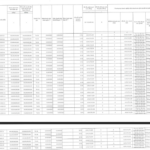

The Hanoi Stock Exchange (HNX) has recently published documents disclosing information regarding the repayment of principal and interest on bonds issued by No Va Real Estate Investment Group Joint Stock Company (Novaland, stock code: NVL).

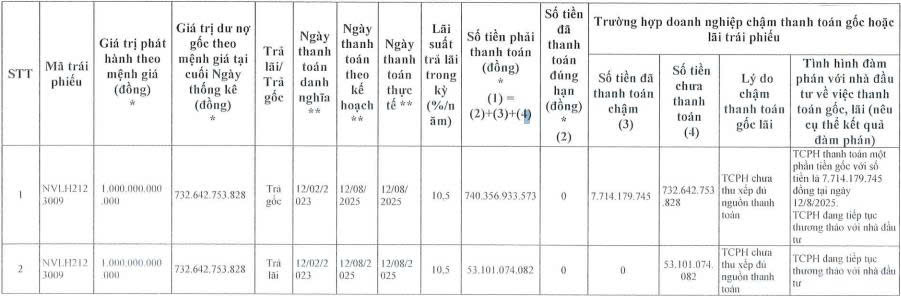

Specifically, according to the plan, on August 12, 2025, Novaland was scheduled to repay nearly VND 793.5 billion in principal and interest for two lots of bonds with the code NVLH2123009.

However, due to a delay in arranging funds, the company has only managed to repay over VND 7.7 billion, with the remaining amount of nearly VND 785.8 billion yet to be paid.

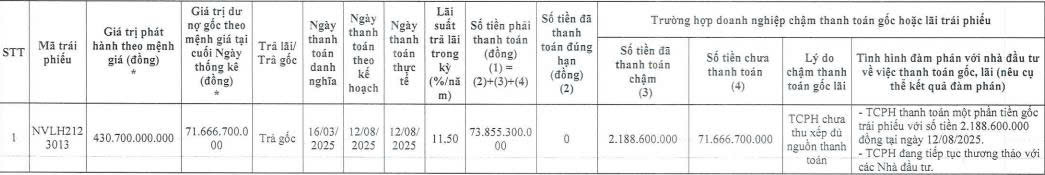

On the same day, August 12, 2025, Novaland was also due to repay nearly VND 73.9 billion in principal for the bond lot with the code NVLH2123013. The company has only repaid approximately VND 2.2 billion, leaving nearly VND 71.7 billion unpaid.

Source: HNX

Novaland has stated that they are in ongoing negotiations with investors regarding the delayed repayment of the outstanding balance on the aforementioned bond lots.

It is known that the NVLH2123009 bond lot was issued on August 12, 2021, with a total issuance value of VND 1,000 billion, a term of 18 months, and a maturity date of February 12, 2023.

The purpose of the issuance was to increase the company’s operating capital and invest in Novaland’s programs and projects that meet the requirements for bond fundraising.

Specifically, the proceeds from the bond offering were used to invest in the development of an urban area in Long Hung, Dong Nai province, and other investment projects of the company.

As for the NVLH2123013 bond lot, it comprised over 4.3 million non-convertible, non-warrant-attached, asset-backed bonds, with a total issuance value of VND 430.7 billion, issued by Novaland on September 28, 2025. With an 18-month term, these bonds are expected to mature on March 28, 2025.

The proceeds from this bond issuance were intended to increase the company’s operating capital and/or that of its subsidiaries. Additionally, the funds were to be invested in programs and projects in the NovaWorld Ho Tram area in Ba Ria Vung Tau province (formerly known as Vung Tau) and/or other programs and projects that meet the requirements for bond fundraising.

In the first half of 2025, Novaland also faced challenges in repaying VND 2,523.4 billion in principal and interest for six bond lots, while successfully repaying over VND 33.2 billion in interest for one lot on time.

Specifically, the company delayed repayment of principal and interest for the following lots: NOVALAND.BOND.2019 with nearly VND 861.2 billion; NVLH2123010 with nearly VND 1,092.5 billion; NVLH2123013 with nearly VND 114.3 billion; NVLH2124002 with nearly VND 285.5 billion; NVLH2232001 with nearly VND 164.6 billion; and NVLH2232002 with nearly VND 5.5 billion.

