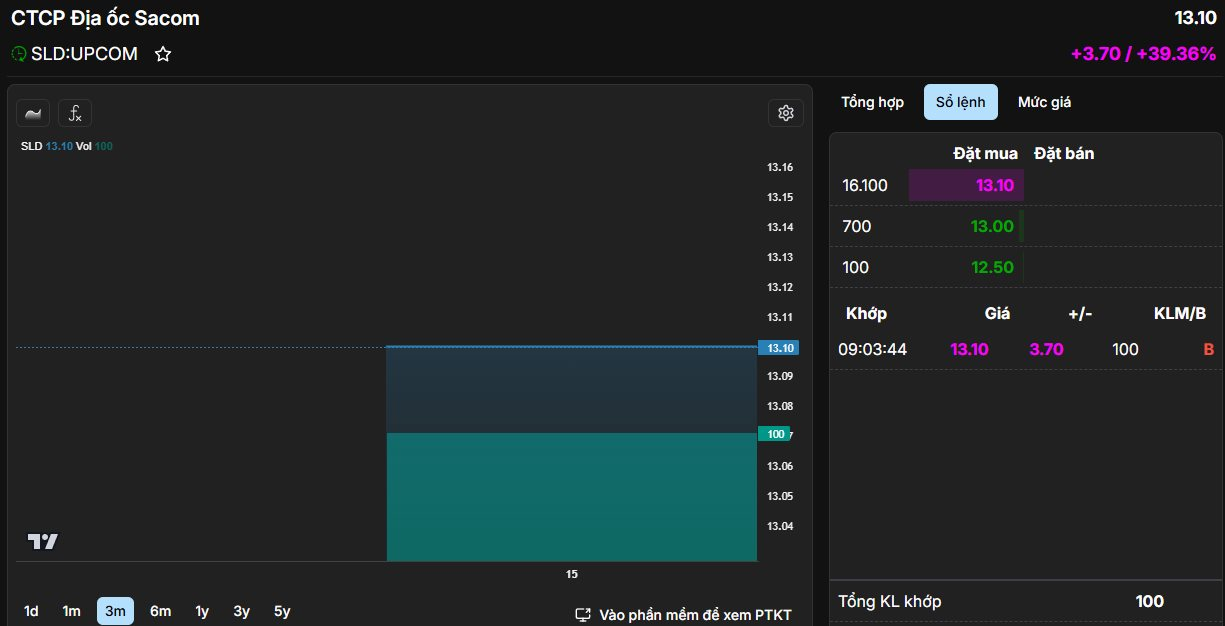

On August 15, approximately 78.6 million shares of SLD, belonging to Sacom Real Estate JSC (Samland), were officially traded on the Upcom market of the Hanoi Stock Exchange.

With an IPO price of VND 9,400/share, SLD’s market price quickly surged to its daily limit of nearly 40% to VND 13,100/share, with low liquidity of 100 matched orders. At this price, Samland’s market capitalization reached VND 1,029 billion.

Established in 2008, Samland is a member of SAM Holdings (SAM). The company has developed projects such as Samland Airport in Ho Chi Minh City, covering an area of 1,044m2, along with Samland Riverside, Samland Tan Van, KDC Samland Nhon Trach, Nhon Trach Residential Area, and the SG-HN Commercial, Service, and Office Center with apartments… In terms of ownership structure, SAM Holdings is the parent company, holding 85.71% of the charter capital.

Previously, Samland had planned to list on the Ho Chi Minh Stock Exchange (HoSE), but at the 2023 Annual General Meeting of Shareholders, the company sought and received approval to cancel this plan as it no longer aligned with Samland’s direction. Subsequently, the company shifted its focus to listing on UPCOM.

In reality, the financial performance of this real estate company has not been particularly promising. In the first half of 2025, Samland did not record any revenue. Financial income of over VND 5 billion helped the company achieve a pre-tax profit of nearly VND 380 million.

For the full year 2025, Samland targets revenue of VND 18.5 billion and pre-tax profit of VND 825 million. Thus, by the end of the first half of 2025, the company had achieved approximately 46% of its annual profit target.

As of June 30, 2025, total assets increased by 5% from the beginning of the year to VND 845 billion. Of this, long-term unfinished assets accounted for nearly VND 708 billion, or 84% of total assets. This item mainly comprises investments in two key projects: the Samland Nhon Trach Residential Area (Dong Nai) project with an area of 55.2 ha, for which VND 571 billion has been recorded, and the Samland Riverside project (Ho Chi Minh City) with an area of 1,798.4 m2, for which VND 136 billion has been recorded.

The company has invested over VND 22 billion in securities, all in DNP of DNP Holding, for which it has had to set aside nearly VND 2 billion in provisions. Samland still has accumulated losses of VND 46 billion, equivalent to 6% of its charter capital.

Foreign Investors Continue Their Selling Spree: Net Sell-Off Exceeds VND 3 Trillion on August 15

Let me know if you would like me to continue refining or expanding this title to better suit your needs.

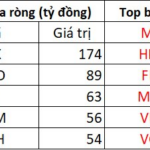

Foreign investors continued their selling spree on HPG stock, offloading a staggering 700 billion VND worth of shares. FPT and MBB also witnessed substantial sell-offs, with outflows of 509 billion VND and 500 billion VND, respectively.

Unleashing the Power of Words: Crafting a Captivating Headline

“Hải An Port Services Unveils Dividend Distribution with a Share Issue of Nearly 39 Million”

As of August 8th, Hai An Port Services has distributed 38.96 million bonus shares as dividend payments to its 14,293 shareholders. This move has successfully increased the company’s charter capital to VND 1,688.6 billion.