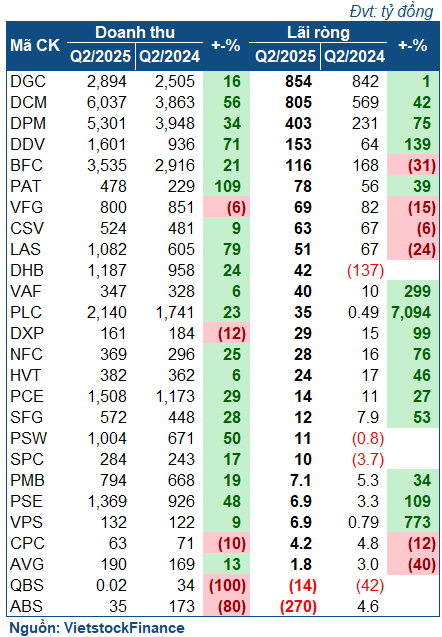

According to VietstockFinance statistics, out of 26 fertilizer and chemical enterprises that announced their second-quarter financial statements for 2025, up to 18 enterprises witnessed profit growth (including 3 enterprises that turned losses into profits). Only 6 enterprises experienced declines, and 2 enterprises, unfortunately, incurred losses.

|

Business results of fertilizer and chemical enterprises in the second quarter of 2025

|

Two major fertilizer companies reap significant profits

Among the large enterprises, 3 out of 4 companies achieved profit growth. Leading in terms of profit was Duc Giang Chemical (HOSE: DGC) with revenue of nearly VND 2,900 billion, up 16% over the same period, and VND 854 billion in net profit. Although it remained relatively stable, this was the second consecutive quarter that the chemical giant achieved a net profit of over VND 800 billion.

The increase in fertilizer prices in the second quarter compared to the same period helped two major fertilizer companies, Ca Mau Fertilizer (HOSE: DCM) and Phu My Fertilizer (HOSE: DPM), achieve significant profit growth. In particular, DCM recorded revenue of over VND 6,000 billion, a 56% increase, and a net profit of VND 805 billion, a 42% growth. Notably, DCM achieved this increase despite the absence of windfall profits from the purchase of cheap shares of Korea-Vietnam Fertilizer Joint Venture (KVF) as in the previous year.

| Business performance of DCM |

On the other hand, DPM recorded net revenue of over VND 5,300 billion and a net profit of VND 403 billion, increases of 34% and 75%, respectively, compared to the same period. These positive results were driven by two main factors: increased production and consumption of fertilizers as market demand rebounded strongly. DPM‘s gross profit margin improved significantly from 13.8% to 16.9%.

Meanwhile, Binh Dien Fertilizer (HOSE: BFC) witnessed a significant decline in performance despite a robust 21% increase in revenue to over VND 3,500 billion. The company’s net profit fell by 31% to VND 116 billion due to fluctuations in raw material costs, resulting in lower gross profit compared to the previous year.

| Business performance of BFC |

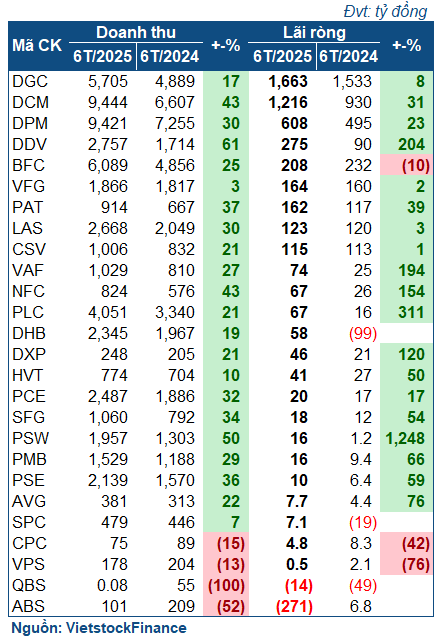

In the first half of the year, the picture remained largely unchanged for the four large enterprises. DGC, with two consecutive quarters of net profit exceeding VND 800 billion, achieved a profit of over VND 1,660 billion, an 8% increase. DCM and DPM recorded net profits of VND 1,200 billion and VND 608 billion, respectively, representing growth of 31% and 23%. However, BFC‘s second-quarter performance significantly impacted its first-half results, with a net profit of only VND 208 billion, a 10% decline.

