Vietnam’s stock market experienced a volatile trading session on August 15, with the VN-Index opening higher but facing strong profit-taking pressures. Towards the end of the session, the index fell by nearly 18 points, dipping below the 1,620 mark, before narrowing losses as several large-cap stocks managed to stay in positive territory. At the close, the VN-Index was down 10.69 points, settling at 1,630 points. Foreign investors continued their net-selling streak, offloading a significant 3.089 trillion VND across the market, marking the seventh consecutive session of net outflow.

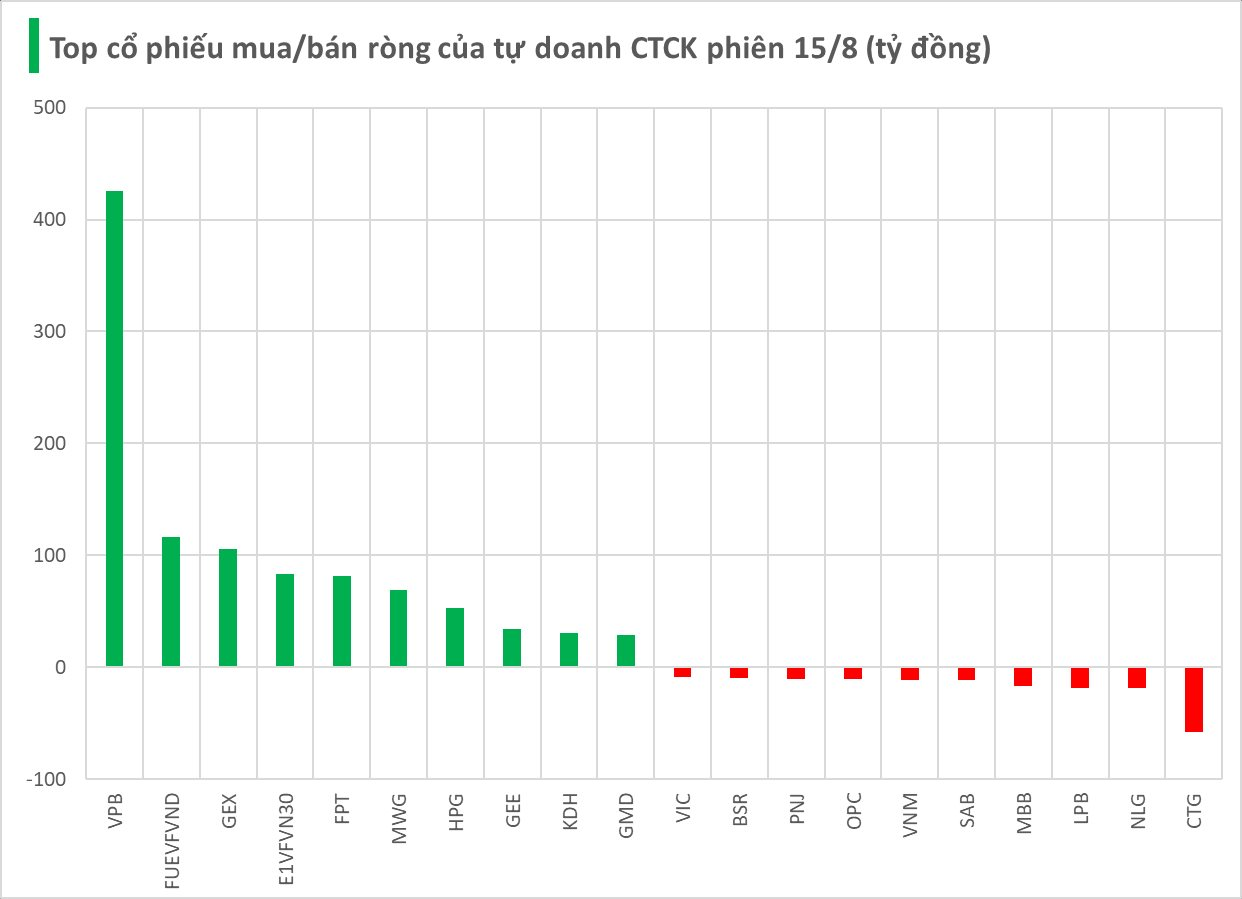

In contrast, proprietary trading by securities companies remained robust, with a net buy value of 859 billion VND on the HoSE.

Specifically, VPB, a bank stock, dominated the net buying with a substantial 426 billion VND, far surpassing other stocks. FUEVFVND followed with 117 billion VND, then GEX (106 billion VND), E1VFVN30 (83 billion VND), FPT (81 billion VND), MWG (69 billion VND), HPG (53 billion VND), GEE (34 billion VND), KDH (31 billion VND), and GMD (29 billion VND).

On the other side, securities companies offloaded CTG the most, with a net sell value of 58 billion VND. This was followed by NLG (19 billion VND), LPB (19 billion VND), MBB (17 billion VND), and SAB (12 billion VND). Several other stocks also witnessed notable net selling, including VNM (12 billion VND), OPC (10 billion VND), PNJ (10 billion VND), BSR (10 billion VND), and VIC (8 billion VND).

The Bank Stock Rout: Brokers’ Own Trading Accounts Dump Shares on Monday

The domestic securities companies turned net sellers on the HoSE stock exchange, offloading stocks worth VND400 billion.