On August 22, Petrovietnam Oil Corporation – JSC (PV Oil – OIL ticker) will finalize the list of shareholders registered to receive a 2.5% cash dividend for 2024 (01 share receives VND 250). With over 1 billion shares in circulation, PV Oil expects to spend VND 250 billion on this dividend. The payment is scheduled for September 11.

Vietnam National Oil and Gas Group (PVN) holds a controlling stake of 80.52% in PV Oil’s shareholder structure and will receive over VND 208 billion in dividends.

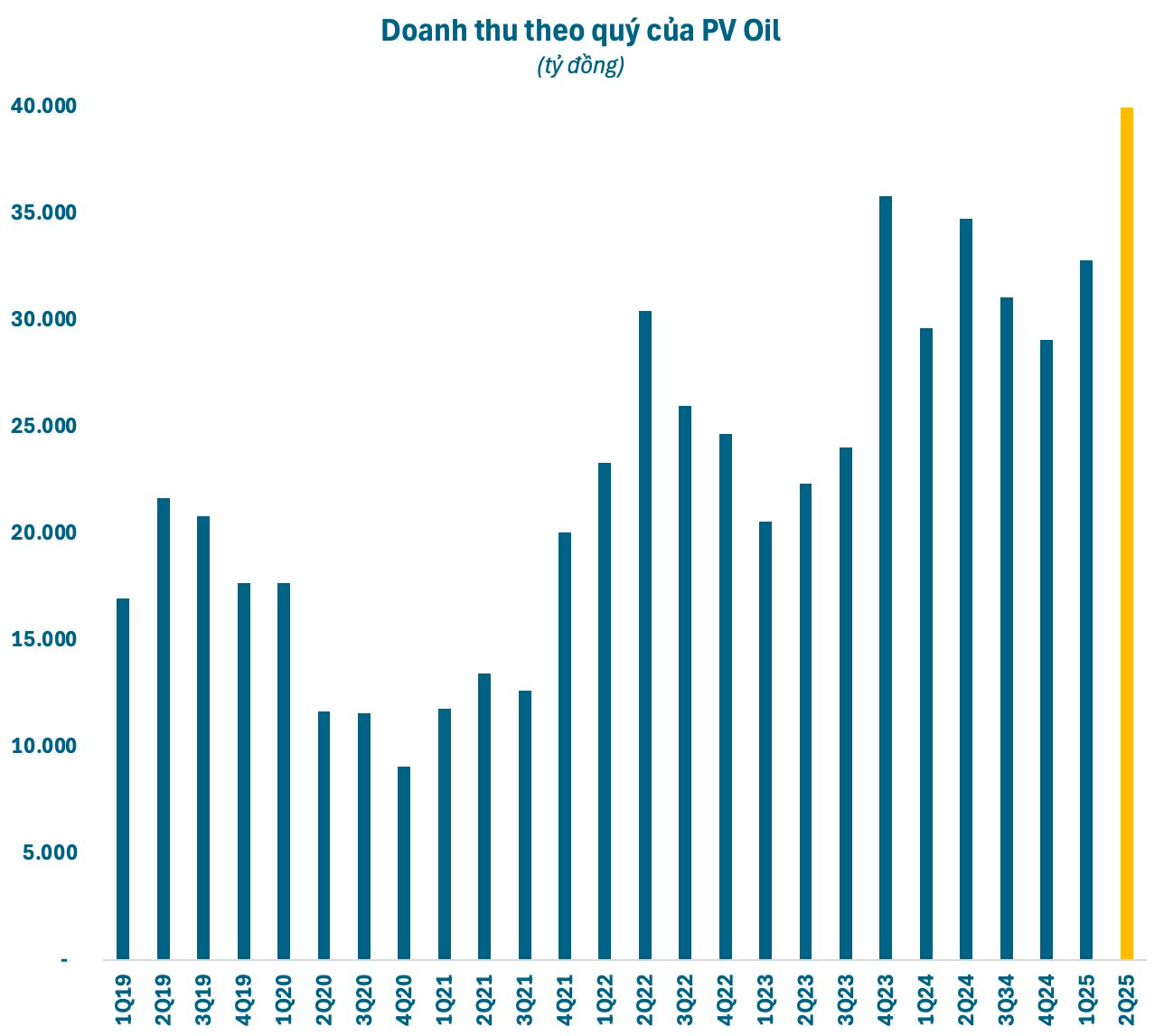

PV Oil is renowned for its consistent top-tier revenue performance on the stock exchange. In Q2 2025, PV Oil recorded impressive revenue of nearly VND 40,000 billion, a 15% increase from the previous year and an all-time high since its inception.

With nearly VND 40,000 billion in revenue, PV Oil ranks just behind Petrolimex (VND 77,054 billion) and Vingroup (VND 46,325 billion) while surpassing other prominent names such as Binh Son Refining and Petrochemical Joint Stock Company (VND 36,772 billion), The Gioi Di Dong (VND 37,620 billion), Hoa Phat (VND 36,286 billion), and Vietnam Airlines (VND 28,361 billion)…