Green Dominates

The second quarter witnessed a divergence in performance among the Vinachem group of companies. DDV experienced a booming quarter with revenue surpassing VND 1,600 billion, a 71% increase over the same period last year, and a net profit of VND 153 billion, more than double that of the previous year. DDV attributed the surge in revenue to increased sales volume and a 28% rise in the average selling price of DAP. Additionally, the company also generated revenue from the sale of ammonia.

| DDV soars high in the second quarter |

Ha Bac Nitrogen Fertilizer (UPCoM: DHB) concluded the second quarter with a net profit of VND 42 billion, a strong recovery from a loss of VND 137 billion in the previous year. The company attributed the improved performance to increased revenue, partly due to stabilized production, as the previous year’s operations were disrupted by a 45-day shutdown caused by lightning. Moreover, the company benefited from the global urea market and focused on serving the domestic market, with the remaining quantities exported to countries such as South Korea and Japan, contributing to exceptional revenue growth.

Viet Tri Chemical (HNX: HVT) also increased its profit, reporting a net profit of VND 24 billion, a 46% increase over the same period, thanks to higher selling prices for its main products, including liquid caustic soda, PAC, and chlorine-based products like bleach. Additionally, the company was able to control its cost of goods sold as some raw material input prices decreased and stabilized, such as aluminum powder and Na2CO3.

In contrast, LAS reported a profit of VND 51 billion, a 24% decrease compared to the previous year. While the sales volume of fertilizers surged by nearly 161%, the sharp rise in raw material prices pushed up the cost of goods sold. The company increased its selling price by only 12.5%, resulting in a significant decline in gross profit margin. Another member of the group, CSV, also reported a 6% decrease in profit to VND 63 billion, mainly due to higher selling and administrative expenses.

| Business performance of LAS |

Overall, most companies in the industry turned a profit, with several names achieving remarkable growth, such as PLC (VND 35 billion, 72 times higher than the previous year), VAF (VND 40 billion, triple the previous year), and VPS (VND 6.9 billion, nearly nine times higher). However, two units incurred losses: QBS and ABS. While QBS narrowed its loss from VND 42 billion to VND 14 billion, its revenue remained negligible. On the other hand, ABS unexpectedly suffered a significant loss of VND 270 billion (compared to a profit of VND 4.6 billion in the previous year) due to provisions for doubtful debts.

Regarding the cumulative picture, despite the divergence in the second quarter, most companies in the Vinachem group performed well due to a favorable first quarter. For instance, DDV tripled its profit to VND 275 billion, LAS earned VND 123 billion (a 3% increase), CSV made VND 115 billion (a 1% increase), and HVT realized a profit of VND 41 billion (a 50% increase). Similarly, other enterprises also painted a bright picture. However, ABS stood out as an exception, as the substantial loss in the second quarter led the company to end the first half with a net loss of VND 271 billion (compared to a profit of VND 6.8 billion in the previous year).

|

Business results for the first half of 2025 for the chemical and fertilizer sector

|

Fertilizer prices remain stable, while chemical prices recover in the third quarter

According to VCBS Securities Company’s forecast, urea prices in the third quarter are expected to slightly decrease or remain stable, following global price movements. However, the implementation of the VAT tax law on fertilizers is expected to motivate enterprises in the industry to reduce selling prices to enhance their competitiveness against imported fertilizers.

Regarding chemical products, after a decline in the second quarter, VCBS anticipates a rebound in caustic soda prices in the third quarter. This recovery is attributed to the expected increase in production volume in the aluminum industry (a significant consumer of caustic soda) in the latter half of the year, driven by policies stimulating industrial production and exports. The paper, textile, and basic chemical industries are projected to enter their peak season in the fourth quarter, boosting the demand for industrial caustic soda. Additionally, China’s stricter environmental regulations may lead to reduced operating capacity or temporary shutdowns of some plants, and planned maintenance at several facilities could disrupt supply.

Similarly, yellow phosphorus prices are also forecast to recover in line with global trends as the sales revenue of major markets improves. Moreover, the demand for fertilizers in India and Brazil is expected to rebound.

SSI Research: VN-Index Poised to Hit 1,800 Points, Short-Term Volatility Creates Opportunities

“SSI Research’s August strategy report presents a bullish long-term outlook, forecasting a sustainable upward trajectory for the VN-Index, targeting the 1,750-1,800 range by 2026. Short-term fluctuations caused by profit-taking provide opportune entry points for investors.”

The Power of Profits: How a 30.2% Rise in Earnings for Over 1000 Businesses is Impacting Stock Performance

The stock market is a vibrant and dynamic arena, where you’ll always find stocks that exhibit a disconnect between their stellar financial performance and their stagnant stock prices. These stocks often fly under the radar, belonging to the mid-cap or small-cap category, unnoticed by most investors.