According to Novaland’s explanation, the delay in repaying the principal and interest for these bond lots was due to difficulties in arranging funds. The company is currently in negotiations with investors regarding the settlement of the outstanding balance on these bond lots.

The lots for which interest was repaid on time include NVL2020-03-340 with over VND 18.5 billion and NVLH2224006 with over VND 14.7 billion.

“Novaland Could Repatriate 4.358 Trillion VND of Provisions from Lakeview Project, BSC Predicts”

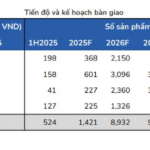

“BSC predicts that the latter half of 2025 will be a supportive phase for NVL, attributed to positive legal progress across projects, significant improvement in financial performance with the reversal of 4,358 billion VND in provisions at Lakeview, and enhanced cash flow from asset sales and installment collections at Aqua City.”

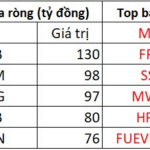

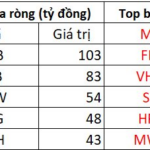

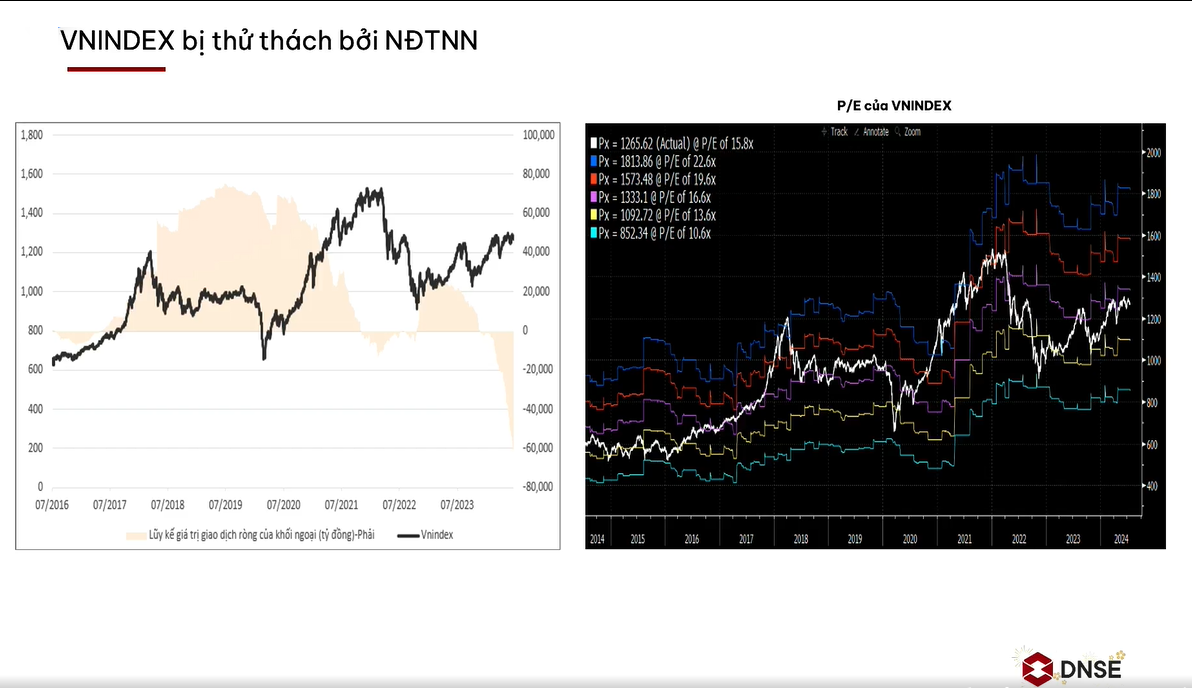

Foreign Sell-Off: 13th August Session Sees Massive Foreign Outflow of Over VND 1,500 Billion – Which Stocks Took the Biggest Hit?

“SHB stocks witnessed a significant boost in foreign investment today, as foreign investors net bought a substantial 130 billion VND worth of shares, making it the most actively traded stock in the market.”

The Real Estate Mogul’s Income in the First Half of 2025: A Comprehensive Overview

Many real estate companies have released their semi-annual financial statements for 2025, shedding light on the compensation and salaries of their top executives.