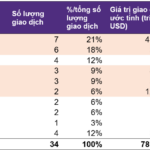

In July, Vietnam’s M&A market witnessed a total of 34 deals, amounting to an impressive $786 million in disclosed and estimated values. Leading the pack was the real estate sector, accounting for a substantial $484 million of that total value.