STOCK MARKET REVIEW FOR THE WEEK OF 08/11/2025 – 08/15/2025

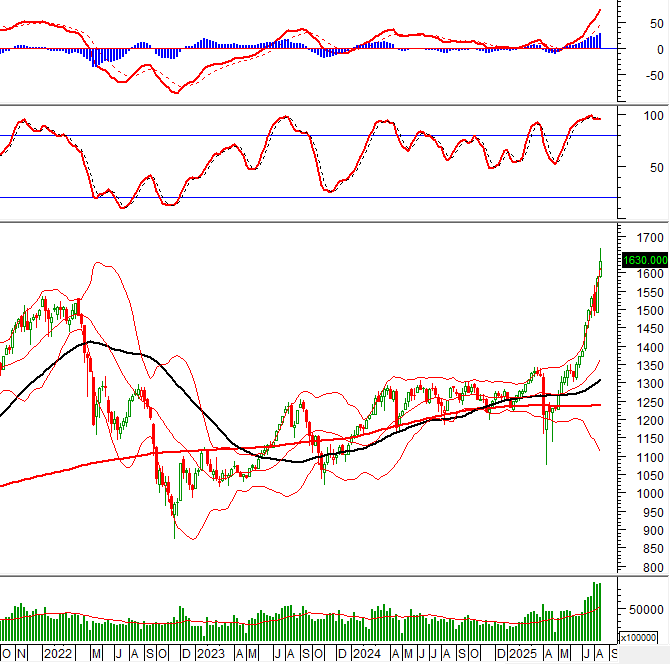

During the week of August 11-15, 2025, the VN-Index continued to reach new highs, with trading volume maintained at a high level above the 20-week average. Positive prospects are still being consolidated as the MACD indicator continues to rise and widen the gap with the Signal line since giving a buy signal in May 2025. However, the index narrowed its gains somewhat as the Stochastic Oscillator maintained a sell signal in the overbought region, indicating the presence of short-term volatility risks.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Big Black Candle pattern appears

In the trading session on August 15, 2025, the VN-Index declined and formed a Big Black Candle pattern, accompanied by an increase in trading volume that exceeded the 20-session average, indicating investors’ cautious sentiment.

Additionally, the Stochastic Oscillator has given a sell signal in the overbought region. If this indicator continues to weaken and falls out of this region in the upcoming sessions, there could be a risk of a short-term correction.

However, the index reached a new 52-week high, and the MACD indicator consistently created higher peaks and troughs (Higher High, Higher Low). This suggests that positive prospects in the medium term remain.

HNX-Index – Stochastic Oscillator has given a sell signal

On August 15, 2025, the HNX-Index reversed its upward trend and declined after seven consecutive gaining sessions, with trading volume increasing and surpassing the 20-session average, reflecting investors’ pessimistic sentiment.

Currently, the Stochastic Oscillator has given a sell signal in the overbought region. If this indicator continues to weaken and falls out of this region, there could be a risk of a short-term decline in the upcoming sessions.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index indicator for the VN-Index is currently above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will diminish.

Foreign Capital Flow Variation: Foreign investors continued to sell off in the trading session on August 15, 2025. If foreign investors maintain this action in the coming sessions, the situation will become even more pessimistic.

Technical Analysis Department, Vietstock Consulting

Dragon Capital: After a Strong Rally, Sensitivity to Negative Factors May Increase

Overall, Dragon Capital maintains a positive outlook. The firm believes that the recent setbacks are only temporary and that the economy will rebound in the coming months. With a strong foundation and positive fundamentals, the future looks bright, and Dragon Capital is confident in the potential for growth and success.

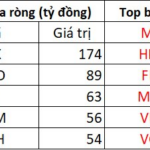

Foreign Investors Continue Their Selling Spree: Net Sell-Off Exceeds VND 3 Trillion on August 15

Let me know if you would like me to continue refining or expanding this title to better suit your needs.

Foreign investors continued their selling spree on HPG stock, offloading a staggering 700 billion VND worth of shares. FPT and MBB also witnessed substantial sell-offs, with outflows of 509 billion VND and 500 billion VND, respectively.