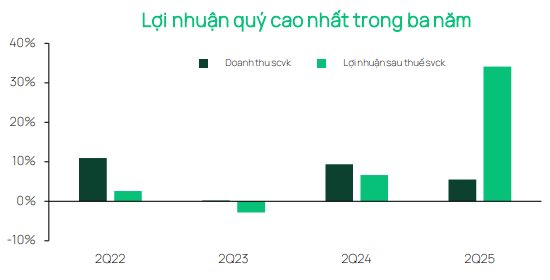

According to statistics as of early August, 97% of listed companies on the VN-Index have announced their second-quarter financial results for 2025, with the market’s after-tax profit increasing by 34.1% year-on-year, marking the strongest quarterly growth since the first quarter of 2022.

With the positive first-half results, in a recent report, Dragon Capital upgraded its full-year 2025 net profit growth forecast for the Top 80 companies from 13.8% to 20.1%.

Among the 80 stocks tracked by Dragon Capital, 39% of companies outperformed and 40% met profit forecasts, making it the highest beat-to-miss ratio in the past three years. By industry, the Financial sector recorded a profit increase of 16.9%, led by banks that benefited from credit growth and improved asset quality, along with securities companies that gained from robust margin lending and proprietary trading activities.

Notably, the Real Estate sector saw a 69% profit increase, supported by the recovery in profits and asset revaluation of housing developers, as well as positive results from large enterprises in the industrial real estate segment. Meanwhile, the Manufacturing and Services sectors both recorded over 45% year-on-year growth in net profit.

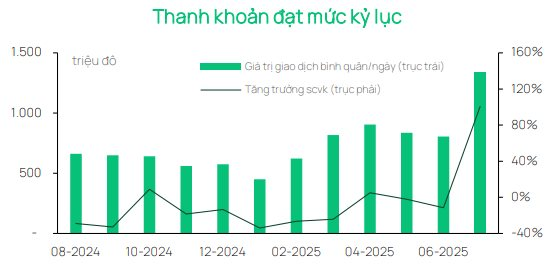

Turning to the stock market, analysts noted that the market witnessed a strong surge in July, with the VN-Index rising 8.9% (in USD terms) from the previous month to close at 1,502 points – the highest level in three years.

Moreover, liquidity remained high, with average trading value surpassing USD 2.1 billion per day and even hitting a record of USD 3 billion in a session early in August. Mid-cap stocks outperformed, boosted by the active participation of individual investors, along with margin lending balances at securities companies reaching record highs.

On the macroeconomic front for July, Vietnam’s economy maintained its strong growth momentum, building on the positive results in the first half of the year. The government has raised its 2025 GDP growth target to 8.3–8.5%, reflecting confidence in the economic outlook for the second half. Manufacturing activity improved, with the Purchasing Managers’ Index (PMI) climbing to 52.4 – the highest level in almost a year.

Credit disbursement as of the end of July increased by 10.2% year-to-date, the highest level in over a decade for this period. The State Bank of Vietnam (SBV) maintained its accommodative monetary policy, injecting record liquidity through open market operations to keep interest rates low amid rising credit demand.

Dragon Capital points out that legal reforms continue to be implemented. The State Bank has issued Circular No. 14/2025, which sets out a roadmap for gradually removing the credit growth limit and adjusting capital adequacy requirements in line with Basel III standards. In parallel, the draft amendments to the Land Law propose adjustments to certain provisions issued in 2024 to improve the operating conditions for real estate developers.

These proposals include applying state-regulated land prices instead of market prices, which could reduce land use costs, along with greater flexibility in project approval, land retrieval, and land use fee payments. Additionally, the proposal to impose a real estate tax has been postponed for further study.

Overall, Dragon Capital maintains a positive outlook. Despite external challenges such as tariffs from the US, the Vietnamese economy remains resilient, supported by stable credit growth, controlled inflation, robust public investment, and positive FDI inflows.

“Investor sentiment may remain optimistic if macroeconomic conditions and corporate earnings continue their current trajectory. However, given the market has recorded one of the strongest rallies in the past three years, sensitivity to global negative factors related to the trade war and economic prospects could increase,” emphasized Dragon Capital.

“Foreign Investors’ Sell-Off: Blue-Chip Stocks Witness a Massive $1 Billion Outflow in the Week of August 11-15, Contrasting the Strong Buying of Securities Stocks”

Foreign investors continued their net selling streak in the billions during the week of August 11-15, with selling pressure intensifying towards the week’s end.

Foreign Investors Continue Their Selling Spree: Net Sell-Off Exceeds VND 3 Trillion on August 15

Let me know if you would like me to continue refining or expanding this title to better suit your needs.

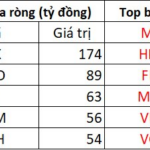

Foreign investors continued their selling spree on HPG stock, offloading a staggering 700 billion VND worth of shares. FPT and MBB also witnessed substantial sell-offs, with outflows of 509 billion VND and 500 billion VND, respectively.