The Vietnamese stock market witnessed a positive week with impressive gains and robust liquidity. The VN-Index closed the week with a significant increase of 45.05 points (+2.84%) to 1,630 points, marking four sessions of gains and only one session of losses. Trading liquidity broke new records, with a total weekly transaction value of approximately VND258.8 trillion (an average of VND51.8 trillion per session). The session on August 15th experienced the strongest volatility in the past two weeks, with the VN-Index dropping 10.69 points due to profit-taking pressure on large-cap stocks.

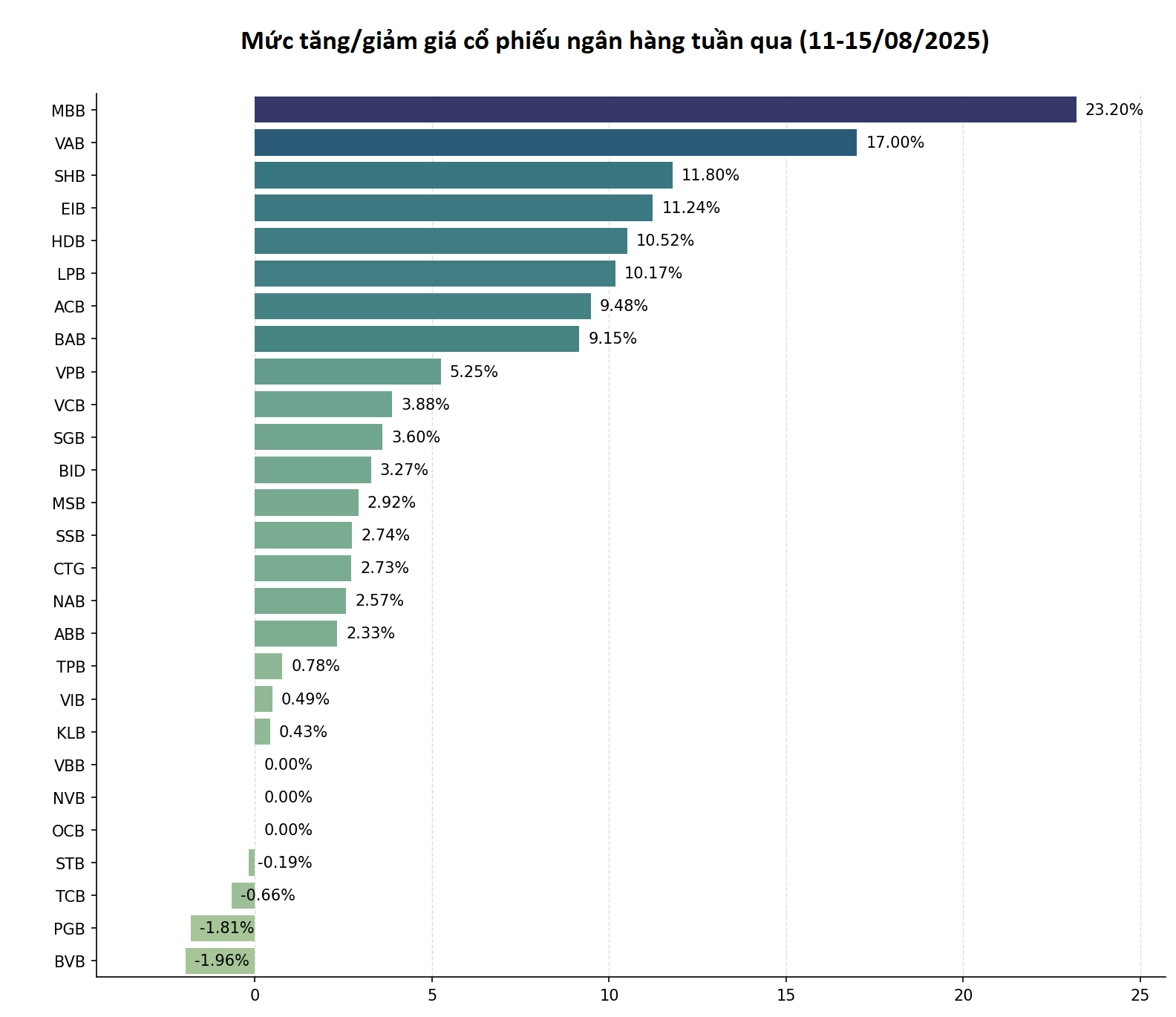

Weekly data revealed a near-unanimous upward trend among banking stocks. Several codes surged by over 10%, including MBB (+23.20%), VAB (+17.00%), SHB (+11.80%), EIB (+11.24%), HDB (+10.52%), and LPB (+10.17%). Other codes also witnessed increases close to the 10% threshold, such as ACB (+9.48%) and BAB (+9.15%).

August 14th marked a breakthrough session, with banking stocks receiving mandatory transfers surging simultaneously. HDB (HDBank), VPB (VPBank), and MBB hit the ceiling, while VCB rose by over 4.3%.

This week, the State Bank of Vietnam issued Circular No. 23/2025/TT-NHNN, which will take effect from October 1, 2025. The circular reduces by 50% the mandatory reserve ratio for credit institutions receiving mandatory transfers and support units as per the approved plan. Banks related to this move, including Vietcombank, HDBank, MB, and VPBank, are expected to benefit from this new regulation.

Liquidity in banking stocks remained high, with the total transaction value of matched orders for 27 banks in the week of August 11-15, 2025, reaching VND66,377 billion, a 2.85% increase compared to the previous week.

As banking stocks rallied, foreign investors offloaded many codes, especially those that witnessed the strongest gains. For instance, foreign investors sold a net amount of over VND600 billion of MBB shares as the code surged by more than 23% during the week.

Additionally, they net sold over VND360 billion of VCB (Vietcombank) shares, VND200 billion of CTG (VietinBank) shares, and VND100 billion of SHB shares, among others.

