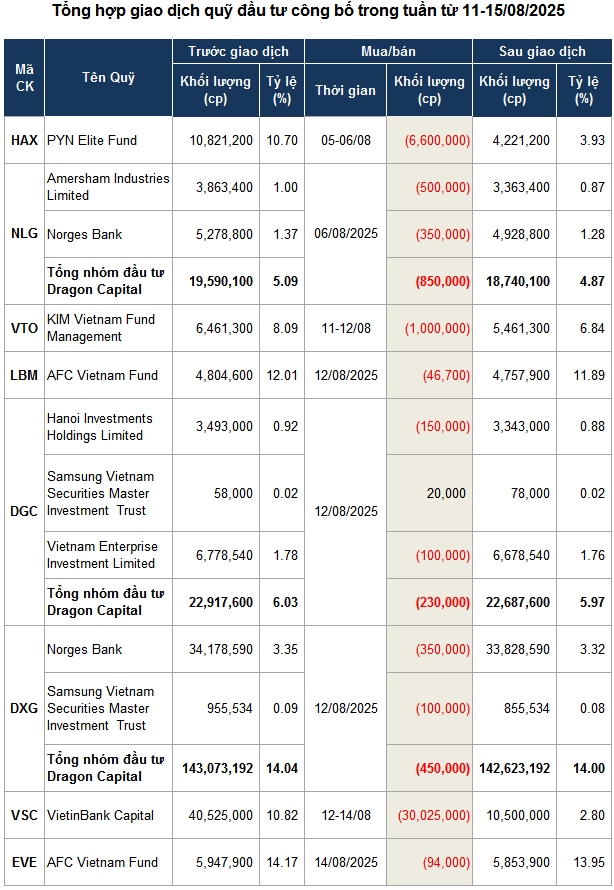

The spotlight is on VietinBank Capital as the fund sold over 30 million VSC shares (Vietnam Container Joint Stock Company) in two sessions on August 12 and 14, coinciding with the stock’s consecutive ceiling price sessions.

At the closing ceiling price, VietinBank Capital is estimated to have pocketed around VND 890 billion, thereby reducing its ownership from 10.82% to 2.8% (10.5 million shares) and is no longer a major shareholder in VSC.

This move follows a series of previous divestments, with the fund selling 17.5 million shares (approximately VND 357.5 billion) on July 25, and another 10.1 million shares (VND 232 billion) on July 29. In total, VietinBank Capital has sold more than 57.6 million VSC shares in less than a month, reaping approximately VND 1,500 billion and reducing its holding from 19% (as of February 2025) to below 3%.

In the market, VSC entered a burst of momentum starting August 11. In just five sessions, the stock surged nearly 35%, including four consecutive ceiling price sessions (August 12-15). At the close of August 15, VSC reached VND 33,850 per share, the highest since its listing.

| VSC stock price movement from the beginning of 2010 to the session on August 15, 2025 |

Dragon Capital also took profits by selling 230,000 DGC shares (Duc Giang Chemical Group Joint Stock Company) and 450,000 DXG shares (Dat Xanh Group Joint Stock Company) on August 12, earning approximately VND 24 billion and VND 10 billion, respectively.

| DGC stock price movement from the beginning of 2024 to the session on August 15, 2025 |

Following these transactions, Dragon Capital’s ownership in DGC decreased to 5.97% (22.7 million shares), and in DXG to below 14% (142.6 million shares).

| DXG stock price movement from the beginning of 2024 to the session on August 15, 2025 |

In the market, DGC and DXG stock prices have recovered strongly after the tariff shock earlier in April. DXG, in particular, rose to its highest level in more than a year, prompting increased profit-taking sentiment.

Source: VietstockFinance

|

– 07:28 17/08/2025

Dragon Capital: After a Strong Rally, Sensitivity to Negative Factors May Increase

Overall, Dragon Capital maintains a positive outlook. The firm believes that the recent setbacks are only temporary and that the economy will rebound in the coming months. With a strong foundation and positive fundamentals, the future looks bright, and Dragon Capital is confident in the potential for growth and success.

Dragon Capital Trims Its Stake in The Gioi Di Dong to Below 6%

Dragon Capital, a prominent foreign investment fund, has recently sold off nearly 1.5 million MWG shares, reducing their ownership stake to 5.9345% in The Gioi Di Dong, one of the leading mobile companies in the region.

Insider Trading: PET Leaders’ Strategic Exit as Share Prices Soar, Welcoming HDCapital as a Major Investor.

Recent developments at the Joint Stock Petroleum Services Corporation (Petrosetco, HOSE: PET) have caught the attention of investors. Five key leaders at the company have registered to sell their entire stock holdings, coinciding with the share price returning to a three-year high. On the flip side, HDCapital has emerged as a significant shareholder, acquiring 15.3 million PET shares on July 28.