The USD Index (DXY) closed on August 15, slipping 0.43 points from the previous week’s close to 97.84.

The greenback’s weakness stemmed primarily from two factors. Firstly, US inflation continued to cool, with the CPI for July 2025 rising just 0.2% month-over-month, following a 0.3% increase in June. This significantly reduced expectations for a hawkish Fed stance. Secondly, the US-China trade truce was extended, helping stabilize global trade prospects and prompting capital shifts towards equities and commodities rather than the USD.

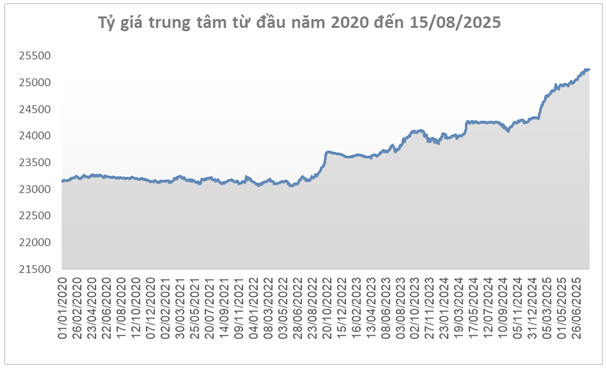

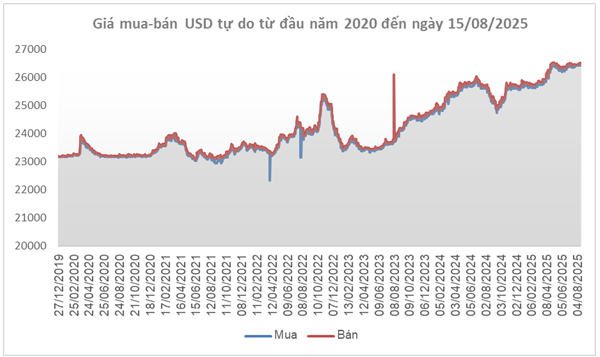

Source: SBV

|

In the domestic market, the State Bank of Vietnam set the daily reference exchange rate for August 15 at 23,249 VND per USD, a rise of 21 VND from the previous week. With a +/- 5% fluctuation band, the ceiling and floor rates applied by commercial banks are 23,987 VND and 26,511 VND per USD, respectively.

The buying and selling rates at the State Bank of Vietnam’s Foreign Exchange Management Agency were listed at 24,037 VND and 26,461 VND per USD, respectively, up 20 and 22 VND from the previous week.

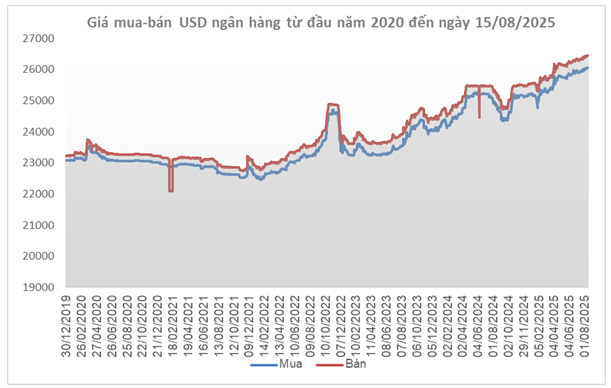

Source: VCB

|

Vietcombank’s listed rates for August 15 stood at 26,060 VND (buying) and 26,450 VND (selling) per USD, marking a 50 VND increase in both directions.

Source: VietstockFinance

|

In the free market, the USD rose by 30 VND on the buying side and 25 VND on the selling side, trading around 26,450 VND to 26,505 VND per USD.

– 17:52 17/08/2025

The Only Private Bank Attracting More Deposits Than VietinBank and Vietcombank This Year

In Q2 of 2025, both Agribank and BIDV surpassed the remarkable milestone of 2 quadrillion Vietnamese dong in deposits for the first time in their history. This achievement is even more impressive when considering that two private banks also crossed the 600-trillion-dong mark during the same period.