The Current Picture of Deposit Interest Rates

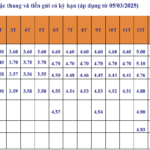

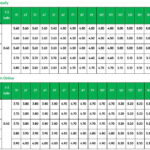

After a period of deposit interest rates surpassing the 6%/year threshold, since April 2025, this rate has almost “disappeared” from the market. Currently, the interest rate for the 12-month term fluctuates between 4.5% and 5.5%/year. Notably, the state-owned bank group (Big 4: BIDV, Vietcombank, Agribank, and VietinBank) offers lower interest rates for the 12-month term, ranging from 4.6% to 4.8%/year.

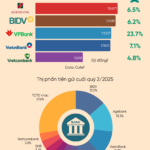

Despite the slowdown in the decline of deposit interest rates in June and only a few banks making adjustments, there has been a significant inflow of funds into banks, especially state-owned banks, which offer the lowest interest rates in the market.

Financial experts attribute this to the unexpected appeal and trust that people have in the banking system.

As of the end of June 2025, the Big 4 state-owned banks held over 50% of total customer deposits across 28 commercial banks, amounting to VND 7.4 quadrillion. Specifically, BIDV led with VND 2.05 quadrillion, followed by Agribank with nearly VND 2.04 quadrillion, VietinBank with VND 1.71 quadrillion, and Vietcombank with VND 1.59 quadrillion.

Private banks, despite offering slightly higher deposit interest rates than the Big 4, also witnessed significant increases in deposit balances in the first half of the year. Notably, MB increased by 10%, Sacombank by 10%, VPBank by a substantial 27%, ACB by 5.6%, SHB by 12%, and Techcombank by 2.3%. Although some joint-stock and digital banks have adjusted their interest rates upwards for longer-term deposits (18-24 months), most depositors still prefer shorter-term deposits (1-6 months) for their flexibility.

Reasons for the Inflow of Funds into Banks Despite Low Interest Rates

Explaining this phenomenon, a leader of a joint-stock commercial bank analyzed that despite the low savings rates, the average interest rates across all terms still ensure a positive real interest rate, i.e., higher than the inflation rate (CPI for the first six months reached 3.27%). This means that depositors not only preserve the principal value but also gain a practical yield.

Confidence in stable monetary policies and the safety of the banking system, coupled with the traditional savings habit of Vietnamese people, plays a dominant role.

Additionally, even when interest rates do not increase or only increase slightly, people still proactively deposit money due to a “defensive” mindset and the expectation of using capital for practical needs in the future.

Although deposits have increased significantly, the deposit growth rate is still considerably lower than the credit growth rate. According to the State Bank of Vietnam (SBV), as of July 29, total credit outstanding across the system increased by 9.8% compared to the end of 2024, while deposits only grew by approximately 8% as of the end of June.

Calculations by MB Securities Company (MBS) show that the credit growth rate is about 1.3-1.5 times higher than the capital mobilization growth rate. This gap is expected to widen and poses the biggest challenge for the banking system in the last months of 2025 and throughout 2026 if it aims to maintain high growth while keeping interest rates stable.

Liquidity pressure is forecasted to continue increasing, putting pressure on deposit interest rates, especially in private joint-stock commercial banks, to attract deposits and ensure capital sources for credit activities. In fact, there has been a slight upward trend in deposit interest rates in July and early August in some private banks such as TPBank, VPBank, and Eximbank.

However, the SBV has requested credit institutions to implement synchronous solutions to stabilize and strive to reduce deposit interest rates, creating room for lower lending rates. This, along with the expectation of the Federal Reserve cutting interest rates in the second half of 2025, could help narrow the VND-USD interest rate gap and enable the SBV to maintain a low-interest rate environment.

According to MBS, the 12-month term deposit interest rate of private joint-stock commercial banks may slightly decrease by 2 basis points to 4.7% by the end of 2025.

Profitable Banks: A Tale of Financial Success

The financial reports of 27 listed commercial banks for the second quarter and first half of 2025 have been released. The cumulative pre-tax profit for the first six months of the year rose by over 16% compared to the same period last year, reaching an impressive figure of nearly VND 172 trillion.

Latest SHB Bank Interest Rates for August 2025: 36-Month Term Deposits Offer the Highest Interest

“As of August 2025, Saigon-Hanoi Commercial Joint Stock Bank (SHB) is offering a competitive interest rate of 5.8% per annum for individual customers who opt for online deposits of 36 months or more. This market-leading rate presents a compelling opportunity for those looking to maximize their savings and watch their money grow.”

The Only Private Bank Attracting More Deposits Than VietinBank and Vietcombank This Year

In Q2 of 2025, both Agribank and BIDV surpassed the remarkable milestone of 2 quadrillion Vietnamese dong in deposits for the first time in their history. This achievement is even more impressive when considering that two private banks also crossed the 600-trillion-dong mark during the same period.

Latest HDBank Interest Rates for August 2025: Which Term Deposit Offers the Best Returns?

As of early August 2025, HDBank offers a maximum interest rate of 6.1% per annum for regular deposits. This competitive rate positions HDBank as a leading financial institution, offering customers an attractive opportunity to grow their savings. With this rate, customers can rest assured that their funds are not only secure but also working hard to deliver substantial returns.