Illustration

What is Bad Debt?

Bad debt, also known as Non-Performing Loan (NPL), refers to debts that borrowers are unable to repay on time, specifically those that are overdue for more than 90 days from the first due date. According to the State Bank of Vietnam (SBV), bad debt is not just about late payments but also includes loans with a high risk of capital loss, affecting the bank’s ability to recover the funds.

In Vietnam, bad debt has become a pressing issue that concerns both regulatory authorities and credit institutions (CIs). According to reports from the SBV, the ratio of on-balance-sheet bad debt in the banking system has increased to around 4-5% in recent years, mainly due to the impact of the COVID-19 pandemic and the global economic downturn. Banks have to make provisions for these bad debts, leading to reduced profits and limited ability to grant new loans.

The National Credit Information Center (CIC) – a unit under the SBV – is responsible for storing and managing the entire credit history of individuals and enterprises. You can access the CIC to inquire about your credit information for free, helping you understand your debt situation. Bad debt is not only a financial burden but also impacts your credit score, making it difficult to access low-interest loans from commercial banks. In the context of high inflation and deposit interest rates as they are now, understanding bad debt helps individuals and businesses plan their finances more sustainably and avoid the risk of bankruptcy or losing collateral.

Classification of Bad Debt

According to Circular No. 02/2013/TT-NHNN (amended and supplemented), the CIC classifies debt into 5 groups based on overdue periods and recoverability. Groups 3 to 5 are considered bad debts, with increasing levels of risk.

Below is a detailed breakdown of these groups:

| Group | Group Name | Overdue Period | Loan Consideration Period |

|---|---|---|---|

| Group 1 | Standard Debt | Up to 9 days | Immediate |

| Group 2 | Debt for Attention | 10 – 29 days | After 12 months |

| Group 3 | Substandard Debt | 30 – 89 days | After 5 years |

| Group 4 | Doubtful Debt | 90 – 179 days | After 5 years |

| Group 5 | Loss Debt | 180 days or more | After 5 years |

- Group 1 (Standard Debt): Includes loans that are still within the grace period or overdue for no more than 9 days, with an assessment from the bank that the full principal and interest can be recovered. This is the ideal group, helping to maintain a good credit score.

- Group 2 (Debt for Attention): Loans overdue for 10 to 90 days, or restructured for the first time but still within the grace period. This group serves as a warning sign, requiring borrowers to monitor their debt closely to prevent it from turning into bad debt.

- Group 3 (Substandard Debt): Loans overdue for 30-89 days, or restructured for the first time with an overdue period of less than 29 days, including those granted interest relief due to financial difficulties. This is the first level of bad debt, impacting the ability to obtain new loans for the next 5 years.

- Group 4 (Doubtful Debt): Loans overdue for 90-179 days, or restructured for the first time with an overdue period of 30-90 days. The bank begins to doubt the recoverability and usually takes stronger measures such as debt enforcement.

- Group 5 (Loss Debt): Loans overdue for more than 180 days, or restructured multiple times and still overdue. This is the most severe level, potentially leading to a total loss of capital and even legal proceedings.

This classification helps banks manage risk effectively and also warns borrowers about their financial situation.

Causes of Bad Debt

Bad debt often stems from shortcomings in personal or corporate financial management, coupled with external factors. Some of the main causes include:

First, late credit card payments or failure to pay the minimum required amount. For example, if you only pay a small portion instead of the full balance, penalty interest will accumulate quickly, pushing the debt into the bad debt group.

Second, failure to pay penalty fees for late loan payments. Many consumer or unsecured loan borrowers ignore these small fees, but they can multiply over time, especially in a high-interest-rate environment.

Third, loss of repayment ability due to unexpected events such as job loss, illness, or economic downturns. Overdrafts and installment purchases are also prone to this situation if income decreases.

Lastly, legal disputes, such as contract disputes or bankruptcy, may prevent borrowers from repaying their debts.

According to statistics from the CIC, about 30% of bad debts come from small and medium-sized enterprises due to poor management. Regardless of the cause, bad debt has serious consequences, including foreclosure of collateral, a decrease in credit score, and difficulties in accessing capital in the future.

3 Fastest Ways to Check Bad Debt

Checking for bad debt is an important step for both banks and individuals or businesses. For banks, according to SBV regulations, they should only grant credit to customers with a clean history to avoid the risk of capital loss. Inquiring through the CIC helps banks make accurate assessments and ensure the safety of the system.

For borrowers, in the context of economic difficulties, bad debt can disrupt production and business activities. Regular checks help keep track of debt situations and allow for timely solutions such as debt restructuring or finding alternative sources of capital. Without checking, you may suddenly be denied a loan, leading to missed business opportunities or emergency expenses.

Moreover, checking for bad debt helps individuals and businesses choose appropriate financial solutions, such as borrowing from banks at lower interest rates instead of resorting to more expensive sources of capital. In the long run, maintaining a good credit history increases the chance of accessing preferential financial products, supporting personal economic development.

Checking through the CIC website

Step 1: Visit https://cic.gov.vn/#/register and fill in your information: full name, date of birth, phone number, email, ID card/citizen identification number, date of issue, place of issue, gender, ID card/CCCD photo (front and back), portrait photo, address, province/city, district/ward, commune/ward. Create a password and confirm.

Step 2: Enter the OTP sent to your phone and click Continue.

Step 3: Wait for a CIC staff member to contact you to verify your information.

Step 4: Receive your login information (username and password) via SMS or email.

Step 5: Log in at https://cic.org.vn and go to the Personal Information section to check your credit history.

Checking through the CIC mobile app

Step 1: Download the CIC app on Android or iOS and register an account following the instructions.

Step 2: Log in after your account has been approved (usually within 1-3 days).

Step 3: Use the bad debt inquiry feature as guided.

Step 4: View the inquiry results directly in the app.

Checking through a bank

For this method, individuals who want to check for bad debt can go directly to the bank/credit institution that granted the loan and provide their ID card/citizen identification card. The bank/credit institution will then check and inform them whether they have bad debt, as well as the total amount and details of the debts.

“A Challenging Road Ahead: Tackling Bad Debt”

The latest bad debt situation in the banking industry paints a more optimistic picture, with a significant slowdown in growth, reflecting the banks’ efforts to manage their asset quality. While the industry-wide non-performing loan ratio remains higher than pre-pandemic levels, the trend is heading in the right direction. This indicates that although challenges persist, the banks’ strategies to tackle bad debt are showing signs of success.

How to Check Your Credit Score for Free?

The shocking story of a customer who swiped their credit card with an initial debt of just VND 8.5 million but forgot to pay it off, resulting in a mountain of debt of nearly VND 9 billion after 11 years, has left many people worried about suddenly finding themselves in a similar situation. Is canceling your credit card the only way to completely eliminate risk for users, or are there more optimal preventive measures?

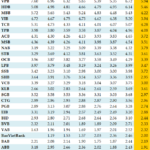

The Bank’s NIM is Thinning

The Q3 2024 NIM for banks across the board witnessed a decline compared to Q2, indicating the industry is grappling with a host of challenges. A stark contrast is emerging between large and small banks, giving rise to an uneven competitive landscape. This dynamic environment demands that banks adopt more agile strategies to enhance their performance and keep pace with the evolving market conditions.