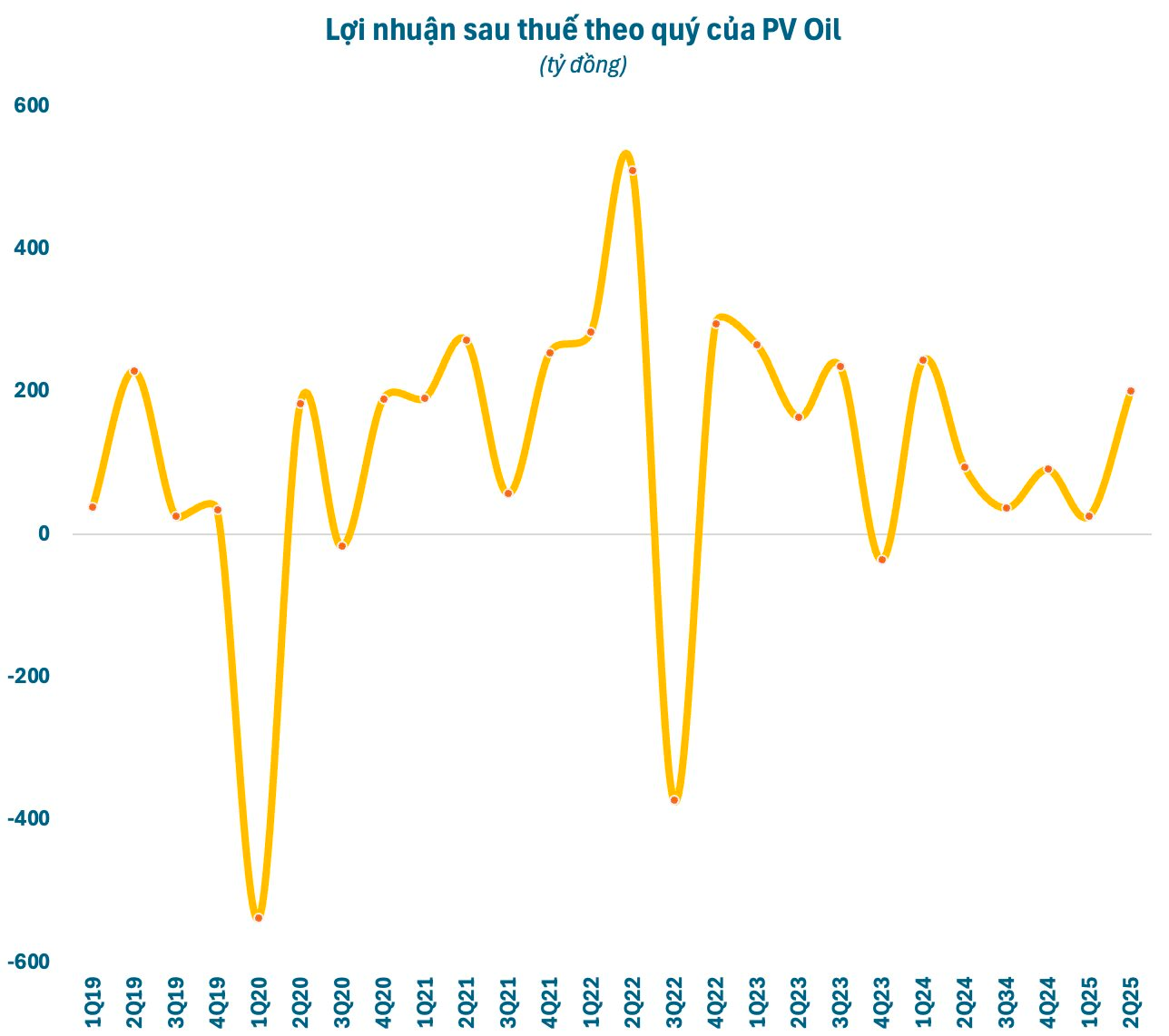

In Q2, financial revenue increased by 32% to VND 229 billion, while financial expenses decreased by 27% to over VND 103 billion. Selling expenses and administrative expenses also increased compared to the previous year. As a result, PV Oil’s after-tax profit surpassed VND 200 billion, more than doubling from the previous year and marking the highest profit in the last five quarters.

The company reported that the average Brent DTD oil price in Q2 2025 was $67.82/barrel, a 20% decrease from the same period last year ($84.97/barrel). The average prices of oil products during this period also decreased by 17-20%. However, the price trend changed with larger variations compared to the previous year. Domestically, the base price announced by the authorities showed an upward trend, contrary to the downward trend in the previous period.

Additionally, financial income increased significantly due to reduced foreign exchange losses, outpacing the increase in interest expenses. Thanks to these factors, PV Oil’s profitability improved considerably.

For the first six months of the year, PV Oil recorded a revenue of VND 72,700 billion, a 13% increase from the previous year. However, after-tax profit reached VND 209 billion, a 35% decrease from the first half of last year due to less favorable results in Q1. With these results, PV Oil has achieved nearly 75% of its revenue target and over 36% of its profit target for the full year.

On the stock exchange, OIL shares are currently trading at VND 12,700/share, a 5% increase since the beginning of the year. The market capitalization stands at over VND 13,000 billion.

