After consecutive record-breaking sessions, Vietnam’s stock market witnessed its first correction. At the close of the trading day on August 15th, the VN-Index dipped by 10.69 points to land at the 1,630-point mark. A positive sign was the sustained high liquidity, with the matching value on HoSE surpassing 57.1 trillion VND.

Foreign Investors’ Activities:

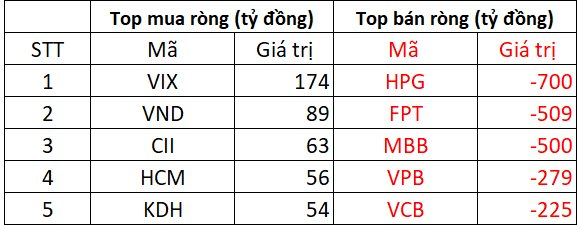

On the HoSE, foreign investors offloaded a substantial 3,016 billion VND, marking the seventh consecutive session of net selling. VIX witnessed the strongest net buying, attracting 174 billion VND from foreign investors. VND, CII, HCM, and KDH also made it to the top net bought list, with values ranging from 54 to 89 billion VND.

Conversely, HPG experienced a remarkable net sell-off of 700 billion VND, followed by FPT and MBB, which were net sold for 509 billion and 500 billion VND, respectively. VPB and VCB also faced notable net selling, with values of 279 billion and 225 billion VND, respectively.

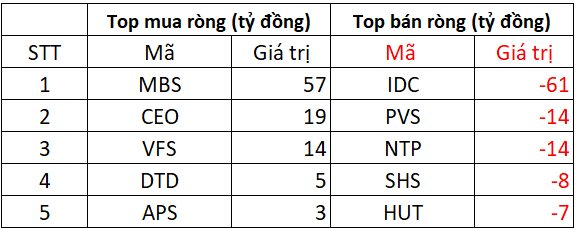

On the HNX, foreign investors net sold approximately 29 billion VND. MBS witnessed robust net buying of 57 billion VND, followed by VFS and CEO, which attracted 14 and 19 billion VND, respectively. DTD and APS also saw modest net buying of 3 to 5 billion VND.

On the selling side, IDC faced a significant net sell-off of 61 billion VND. PVS and NTP were also net sold for 14 billion VND each, while SHS and HUT experienced net selling of around 7 to 8 billion VND.

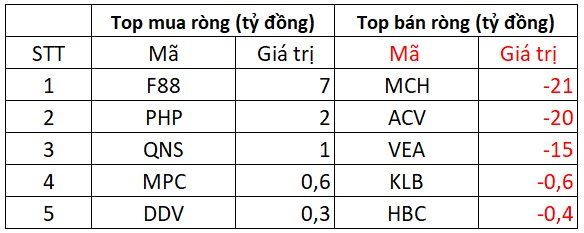

Turning to the UPCOM, foreign investors offloaded a net 44 billion VND. F88 emerged as the most net bought stock, attracting 7 billion VND. Meanwhile, PHP, QNS, MPC, and DDV witnessed modest net buying, ranging from a few hundred million to a few billion VND.

On the selling side, ACV and MCH witnessed substantial net selling of 20 to 21 billion VND. VEA was also net sold for 15 billion VND, while KLB and HBC faced less intense net selling pressure.

Market Beat: Foreigners Maintain Heavy Sell-off, VN-Index Retreats to 1,630 Points

The trading session concluded with the VN-Index dipping 10.69 points (-0.65%), settling at 1,630 points. Likewise, the HNX-Index witnessed a decline of 2.81 points (-0.99%), closing at 282.34 points. The market breadth tilted towards decliners, as 609 stocks closed in the red, while 242 stocks ended in the green. The VN30 basket mirrored this trend, with 19 stocks losing ground against 9 gainers and 2 stocks remaining unchanged.