Demanding American Partners: A Challenge for Vietnamese Businesses

In a talk show on the 20% retaliatory tariff imposed by the US, its impact, and solutions for businesses, Dr. Can Van Luc shared insights on how Vietnamese enterprises have been navigating the situation. While the tariff was announced in April, exports to the US remained unaffected until June. Businesses seized this opportunity to accelerate shipments before the official implementation of the tariff. However, the challenges began to surface in July, with American partners becoming more cautious in their orders and reducing purchase quantities.

Mr. Nguyen Manh Hung, Vice Chairman and CEO of Nafoods Group, confirmed the increasing difficulties and delays in exporting to the US market. Nafoods Group exports to 70 countries, with the US being a significant market, accounting for 22% of their sales, including fresh and processed fruits.

Dr. Can Van Luc stated that negotiations are ongoing to reduce the retaliatory tariff below 20%.

During the waiting period from mid-July until now, American buyers have been very cautious and have reduced their purchase volumes. We are negotiating with them to share the burden of the 20% tariff. However, these negotiations are proceeding slowly as both sides are being cautious

, Mr. Hung shared.

He further elaborated on the challenges, stating that if the 20% export tax on agricultural products is passed on to customers, consumers will not accept it. As a result, businesses have to share this cost, leading to reduced profit margins or even losses. Moreover, partners are delaying purchases and being cautious with their orders, forcing enterprises to accept inventory buildup and struggle with cash flow.

If the 20% tax rate for agricultural products is finalized, we can still accept it if there are supportive policies such as interest rate subsidies for export loans, reduced administrative procedures, and more support for production, preservation, and transportation conditions…

My concern is the long-term disadvantage for farmers. Fresh fruits imported from the US currently have an advantage over Vietnamese fruits exported to the US. If the import tax is 0%, the pressure on both Vietnamese farmers and enterprises will be immense, as domestic costs will increase. Cheaper American fruits will further challenge the competitiveness of local produce

, Mr. Hung added.

Similarly, the textile industry has experienced slower exports to the US since July. According to Mr. Pham Van Viet, Chairman of Viet Thang Jean Company, textile exports to the US have significantly declined this month.

Businesses that produced orders for the US market until June 20th were able to ship them before the anticipated tax imposition. New orders with new designs are being processed, while basic items are being reviewed due to the tax situation. It is anticipated that exports to the US market will only increase again in September.

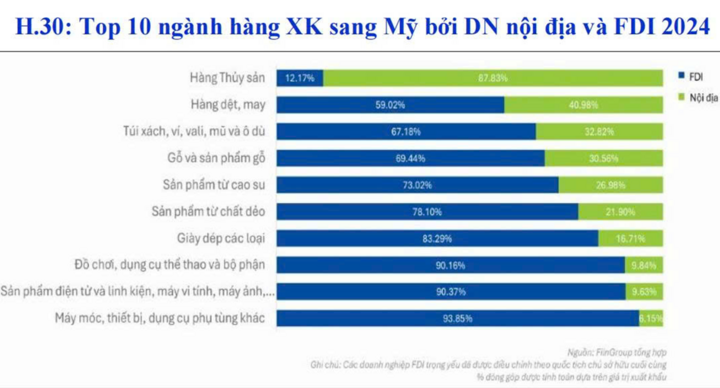

Top 10 export industries to the US market, with 87.83% of Vietnamese businesses directly participating in the seafood industry. (Source: BIDV Institute for Development Research)

Revitalizing Old Markets

Mr. Viet also shared that despite the decline in July, the textile industry has maintained growth in the first seven months of the year and is striving to achieve a double-digit increase.

One advantage is that the year-end shopping season is approaching. Moreover, the Vietnamese textile industry has exported to 107 countries and territories. To reduce dependence on the US market, we are shifting our focus to the EU, which offers more stability and sustainability. For Viet Thang Jean, the US market used to account for 30%, but since the beginning of this year, we have been pushing into the EU, South Korea, and other new markets, as well as increasing our domestic sales

, Mr. Viet stated.

