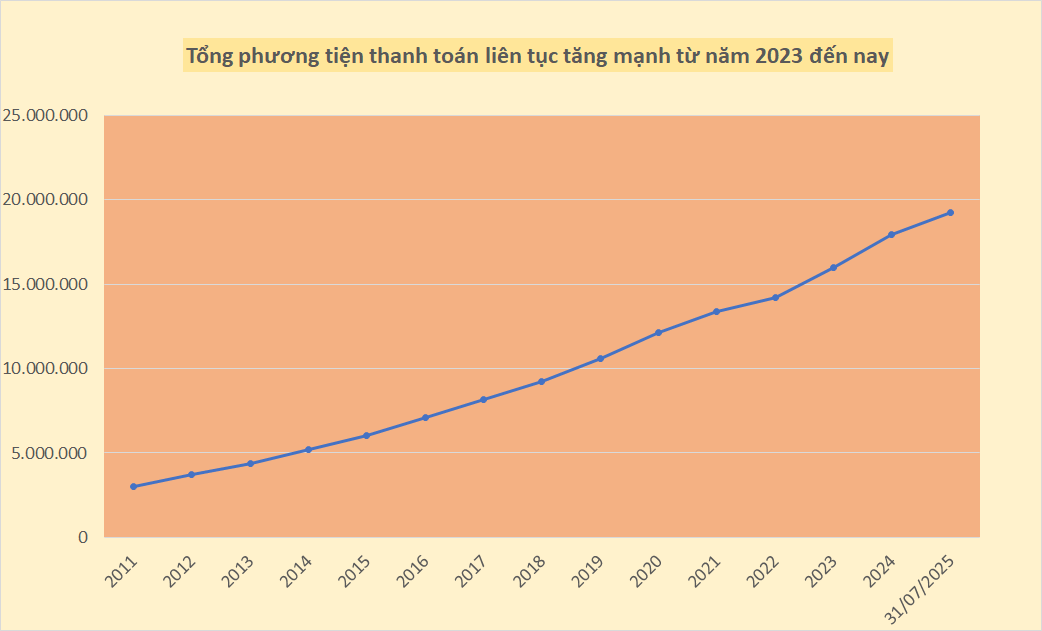

Strong Money Supply Growth in the First Seven Months of 2025

According to recent data released by Governor Nguyen Thi Hong, the total means of payment (money supply M2) in the first seven months of the year increased by 7.5% compared to the end of 2024 – nearly double the growth rate of the same period last year.

Based on the data published by the State Bank of Vietnam, the additional M2 money supply in the first seven months reached more than VND 1,343 trillion, higher than the average annual increase over the past decade (2014 – 2024) of VND 1,229 trillion per year. Prior to this, money supply increased by VND 1,916 trillion in 2024 and VND 1,772 trillion in 2023. Compared to the figure recorded at the end of 2015 (nearly VND 6,020 trillion), the scale of Vietnam’s total means of payment is now 3.2 times larger.

Source: Author’s compilation from data announced by SBV

The Governor explained that the strong growth in money supply in the first seven months was largely due to the State Bank of Vietnam’s implementation of restructuring plans for the banking system, especially special lending for the transfer of banks subject to compulsory purchase.

Previously, within just three months at the end of 2024 and the beginning of 2025, the SBV completed the transfer of four weak banks (CB to Vietcombank, Oceanbank to MB, DongA Bank to HDBank, and GPBank to VPBank).

The Law on Credit Institutions of 2024 stipulates that the transferee of a specially controlled bank has the right to borrow refinancing at the interest rate applied by the transferee for lending, and to deposit money at the transferred commercial bank; the amount and term of refinancing shall not exceed the amount and term of the transferee’s lending and depositing at the transferred commercial bank.

Governor Cautions About Rising Core Inflation

At the regular Government meeting for July, held online with provinces and centrally-run cities on August 7 under the chairmanship of the Prime Minister, Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong cautioned about inflationary trends in recent times.

