Mrs. Minh Phuong, a resident of Hanoi, shared that she and her husband both hail from provincial backgrounds and moved to the capital to pursue their careers. After six years of marriage, their combined income has only recently reached the 100 million VND per month mark, with previous years fluctuating between 40 and 80 million VND. However, despite their efforts, the family is only able to save 15 to 20 million VND each month, totaling approximately 700 million VND in savings over the past six years. Their dream of owning a home in Hanoi still feels out of reach.

Currently, the family rents a three-bedroom apartment for 12 million VND per month. With additional expenses such as utilities, service fees, domestic helper wages, loan repayments for a house they are building in their hometown, food, education for their two children, medical expenses, transportation, and supporting their parents, there is barely anything left at the end of the month.

“A combined income of 100 million VND per month may seem comfortable, but in Hanoi, especially when you’re raising young children and renting, the financial pressure is immense,” Mrs. Phuong remarked.

The challenges faced by Mrs. Phuong’s family are not unique. Many young families in Hanoi, despite having relatively good incomes, struggle with the dream of homeownership. Mr. Xuan Long and his wife, also residents of Hanoi, fall into this category. With a stable combined income of 50 to 70 million VND per month, the couple has managed to save around 400 million VND over the years. Initially, they planned to use this money as a down payment on a house. However, after surveying the market, they felt discouraged.

“Even a two-bedroom apartment in the outskirts of Hanoi now costs over 3 billion VND. Our savings are insignificant compared to the current property prices,” shared Mr. Long.

He further explained that with their current income, purchasing a home would mean taking out a bank loan of several billion VND and being burdened with interest payments for many years. This financial pressure is especially daunting with young children and rising living costs. “The thought of a long-term loan makes me anxious. If we save more, I worry that property prices will continue to rise, but if we buy now, I fear we’ll be overwhelmed by debt,” he added.

Real estate brokers who are members of the Vietnam Real Estate Brokers Association (VARS) have shared that many of their clients, young people with good incomes of 40 to 50 million VND per month, are reluctant to purchase property without financial support from their families. The burden of loan repayments, especially with floating interest rates increasing after the promotional period, is a significant barrier for young buyers.

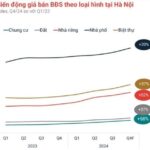

This situation is a result of an increasing supply of apartments in Hanoi, but with a mismatch between the type of housing available and the needs of buyers. According to VARS, from the third quarter of 2024 until now, there have been no new apartment projects launched in Hanoi with prices below 60 million VND per square meter.

In the first half of 2025, 60% of new apartment supply was priced above 80 million VND per square meter. Some apartment projects in the outskirts of Hanoi are also priced at 55 million VND per square meter.

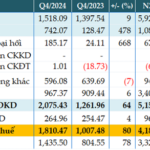

Data from CBRE, a research unit, showed that Hanoi had more than 6,800 new apartments for sale in the second quarter of 2025, nearly double the number in the first three months. However, the selling prices of these new projects were kept high by developers, averaging 79 million VND per square meter (excluding VAT, maintenance fees, and discounts), a 33% increase compared to the same period last year. Areas that used to have average prices of 40 to 50 million VND per square meter, such as Ha Dong and Hoang Mai, now have new projects priced above 70 million VND per square meter.

Savills Vietnam recorded an even higher average price of 91 million VND per square meter, a 40% year-on-year increase. The market is almost devoid of primary products priced below 2 billion VND per unit, while 67% of new supply is priced above 4 billion VND.

The trend of “hesitance to marry and reluctance to have children” threatens market liquidity

Mr. Nguyen Van Dinh, Chairman of VARS, warned that the continuous surge in Hanoi’s property prices poses risks to the healthy development of the market and exacerbates income inequality and social disparities.

Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association (VARS)

Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association (VARS)According to statistics from the General Statistics Office of Vietnam, the average age of first-time marriages has increased from 24.1 years old in 1999 to 27.2 years old in 2024. Meanwhile, the birth rate in 2024 has halved compared to 1989, reaching the lowest level in history at 1.91 children per woman, with a more rapid decline in the past two years.

Along with the trend of late marriages and the “hesitance to marry and reluctance to have children” mindset prevalent among young people, especially in big cities, Vietnam is experiencing a rapid aging population.

Notably, in metropolises like Hanoi and Ho Chi Minh City, the fertility rate is approaching the “seriously low birth rate” category (below 1.3 children per woman) according to the United Nations’ classification.

The Vietnam Real Estate Brokers Association Institute of Real Estate Research (VARS IRE) analyzed that the trend of “hesitance to marry and reluctance to have children” is not only a consequence of the high cost of living but, in the long run, will become a factor that negatively impacts the real estate market.

VARS IRE suggested that the decreasing birth rate leads to a reduction in household size and the working-age population, which are the primary customers of the real estate market. This shift in demographics results in a decreased demand for housing and a preference for smaller, cost-efficient properties. Meanwhile, property prices remain high and inflexible, leading to reduced absorption rates in larger, more expensive segments, increased inventory, and liquidity challenges for developers.

As home prices continuously outpace affordability, young people’s dreams of owning a home fade, and many opt for long-term rentals instead. This reality not only affects the demand for real estate but also negatively impacts decisions about marriage and childbirth, exacerbating the risk of population decline in the future—a scenario already witnessed in Japan, South Korea, and Singapore.

To avoid falling into this vicious cycle, VARS IRE recommended a comprehensive approach that includes promoting social housing development in major cities, encouraging commercial housing at reasonable prices through procedural and credit incentives and preferential rights in project bidding, shifting the focus from “build-to-sell” to “build-to-rent,” exploring REITs and public-private partnerships with the government providing land and infrastructure support, and enterprises investing and operating.

Build an Emergency Fund to Make Financial Fluctuations Less Frightening

“In the face of unpredictable challenges such as pandemics, economic crises, and waves of layoffs, it is essential to build a financial safety net early on, especially for young families. This safety net serves as a shield, protecting your financial plans and providing resilience in the face of any risks that may come your way.”

The Real Estate Renaissance: A Booming Market Unveiled

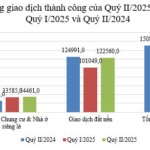

According to the Ministry of Construction’s report on the real estate market in Q2 2025, real estate transactions (apartments, individual houses, and land plots) continued an upward trend, recording 157,021 transactions, a significant 2.2-fold increase compared to the first quarter.