Vietnam Joint Stock Commercial Bank for Foreign Trade (VCBS) has announced changes to several senior leadership positions.

Specifically, Mr. Le Viet Ha will step down from his role as Deputy General Director to be appointed as a member of the VCBS Board of Directors.

Next, Ms. Bach Thi Thanh Ha, Head of Public Relations of Vietnam Joint Stock Commercial Bank for Foreign Trade (Vietcombank, code: VCB), was appointed as a member of the VCBS Board of Directors.

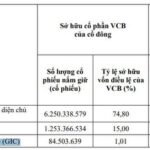

Both Mr. Le Viet Ha and Ms. Bach Thi Thanh Ha will hold their positions for the remaining term of the 2022 – 2027 tenure. Simultaneously, each of them is appointed as an authorized representative, representing 15% of Vietcombank’s capital contribution at VCBS from the date of appointment, August 14.

According to VCBS’s introduction, Mr. Le Viet Ha graduated in Finance and Banking from the Banking Academy and received a Bachelor of Laws from Hanoi Law University.

Ms. Bach Thi Thanh Ha, on the other hand, obtained a Master of Business Administration (MBA) in 2010 through a partnership program between the National University and the Solvay Brussels School of Economics and Management, Belgium.

Ms. Ha joined Vietcombank in 1995 and has extensive experience in credit, finance and accounting, and brand communications. She has held several key positions, including Head of Financial Management, Head of Finance and Accounting at Vietcombank’s Head Office and Member of the Board of Directors of the Financial Leasing Company, and Head of Public Relations at Vietcombank’s Head Office.

In addition to the changes in the Board of Directors, VCBS also witnessed a change in the role of the Supervisory Board members.

Specifically, Ms. Pham Thanh Huyen, Head of Vietcombank’s Operations Supervision, will no longer hold the position of VCBS Supervisory Board member for the 2022-2027 term. Her replacement is Ms. Pham Huyen Trang, Deputy Head of Vietcombank’s Operations Supervision, effective from August 14.

In another development, the VCBS Board of Directors has approved the 2025 business plan with a revenue of VND 1,669.29 billion and a brokerage market share ranking among the top 10 leading securities companies.

In the first half of 2025, VCBS recorded over VND 747 billion in revenue, down 7% compared to the same period last year, achieving 45% of the yearly plan.

Net profit for the first half was over VND 203 billion, down 29%. The explanation for this decrease is the impact of reduced liquidity and volatile market conditions on brokerage and proprietary trading activities.

In terms of market share, VCBS accounted for 2.89% in the first half, ranking among the top 10 leading securities companies in brokerage market share on the HoSE.

The Great Leadership Shuffle: VCBS Targets 1.67 Trillion in Revenue by 2025

On August 14th, VCBS – a prominent securities company affiliated with Vietnam’s Foreign Trade Joint-Stock Bank – announced significant changes to its key personnel in both the Board of Directors and the Supervisory Board. Just prior to this, the company unveiled ambitious plans for its 2025 business outlook, targeting a revenue of VND 1,669.29 billion and a top 10 brokerage market share.

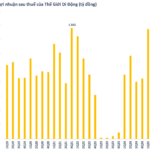

The Magic Formula to Boosting The Gioi Di Dong’s (MWG) Profit Margins

VCBS estimates that approximately 800 MWG stores will reach the end of their depreciation life this year, resulting in a significant cost saving of nearly VND 900 billion for the company and a positive boost to its profit margin.