According to the Governor, inflationary pressures are on the rise. Factors such as electricity price adjustments, healthcare service fees, and rental costs are creating input cost pressures and pushing up core inflation continuously in recent months.

“Core inflation – which reflects the long-term impact of monetary policy – is an important indicator that cannot be overlooked by policymakers,” emphasized the head of the banking sector. She added, “Inflation, once it takes hold, can escalate quickly, but controlling and reducing it is a challenging task. This is why proactive, responsive, and cautious policy management is essential.”

Governor of the State Bank of Vietnam, Nguyen Thi Hong, speaks at the conference. Photo: VGP/Nhat Bac

The Governor affirmed that in the first seven months of 2025, the SBV proactively and flexibly managed monetary policy, closely following actual developments. Monetary regulation measures were implemented to simultaneously support growth and curb inflation.

Additionally, the SBV’s use of the open market operation tool to inject short-term funds helped maintain liquidity for the credit institution system, facilitating credit expansion while stabilizing interest rates. This was particularly important given the government’s requirement to stabilize interest rates to support production and business activities, despite rising credit demand.

In the long term, the Governor emphasized the need for synchronized solutions to enhance the effectiveness of monetary policy. Among these, two proposals were highlighted as key focuses.

Firstly, there is a need to vigorously develop the capital market to meet medium and long-term capital needs, thereby reducing pressure on the banking system’s short-term capital. This direction has been agreed upon by the Government in its latest dispatch.

Secondly, it is essential to expand the credit guarantee program for small and medium-sized enterprises. Providing these enterprises with access to capital through guarantee mechanisms would create a strong production impetus across all sectors of the economy.

Additionally, for sectors such as real estate and infrastructure, which require significant medium and long-term capital, it is advisable to raise funds through corporate bond issuance, local bonds, or international loans.

“Only by raising funds through the appropriate channels and in alignment with the nature of the capital can we achieve both high growth and sustainable stability,” concluded Governor Nguyen Thi Hong.

“How Did Vietnam, a Poor Economy with High Inflation, Successfully Navigate and Emerge from Two Major Crises to Achieve Double-Digit Growth?”

“In a bold statement to the IMF, WB, ADB, WTO, and 650 foreign investors, Vietnam, a once impoverished nation, declared its openness to the world. As per Professor Nguyen Mai, a renowned economist, Vietnam pledged to amend its constitution and protect foreign investors’ assets and interests. This courageous declaration marked a significant turning point for the country’s economy, positioning Vietnam as an ideal destination and a second home for FDI businesses.”

The Race to the Top: How Vietcombank, MB, VPBank, and HDBank Soar After a 50% Cut in Reserve Requirements

The decision by the State Bank of Vietnam to reduce the mandatory reserve ratio by 50% for credit institutions participating in the restructuring process has provided a significant liquidity boost for the four banks involved in the transfer. This policy move has had a multifaceted impact, simultaneously reducing funding costs, directly enhancing liquidity, and promoting credit growth.

The Art of Monetary Policy: Navigating Interest Rates and Exchange Rates with Agile Governance.

The government has requested that the State Bank of Vietnam proactively undertake research, evaluation, and forecasting within the scope of its functions, tasks, and authority. This includes developing monetary policy scenarios and orientations from now until the end of 2025 and for 2026. A report is to be submitted to the Government’s Standing Committee for consideration and feedback no later than August 20, 2025.

“Pursuing Excellence: Achieving Socio-Economic Goals for 2025”

The Prime Minister has urged all ministries, sectors, and localities to rally and address challenges, limitations, and shortcomings. By seizing every opportunity, we aim to achieve the economic and social development goals set for 2025, especially targeting a GDP growth rate of 8.3 – 8.5%, keeping CPI increase below 4.5%, and maintaining macroeconomic stability. These efforts will lay the foundation for even greater success in 2026, with aspirations to reach a growth rate of 10% and beyond.