Recently, banks have also been consecutively distributing dividends or finalizing shareholder lists to seek opinions on important issues.

Notably, Military Commercial Joint Stock Bank (MB – Code: MBB) finalized its shareholder list on August 14th to pay dividends in both stocks (32% ratio) and cash (3% ratio).

Orient Commercial Joint Stock Bank (OCB – Code: OCB) also finalized its shareholder list on August 11, 2025, to issue nearly 197.3 million shares to increase charter capital from equity sources with an issuance ratio of 8% (shareholders owning 100 shares will receive 8 new shares).

Vietnam Asia Commercial Joint Stock Bank (VietABank – Code: VAB) finalized its shareholder list on August 15th to issue additional shares to increase charter capital from equity sources. Accordingly, VietABank will issue over 276.4 million shares to existing shareholders at a ratio of 100:51.19, meaning that for every 100 rights, shareholders will receive 51.19 new shares.

Saigon Commercial Joint Stock Bank (SHB) announced that it would finalize its shareholder list on August 19th to pay dividends in stocks at a ratio of 13%.

The Stock Market is Extending its Trading Hours: A Game-changer for Investors?

“Allowing investors to trade through the lunch break would present both opportunities and challenges for the Vietnamese stock market. T+0 could be a game-changer, but it’s a double-edged sword.”

“Vietstock Weekly: Shaking Things Up at the Summit”

The VN-Index reached new heights last week, with trading volumes maintained above the 20-week average. The positive outlook is reinforced by the MACD indicator, which continues to rise and diverge from the Signal line since its buy signal in May 2025. However, the index’s slight pullback amid the Stochastic Oscillator’s sell signal in the overbought territory indicates the presence of short-term volatility risks.

Dragon Capital: After a Strong Rally, Sensitivity to Negative Factors May Increase

Overall, Dragon Capital maintains a positive outlook. The firm believes that the recent setbacks are only temporary and that the economy will rebound in the coming months. With a strong foundation and positive fundamentals, the future looks bright, and Dragon Capital is confident in the potential for growth and success.