M&A Deal for a “Golden Land” Plot: The Strategic Investors’ Game

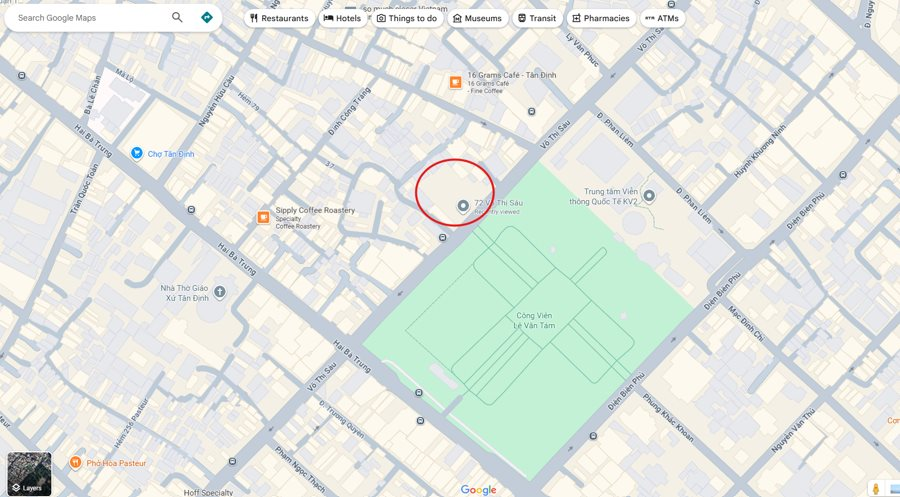

In mid-July 2025, UOA Vietnam Pte. Ltd., a subsidiary of Malaysia’s leading real estate group, UOA Group, announced the completion of its acquisition of VIAS Hong Ngoc Bao JSC. This move grants UOA full control over the target company’s core and sole asset: the development rights for a plot of land spanning over 2,000 sqm on Vo Thi Sau Street, Tan Dinh Ward, one of the few remaining prime locations in the heart of District 1, with approved planning indicators allowing for up to 22 floors.

UOA Vietnam Pte. Ltd. acquires prime land in District 1, Ho Chi Minh City

This M&A deal exemplifies a typical project acquisition, underscoring the keen interest of foreign investors in the scarce clean land funds remaining in the city’s core area. For the sellers, namely the shareholders related to VIAS Capital, this exit is considered a successful realization of profits from holding a high-value asset.

Site Plan of the Acquired Land

Unraveling UOA Group’s Financial Clout

UOA Group is a well-known player in the regional real estate market. Established in 1987, its parent company, United Overseas Australia Ltd, is dual-listed on the Australian Securities Exchange (ASX) and the Singapore Exchange (SGX). However, the heartbeat of the group lies with UOA Development Bhd, listed on Bursa Malaysia. With a market capitalization of approximately 4.2 billion Ringgit (nearly USD 900 million), it stands as one of Malaysia’s largest real estate companies.

In Vietnam, UOA has quietly made its mark through the development and collaboration in high-quality projects, reflecting a selective and long-term investment strategy. Their first foray into the market was with UOA Tower (District 7) , which also serves as their headquarters in the country. This Grade A office building is located in the Phu My Hung urban area and has been operationally stable. At The MarQ (District 1) , UOA partnered with Hongkong Land to develop a luxury residential project, showcasing their experience in working with prominent partners and understanding of the high-end segment.

The MarQ, a luxury residential project in District 1, Ho Chi Minh City

The group also collaborates with CapitaLand Development in the super complex project, Sycamore (in Binh Duong), spanning over 18.9 hectares. With its extensive experience and strong financial backing, UOA Group’s solo undertaking of this land acquisition deal signifies a new step in their expansion strategy within Vietnam.

UOA Group’s decision to invest a substantial sum is not arbitrary but rooted in a profound analysis of Ho Chi Minh City’s office rental market, which presents a confluence of favorable “time and location” factors.

