Viettel Global Joint Stock Company (Viettel Global, ticker symbol: VGI, trading on the UPCoM exchange) has announced that August 28, 2025, is the record date for shareholders to receive cash dividends for the 2024 financial year.

Viettel Global plans to distribute a cash dividend to shareholders at a rate of 7.50377%, meaning that for every share owned, shareholders will receive 750.377 VND. The payment date is set for September 29, 2025.

With over 3.04 billion VGI shares currently in circulation, Viettel Global is expected to pay out more than 2,284 billion VND in this dividend distribution.

Illustrative image

As of June 30, 2025, the Military-Telecoms Group (Viettel) owned 99.03% of Viettel Global’s charter capital, equivalent to over 3.01 billion VGI shares. Viettel is estimated to receive nearly 2,261.8 billion VND from this dividend payout.

The above dividend payment proposal was approved by Viettel Global’s shareholders at the 2025 Annual General Meeting of Shareholders (AGM) held on June 5, 2025.

In terms of business performance, according to the consolidated financial statements for Q2 2025, Viettel Global recorded revenue of over 10,514.4 billion VND, a 21% increase compared to the same period last year. Gross profit reached nearly 5,595.9 billion VND, a 16% increase year-on-year.

Additionally, the company earned nearly 1,330.5 billion VND in financial income, a 6.2% decrease from the previous year, and recognized a profit of over 175.1 billion VND from joint ventures and associates, a 60.2% increase.

After deducting taxes and expenses, Viettel Global reported a net profit of over 2,881.7 billion VND, up 135.8% compared to the same period in 2024.

For the first six months of 2025, Viettel Global’s cumulative revenue was over 20,170.9 billion VND, a 21.6% increase compared to the same period in 2024. Profit after tax was nearly 3,289.7 billion VND, a 15.2% increase year-on-year.

As of June 30, 2025, the company’s total assets increased by 7.8% from the beginning of the year to over 68,385.6 billion VND. Cash and cash equivalents accounted for 22.3% of total assets, at over 15,219.9 billion VND, while short-term and long-term financial investments totaled nearly 26,716.4 billion VND, or 39.1% of total assets.

On the liabilities side of the balance sheet, Viettel Global’s total liabilities were nearly 29,211.3 billion VND as of June 30, 2025, a 5.8% increase from the beginning of the year. Other short-term payables accounted for 24.9% of total liabilities, at approximately 7,276.8 billion VND, while short-term unearned revenue was nearly 3,823.1 billion VND.

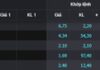

The Market Beat: Foreigners End Selling Streak

The market closed with slight losses, as the VN-Index dipped by 0.23 points (-0.02%) to finish at 1,228.10, while the HNX-Index shed 0.47 points (-0.21%), closing at 221.29. The market breadth tilted towards decliners, with 371 tickers in the red versus 341 in the green. Meanwhile, the large-cap VN30 index displayed a more balanced performance, with 11 tickers losing ground against 13 advancing stocks and 6 remaining unchanged.