Additionally, he highlighted the benefit of the 17 free trade agreements (FTAs) that Vietnam has signed. Markets like South Korea, Japan, and the EU have shown strong import performance.

For businesses that rely heavily on the US market, with 70-80% of their exports going there, we have proactively shared orders from other markets. We have decided not to focus on any single market given the current volatile situation

, Mr. Viet added.

In the agricultural sector, Mr. Phan Minh Thong, Chairman of Phuc Sinh Group, shared that Vietnam exports a wide range of products to the US, including seafood, coffee, pepper, and cashew nuts. Vietnam is also the largest exporter of pepper to the US.

When compared to Thailand and the Philippines, which have a 19% tax rate, and Brazil, Vietnam’s biggest competitor, with a 50% tax rate, Vietnam still has opportunities. However, associations, industries, and partners are continuing negotiations, aiming for a 0% tax rate on products that the US does not produce, such as pepper, cinnamon, and anise.

Vietnam exports significant volumes of pepper, coffee, and cashew nuts to the US annually.

In the furniture industry, Mr. Phung Quoc Man, Chairman of the Ho Chi Minh City Association of Fine Arts and Wood Processing (HAWA), shared that businesses have adapted to the situation. Negotiation results between the US and competing countries in the furniture industry have not shown significant differences over the years, remaining at 19-20%.

However, the Vietnamese furniture industry has several advantages. Vietnamese craftsmen possess superior skills, and Vietnamese furniture is renowned for its intricate designs, making it highly favored by American consumers.

Our partners affirmed that out of ten items in an American kitchen, four are from Vietnam

, Mr. Man said.

The HAWA Chairman also provided encouraging data, stating that in the first seven months of 2025, Vietnam’s furniture and wood product exports to the US reached 5.6 billion USD, an 11.6% increase compared to the same period last year. This indicates the effectiveness of businesses’ strategies in dealing with the tariff challenge.

In the long term, furniture businesses are focusing on market diversification, cost reduction to lower product prices, and revitalizing old markets.

The top five markets for Vietnamese wood products are the US, China, South Korea, Japan, and the EU. However, not all wood products are exported to these markets in the same proportions. For instance, Japan imports a large volume of wood chips and pellets, South Korea imports pellets, China imports wood chips and industrial wood, and the EU mainly imports outdoor products.

There is still room for other products in these markets, and we are working on exploiting and revitalizing them. I believe that with the results of the first seven months sustaining the momentum of 2024, we can hope to maintain our furniture and interior export revenue even after the tax rate is applied

, Mr. Man stated.

Notably, Mr. Man revealed a bold initiative by some enterprises to establish production facilities in the US, allowing them to tap into the market while circumventing trade barriers.

According to Dr. Can Van Luc, in the base scenario where the US imposes a 20% retaliatory tariff on Vietnamese exports, it is estimated that Vietnam will have to pay an additional 25-30 billion USD per year.

Negotiations are ongoing to achieve a lower tax rate, ideally between 15-17%.

In this context, Dr. Luc suggested that businesses should take advantage of supportive policies on taxes, fees, and interest rates and adopt technology in production to reduce costs and prices. Additionally, they should assess the impact on their industry and enterprise to proactively respond and develop plans to share the cost burden with partners.

Businesses should also seize opportunities arising from new-generation FTAs and enhanced relations with countries like the US, Japan, Australia, Malaysia, New Zealand, Singapore, and Thailand to diversify markets, partners, supply chains, and products.

Exporting Crab and Shrimp Hits a 10-Year Record High, Raking in Billions

In the first half of 2025 alone, crab and crayfish exports reached a staggering $173 million, surging by 38% compared to the same period in 2024. This remarkable achievement sets a new record high for the past decade, showcasing the thriving nature of the industry.

The Trump Administration’s Tariff Details on US Trading Partners

On August 7th, the new round of countervailing duties took effect for countries and territories trading with the United States.