Scarcity in the City Center

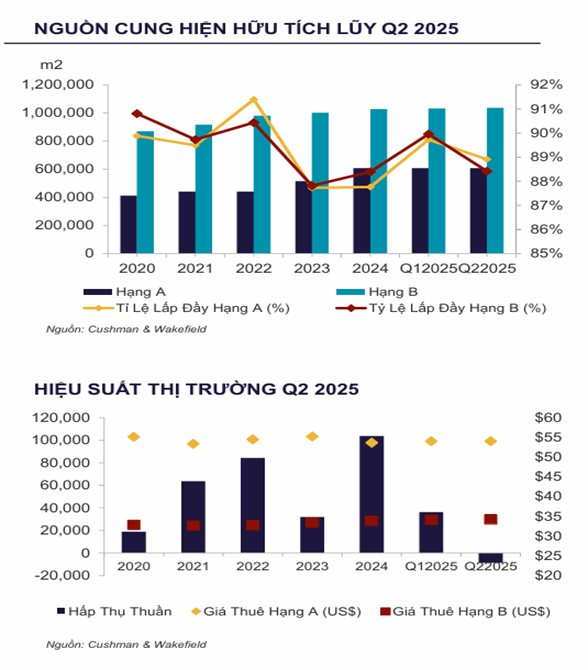

According to CBRE’s Q1 2025 report, Ho Chi Minh City’s office market saw no new supply during the quarter. The scarcity of quality spaces in the central business district (CBD – District 1) is becoming increasingly evident. Data from Cushman & Wakefield reveals that in the 2025-2027 period, the city center is expected to gain only about 103,559 sqm of rentable space, primarily from two highly anticipated projects: Marina Central Tower (approximately 67,600 sqm) and Lotus Tower (about 31,948 sqm).

This scarcity contrasts sharply with the more abundant supply in peripheral areas like Thu Duc City and District 7, which are projected to add nearly 160,000 sqm of new space. This supply-demand imbalance has driven up the value of the scarce remaining land plots in District 1.

Meanwhile, market demand stems from foreign-invested enterprises. CBRE’s report indicates that the Information Technology sector continues to lead in rental demand (accounting for 31% of transactions), followed by Finance/Banking/Insurance (16%). These sectors have stringent requirements for office quality.

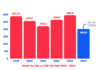

Demand Fueled by the Entry of ByteDance, Marvell Technology, and More

The Fly-to-Quality trend is unmistakable, with over 60% of transactions involving relocations aimed at upgrading to higher-quality buildings. Consequently, while vacancy rates for Grade A offices in the center have improved (dropping to 16.9% in Q1 2025 per CBRE), older buildings in the Grade B segment face heightened competition. Notably, rental rates have remained high and stable. As per market reports from Savills and Cushman & Wakefield, average rents for Grade A offices in Ho Chi Minh City’s central area fluctuate around USD 55-60 per sqm per month.

Despite economic challenges, rents show no deep downward trend due to the scarcity of supply, making this a compelling real estate investment for stable cash flow.

Demand for Quality Offices in Ho Chi Minh City

The Fly-to-Quality trend is evident in a series of large leasing transactions during 2024-2025, particularly from technology and multinational corporations. Notable examples include the leasing of Grade A+ space by tech giant ByteDance (China) at The Nexus (District 1) and the expansion of GSK Pharma at The Metropolitan (District 1).

Against this backdrop, UOA’s deal is a strategic masterstroke. Instead of competing in peripheral areas, they opted to acquire a legally secured land plot in the supply-starved city center to develop a Grade A product tailored to the high-end tenant segment driving the market.

A Rogue Bank Code: The Sudden Surge of Prop Trading in Vietnam’s Stock Market

The HoSE witnessed a notable trading session on Thursday, with foreign investors and securities companies taking center stage. While foreign investors displayed confidence in the market by snapping up stocks, securities companies offloaded a substantial amount, amounting to a net sell value of VND 621 billion. This contrasting behavior between the two key market players has left market participants intrigued, with many wondering what the future holds for Vietnam’s stock market.

Market Mayhem: Navigating the Storm

The VN-Index experienced vigorous tug-of-war action with above-average trading volume. The MACD indicator continues its upward trajectory, providing a buy signal and reinforcing the positive short-term outlook. However, intense fluctuations within the session are likely to persist as the index forges new peaks.

“The Making of HCMC’s Land Price Index for 2026 and Beyond: A Comprehensive Guide”

The Ho Chi Minh City Department of Agriculture and Environment has proposed maintaining the previously issued land prices in three localities (Ho Chi Minh City, Binh Duong, and Ba Ria-Vung Tau) and integrating them into a unified land price table applicable to Ho Chi Minh City from January 1, 2026, until the Ho Chi Minh City People’s Committee issues a new land price table as a replacement.