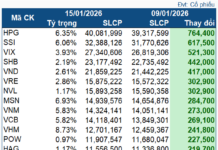

VinaCapital Investment Management JSC recently reported on the results of its transactions involving the purchase of KDH shares of Khang Dien House Trading and Investment Joint Stock Company.

According to the report, from July 16, 2025, to August 14, 2025, VinaCapital’s Market Access Stock Fund was only able to successfully purchase 141,000 shares out of the previously registered amount of 500,000 shares.

Following this transaction, the fund’s holdings in KDH shares increased from over 1.6 million to over 1.9 million shares (including dividend payments in shares during the registered trading period), raising its ownership stake from 0.162% to 0.1738% of Khang Dien House’s capital.

Illustrative image

During the same trading period, the VinaCapital Modern Economy Stock Investment Fund also purchased 800,500 KDH shares out of the planned 1 million shares.

Prior to the transaction, this fund held over 1.6 million KDH shares, representing a 0.1622% ownership stake. After the transaction and including dividend payments in shares during the registered trading period, the fund’s holdings increased to over 2.6 million shares, equivalent to a 0.2327% stake in Khang Dien House’s capital.

The reason given for the two VinaCapital funds not completing their planned share purchases was that market conditions were not suitable.

Meanwhile, another VinaCapital member fund, the Hung Thinh Stock Investment Fund, has registered to purchase 850,000 KDH shares to restructure its investment portfolio. The transaction is expected to take place via matching and/or negotiated orders from August 12, 2025, to September 10, 2025.

If successful, the fund will increase its holdings in KDH shares from 616,410 to nearly 1.5 million, raising its ownership stake from 0.0549% to 0.1307% of Khang Dien House’s capital.

On the other hand, Mr. Huynh Chi Tam, Secretary of the Board of Directors and authorized person for information disclosure of Khang Dien House, has registered to sell 60,000 KDH shares for personal financial needs. The transaction is expected to take place via matching orders from August 7, 2025, to September 5, 2025.

Prior to the transaction, Mr. Tam held 358,400 KDH shares, representing a 0.032% ownership stake in Khang Dien House. If the sale is successful, his holdings will decrease to 298,400 shares, reducing his ownership stake to 0.027%.

VinaCapital: Three Key Sectors to Benefit from Vietnam’s Policy Tailwinds

Vietnam is embarking on an era of Doi Moi 2.0, a rapid transformation from policy statements to tangible outcomes. This is evidenced by the 34 laws passed in June 2025, alongside extensive administrative reforms.