DS3 has recently been issued an administrative sanction by the State Securities Commission of Vietnam (SSC) on August 13, pertaining to violations in information disclosure.

According to the decision, DS3 failed to disclose information within the prescribed time frame on the SSC’s disclosure system, the HNX website, and the company’s website for several documents. These include the 2024 management report and board resolutions related to transaction policies with related parties from 2023 to 2025.

Additionally, the company was found to have disclosed incomplete information in its 2023 and 2024 management reports by not disclosing the relationship between Mr. Hoang Ha Phuong, Chairman of DS3‘s Board of Directors, and Nalico Construction Investment JSC. They also failed to fully disclose the board resolutions regarding transactions with related parties.

Mr. Hoang Ha Phuong, born in 1979, held several important positions before joining DS3, including Chairman of the Board of Directors of Nalico Construction Investment JSC, General Director of Tasco JSC, and General Director of Kosy JSC…

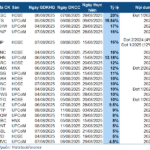

|

Due to multiple violations, DS3 was fined a total of VND 120 million. The company was given mitigating circumstances for cooperating with authorities during the handling process.

Improved financial performance, but still carrying forward losses

DS3 operates in the field of inland waterway management and maintenance, managing 426.5 km of waterways in Quang Ninh province, including routes from the Bach Dang River to Tho Xuan Port and channels to various islands. The company has a wide management scope with multiple operating stations across the region.

In Q2 2025, the company recorded a net profit of nearly VND 5.1 billion, almost 20 times higher than the same period last year, with a revenue increase of over 427% to over VND 32 billion. The gross profit margin improved to 27.3% from 23.5% in the previous year. DS3 attributed these positive results to their business restructuring and expansion of waterway operations, which is their core strength.

For the first half of 2025, revenue exceeded VND 40.5 billion, and net profit was over VND 5.7 billion, both the highest in the company’s semi-annual history. However, due to a record loss of over VND 36 billion in 2022, the company still carries forward a loss of over VND 11.6 billion as of June 30, 2025.

| DS3’s Semi-Annual Financial Performance over the Years |

Stock remains on warning status despite slight price recovery

DS3’s stock is currently on the Hanoi Stock Exchange’s (HNX) warning list. The share price stands at VND 6,300/share, an increase of over 8% in the last week and nearly 19% in the last three months, with an average trading volume of more than 4,600 shares per session. Despite the improved market price, the stock remains on warning status due to the accumulated loss.

| Price Movement of DS3 Shares Since the Beginning of 2025 |

– 09:28 17/08/2025

The Stock Code Soars Over 80% Despite the Company Being Repeatedly “Named and Shamed” and Fined.

“TST Joint Stock Company, a leading telecommunications technical services provider, has seen an impressive surge in its stock price (TST) on the UPCoM exchange. Over the past two months, TST stock has skyrocketed by over 80%, outperforming the market and catching the eye of investors.”

“HAGL Faces Sanctions for Failing to Disclose Bond-Related Information”

HAG failed to disclose information on the HNX system regarding the following documents: Report on the usage of proceeds from bond issuance for bonds with outstanding debts audited by qualified auditors in 2023 and 2024, as well as the semi-annual report for 2024.