Illustrative image

Over the past three years, India has significantly ramped up its crude oil imports from Russia, taking advantage of discounted prices ranging from $5 to $30 per barrel, following Europe’s sanctions on Russian energy.

According to Moneylife, the benefits of this cheap oil have largely gone to oil corporations and the government’s budget. Specifically, private companies such as Reliance Industries and Nayara Energy, along with state-owned enterprises like Indian Oil and Bharat Petroleum, have reaped approximately 65% of the total profits from discounted oil, while the remaining 35% went to the government. Some businesses have seen their profits surge by up to 25 times compared to pre-discount levels.

Retail fuel prices in India continue to be burdened by high taxes. In Delhi, the central government’s special excise duty stands at ₹21.90 per liter for gasoline and ₹17.80 per liter for diesel, in addition to state taxes of ₹15.40 and ₹12.83, respectively. Taxes account for over 40% of the retail selling price. An additional ₹2 special excise duty imposed in April 2025 resulted in an extra ₹32,000 crore revenue for the central government but also limited the extent of fuel price reductions passed on to consumers.

Private refineries have also greatly benefited from Russian supplies. In the first half of 2025, Reliance and Nayara accounted for 45% of the total 23.1 million barrels of Russian oil imported into India, with refining margins reaching $12.5 to $15.2 per barrel. A portion of the refined products was exported to Europe, the US, UAE, and Singapore, generating significant revenue.

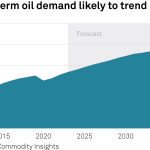

The share of Russian oil in India’s crude imports increased from 0.2% in 2021 to 35.1% in 2025, amounting to approximately 1.67 million barrels per day and meeting nearly 37% of the country’s domestic demand. Long-term contracts, such as the 10-year deal signed by Reliance in late 2024 for 500,000 barrels per day, make a sudden shift in supply sources challenging.

This move has drawn a response from the US. The Trump administration recently imposed a 50% tariff on India’s imports of Russian oil, accusing Indian refineries of re-exporting products to Europe and other regions. New Delhi objected, calling the tariffs “unfair” and emphasizing that the purchase of Russian oil is necessary to ensure energy security for its 1.4 billion people.

Following the US tariff imposition, around 2 million barrels of Nigerian oil are expected to arrive in India during September-October 2025. The Indian Oil Corporation (IOC) has purchased one million barrels of Agbami oil through a tender from Trafigura. Bharat Petroleum Corporation Limited (BPCL), the second-largest state-owned refinery, has also concluded spot purchases and is negotiating additional September-loading cargoes.

In parallel with Nigeria, India is increasing purchases from various other sources, including 1 million barrels of Girassol oil from Angola, 1 million barrels of Mars oil from the US, 3 million barrels of Murban oil from Abu Dhabi, and an additional 2 million barrels from Nigeria.