According to VietstockFinance‘s statistics, 16 rubber companies listed on HOSE, HNX, and UPCoM have released their financial reports for Q2 2025, with a combined revenue of over 10.4 trillion VND, a 17% increase year-on-year. The industry’s net profit exceeded 2 trillion VND, a 51% surge, with the majority contributed by rubber extraction companies.

Shrinking Gross Profit Margin

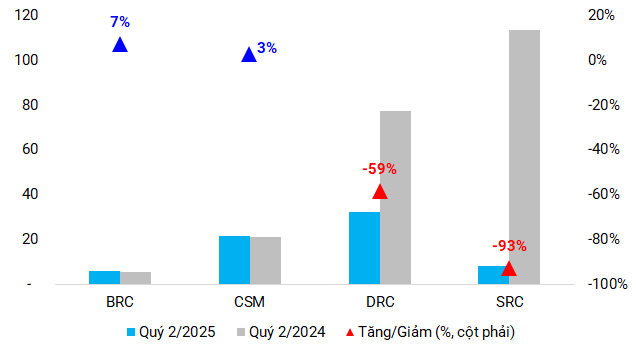

In Q2, many tire manufacturers experienced a significant decline in gross profit margin, clearly reflecting the impact of rising raw material costs. Despite maintaining growth or even setting new records in revenue, this group’s profits witnessed a considerable decrease compared to the previous year.

Leading in terms of revenue scale was Cao su Đà Nẵng (HOSE: DRC) with a slight 1% increase to reach 1.38 trillion VND. However, net profit dropped by 58% to 32 billion VND, as the gross profit margin fell to 11.2%, the lowest since 2018-2019. The company attributed this to the sharp rise in raw material prices.

Similarly, Cao su Sao Vàng (HOSE: SRC)‘s gross profit margin plummeted from 14.3% to 10.1%, the lowest in 13 years, despite a 14% rise in revenue to 376 billion VND. Without the extraordinary income from land lease transfers like last year, net profit plunged by 93% to 8.1 billion VND.

Công nghiệp Cao su Miền Nam (Casumina, HOSE: CSM) witnessed a 13% decline in revenue to 1.1 trillion VND. Although the gross profit margin decreased from 15.7% to 13.7%, profit slightly increased by 2.6% to 22 billion VND due to effective cost control.

|

Declining gross profit margins for SRC and DRC (in %)

Source: Author’s compilation

|

|

Tire manufacturers witness profit decline despite revenue growth (in billion VND)

Source: Author’s compilation

|

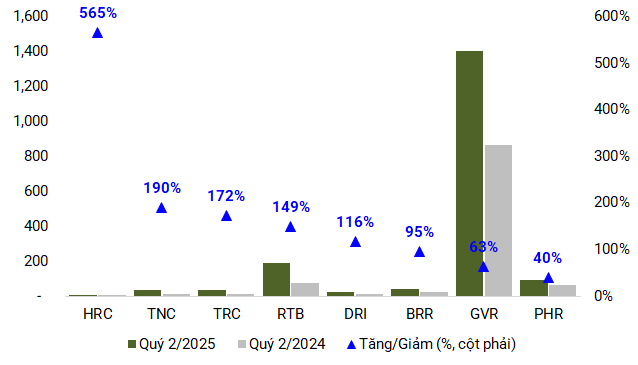

Rubber Extraction and Processing Companies Continue to Prosper

In contrast to the gloom of product manufacturers, rubber extraction and processing enterprises continued to benefit from rising prices. The average selling price in Q2 surpassed 50 million VND per ton, a 20% increase compared to the same period in 2024.

Tập đoàn Công nghiệp Cao su Việt Nam (HOSE: GVR) maintained its leading role, with a 30% revenue increase to 6 trillion VND and a net profit of 1.4 trillion VND, up by 63%. The gross profit margin was sustained at 27%, higher than the 25.3% in the previous year.

This performance was partly attributed to the outstanding results of several subsidiary units. Cao su Tây Ninh (HOSE: TRC) achieved a revenue of 132 billion VND and a profit of 35 billion VND, increases of 46% and 172%, respectively, thanks to improved output and selling prices in both Vietnam and Cambodia.

Cao su Tân Biên (UPCoM: RTB) broke records with a net profit of 191 billion VND, surging by 149%, driven by over 167 billion VND in non-recurring income from rubber garden clearance.

Cao su Hòa Bình (HOSE: HRC) witnessed a threefold surge in revenue, surpassing 60 billion VND, and a 565% leap in profit to 3.3 billion VND, attributed to an average selling price of 53 million VND per ton and the reversal of provisions.

Cao su Bà Rịa (UPCoM: BRR) posted a 95% jump in profit to 41 billion VND, fueled by selling prices and rubber garden clearance. Cao su Phước Hòa (HOSE: PHR) recorded a revenue of 368 billion VND and a profit of 90 billion VND, a 40% increase, thanks to improved gross profit margin and income from joint ventures, land compensation, and support for the Ho Chi Minh City-Thu Dau Mot-Chon Thanh Expressway project.

Several companies also seized market opportunities. Cao su Thống Nhất (HOSE: TNC) achieved its highest profit since 2021, at 32 billion VND, marking a 190% surge, with a gross profit margin climbing to 34% from 23.5% in the previous year.

|

Most rubber extraction companies witness profit increases compared to the previous year (in billion VND)

Source: Author’s compilation

|

Special Cases

Despite a decline in profit due to the absence of irregular income, Cao su Đồng Phú (HOSE: DPR) benefited from a 17% increase in output, surpassing 1,660 tons.

Cao su Đắk Lắk (UPCoM: DRI) witnessed an 81% surge in revenue from rubber sales to 113 billion VND, boosting profit by 116% to 21 billion VND. Meanwhile, Cao su Đắk Lắk (UPCoM: DRG) experienced a 22% decrease in revenue to 146 billion VND after excluding the results of its subsidiary, Đầu tư Cao su Đắk Lắk (UPCoM: DRI). However, net profit soared to a record high of 101 billion VND, attributed to the divestment of DRI capital, generating over 86 billion VND in income.

Cao su Sông Bé (UPCoM: SBR) reversed its losses to earn a profit of 4.2 billion VND, despite a sharp 69% drop in revenue, due to increased income from deposits and loans.

Vietcombank Securities (VCBS) predicts that rubber prices are likely to fluctuate within a narrow range in the coming months, as supply is expected to improve with several Southeast Asian countries entering the harvest season, while demand remains subdued. However, there are positive signs, such as the consecutive monthly growth in car sales in China and the increase in tire imports into the US, offering hopes for a recovery in consumption.

– 09:00 17/08/2025

The Ultimate Cash Cow: Unveiling the Financial Giant with a Stellar Performance that Rivals the Best

In Q2, the company reported a revenue of nearly VND 40 trillion, a 15% increase year-over-year, marking an all-time high since its inception.

A Sunny Outlook for the Cement Industry: Profits Soar to 12-Quarter High

The cement industry has seen a remarkable turnaround in the second quarter of 2025, with a stunning recovery in profits. The sector reported a whopping 216 billion dong in earnings, a nearly three-year high and a massive 6.4 times increase compared to the same period last year. This impressive performance marks a significant shift for the industry, with many businesses turning their fortunes around and moving from losses to impressive gains.