According to statistics, 23 enterprises announced dividend closures for the week of August 18-22, with 17 enterprises paying dividends in cash. The highest rate was 60% and the lowest was 1%.

In addition, 5 enterprises paid stock dividends, and 1 enterprise issued additional shares.

Gelex Electric Joint Stock Company (GELEX Electric, code: GEE) has just approved the plan to temporarily pay the first-term 2025 dividend in cash at a rate of 30% of par value, equivalent to VND 3,000 per share. Accordingly, the record date of shareholders entitled to dividends is August 21, 2025. The expected payment time is September 10, 2025.

With 366 million circulating shares, the company will spend more than VND 1,000 billion to pay dividends to shareholders.

Gelex Electric’s current shareholder structure records the largest shareholder as Gelex Group Joint Stock Company (code GEX), holding 292.8 million shares, equivalent to nearly 80% of capital. As such, Gelex Group will receive nearly VND 900 billion in this dividend payout.

Ben Thanh Trading and Service Joint Stock Company (code: BTT) has just announced the plan to pay 2024 dividends in cash at a rate of 30%, equivalent to VND 3,000/share. With more than 13.5 million circulating shares, the total payment value amounts to VND 40.5 billion, the second highest in the company’s operating history, only after the record of 33.5% in 2023.

Accordingly, the ex-dividend date is August 21, 2025. The company will divide the dividend payment into two installments: the first on September 10 and the second on January 2, 2026, with each installment paying 15%. Benthanh Group, the largest shareholder of BTT, currently holding 41.39% of the shares, will receive more than VND 16.7 billion from this payout.

Hoang Huy Financial Services Investment Joint Stock Company (code: TCH) has just approved the plan to issue an additional 200.5 million shares to existing shareholders, equivalent to 30% of the circulating shares. The ex-rights date is August 20, and the record date is August 21. The subscription and payment period for the share purchase will take place from August 27 to September 15.

The goal is to raise more than VND 2,000 billion to implement two key real estate projects in Hai Phong.

Accordingly, the subscription ratio is 10:3 (for every 10 shares held, shareholders will be entitled to buy 3 new shares at a price of VND 10,000 per share – equivalent to only about 41% of the market price of the TCH shares traded at the closing session on August 7 (VND 24,150 per share).

Nam Tan Uyen Industrial Park Joint Stock Company (code: NTC) has just announced the resolution of the Board of Directors on paying 2024 dividends. Specifically, the company plans to pay 2024 dividends in cash at a rate of 60%, meaning that for each share held, shareholders will receive VND 6,000. The record date for implementing the right is August 25, 2025, and the payment date is September 25, 2025.

With nearly 24 million NTC shares circulating in the market, Nam Tan Uyen is expected to spend nearly VND 144 billion on this dividend payout.

As of June 30, 2025, Phuoc Hoa Rubber Joint Stock Company holds nearly 7.9 million NTC shares and is expected to receive more than VND 47.3 billion in dividends from Nam Tan Uyen.

In addition, Vietnam Rubber Industry Group Joint Stock Company also receives more than VND 19.4 billion in dividends by holding more than 4.9 million NTC shares; Saigon VRG Investment Joint Stock Company receives more than VND 28.7 billion by holding nearly 4.8 million shares.

On August 22, Vietnam Oil and Gas Joint Stock Company (PV OIL, code: OIL) will close the list of registered shareholders to receive 2024 cash dividends at a rate of 2.5% (1 share receives VND 250). With more than 1 billion circulating shares, PV OIL expects to spend VND 250 billion on this dividend payout. The expected payment date is September 11.

In PV OIL’s shareholder structure, Vietnam National Oil and Gas Group (PVN) is the parent company that directly holds 80.52% of the capital and will receive more than VND 208 billion in dividends.

Unleashing the Power of Words: Crafting a Captivating Headline

“Hải An Port Services Unveils Dividend Distribution with a Share Issue of Nearly 39 Million”

As of August 8th, Hai An Port Services has distributed 38.96 million bonus shares as dividend payments to its 14,293 shareholders. This move has successfully increased the company’s charter capital to VND 1,688.6 billion.

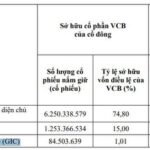

A Fund Sells Over 55 Million Vietcombank Shares

As of now, the foreign fund only holds over 84.5 million VCB shares, equivalent to 1.01% of Vietcombank’s charter capital.