A Former VIX Member Appointed as VTGS Chairman

On August 15th, VTG Securities JSC (VTGS) announced an unexpected change in leadership. The company relieved Ms. Nguyen Thi Thanh Thuy of her duties as Chairman and appointed Mr. Thai Hoang Long as the new Chairman. This decision takes effect immediately upon the company’s receipt of approval from the State Securities Commission regarding the change in legal representative.

“Digiworld Aims for Ambitious 15-25% Annual Compound Growth, Prepares to Venture Into a New Automotive Sector”

On August 13, HSC Securities Joint Stock Company, in collaboration with Digiworld Corporation, hosted an exclusive C2C (Connecting to Customers) workshop themed “Digiworld: A Journey of Market Shaping.”

“TDC Aims to Garner $30 Million from the Transfer of Lot E15 in the Hoa Loi Residential Area”

On July 21, 2025, Becamex TDC, a leading real estate company listed on the Ho Chi Minh Stock Exchange (HOSE: TDC), and Global Corp proudly announced the signing of a term sheet for the transfer of residential properties in Lot E15, located within the TDC Hoa Loi residential project in Binh Duong Ward, Ho Chi Minh City.

A Sunny Outlook for the Cement Industry: Profits Soar to 12-Quarter High

The cement industry has seen a remarkable turnaround in the second quarter of 2025, with a stunning recovery in profits. The sector reported a whopping 216 billion dong in earnings, a nearly three-year high and a massive 6.4 times increase compared to the same period last year. This impressive performance marks a significant shift for the industry, with many businesses turning their fortunes around and moving from losses to impressive gains.